Revolut Plus Review 2024 -

Tailored for users seeking extra protection

Updated 06 Feb 2024

This review aims to dissect the nuances of the Plus Plan, giving you all the necessary insights to gauge its suitability for your fiscal habits and goals.

Revolut Plus enhances the user experience beyond the standard account, incorporating features like improved savings rates, robust insurance policies, and personalized card options. So, whether you’re eyeing the Revolut Plus card for its sleek design or the Plus plan for its economic edge, heres what you need to consider.

Bank Account

Company

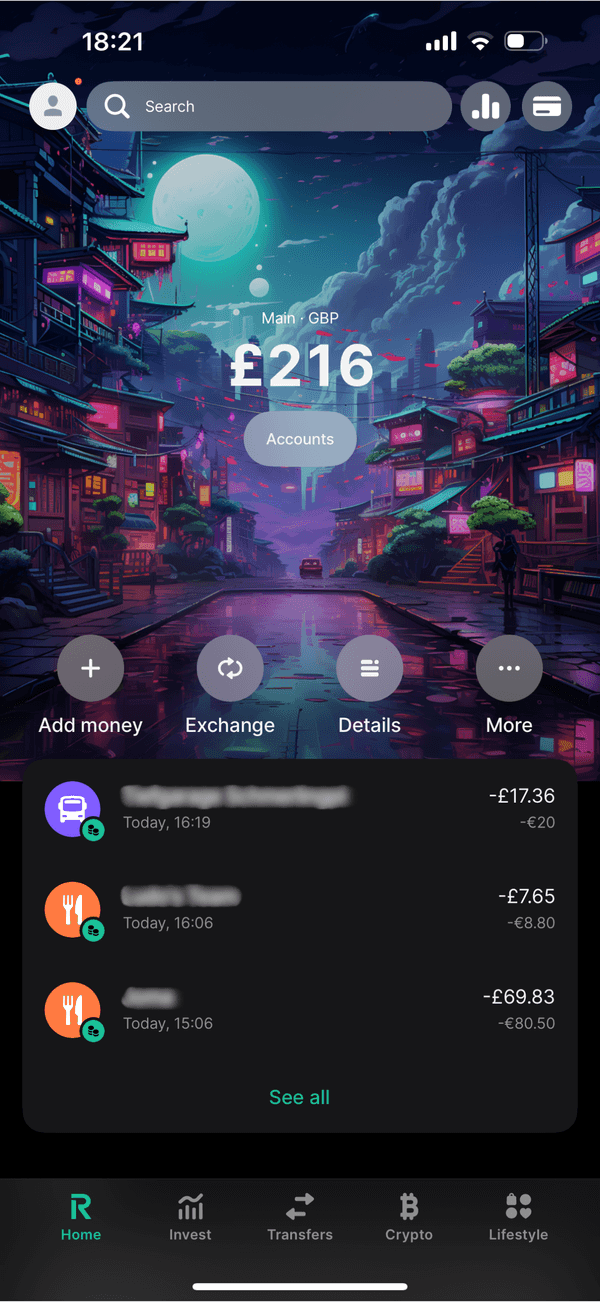

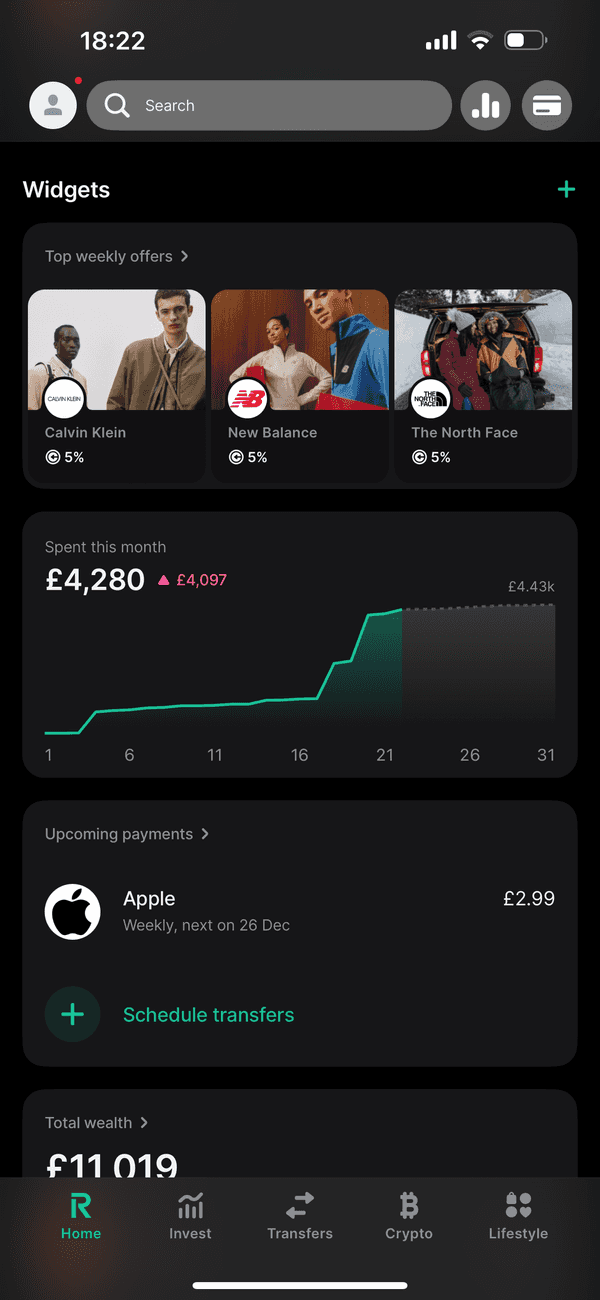

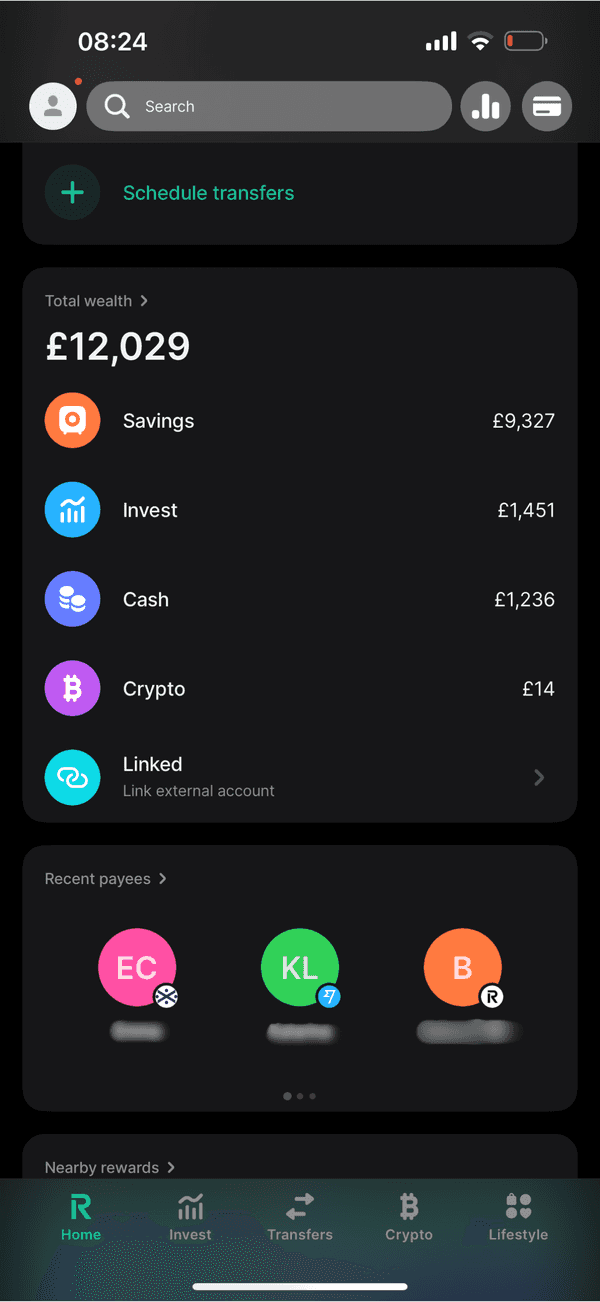

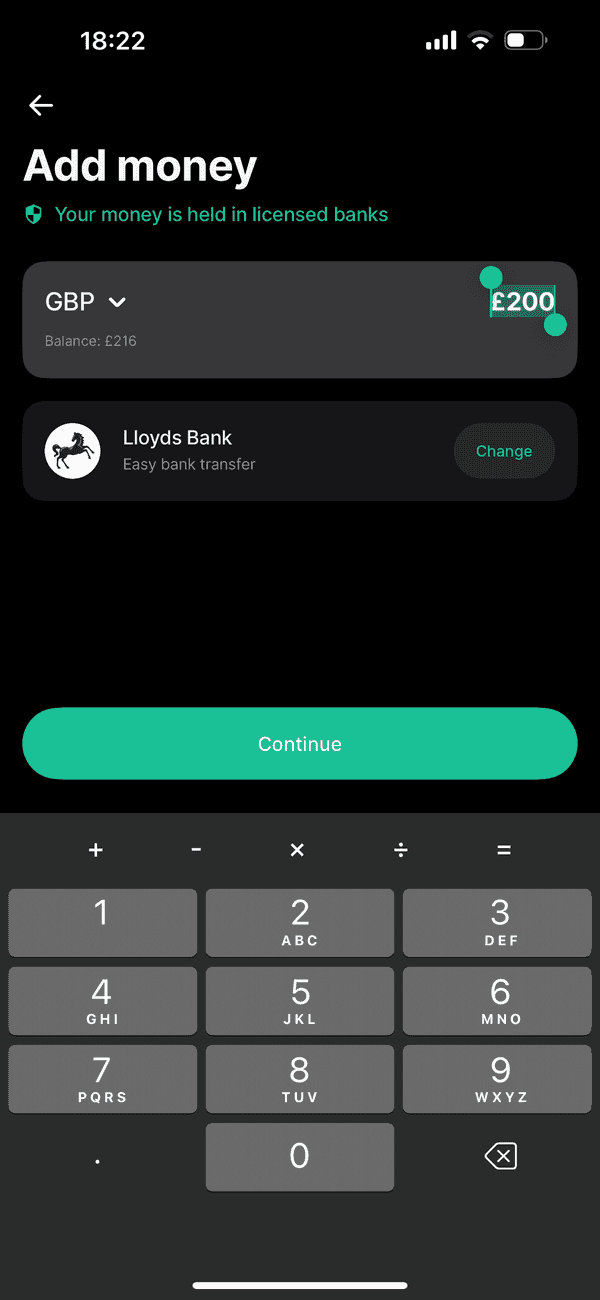

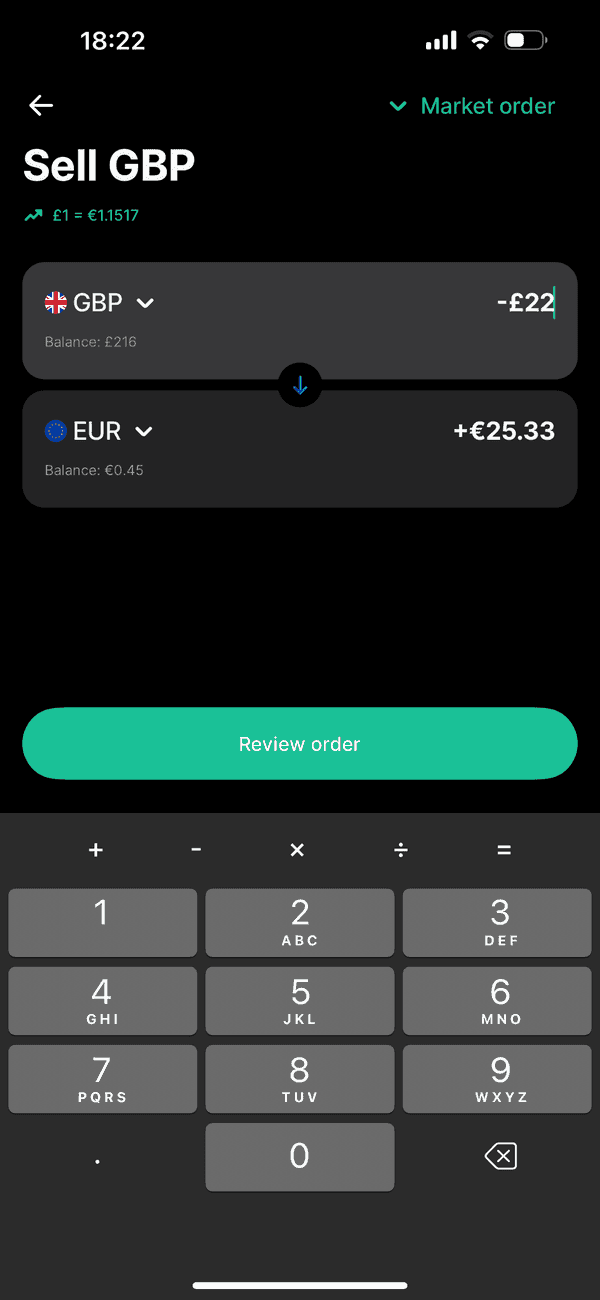

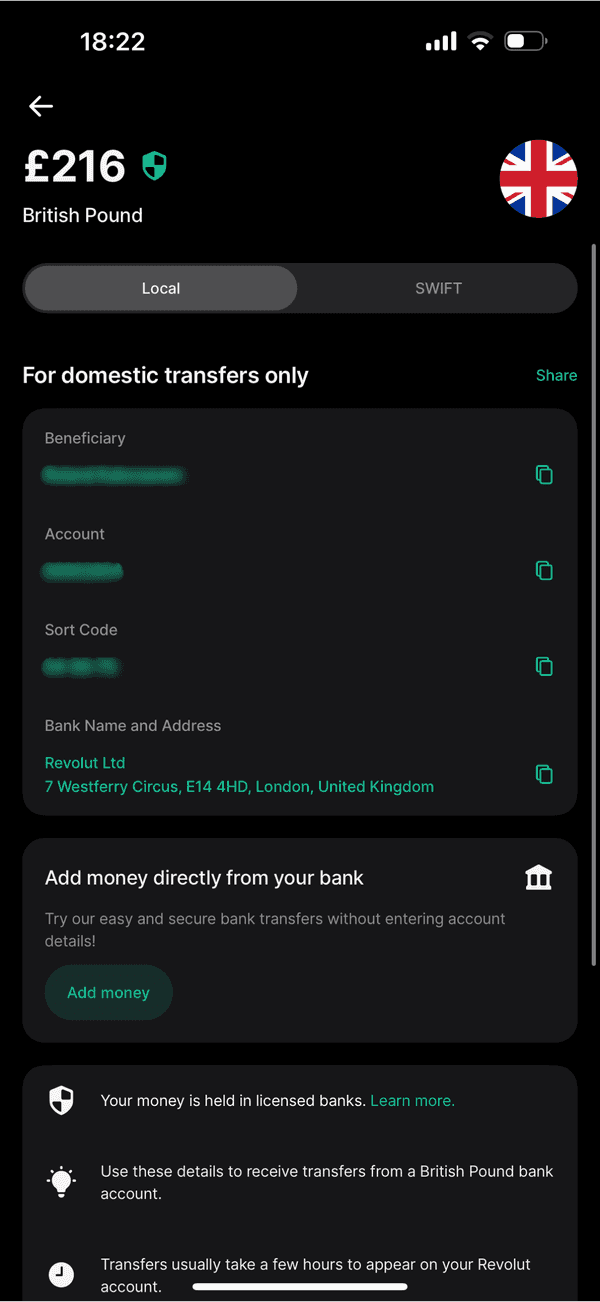

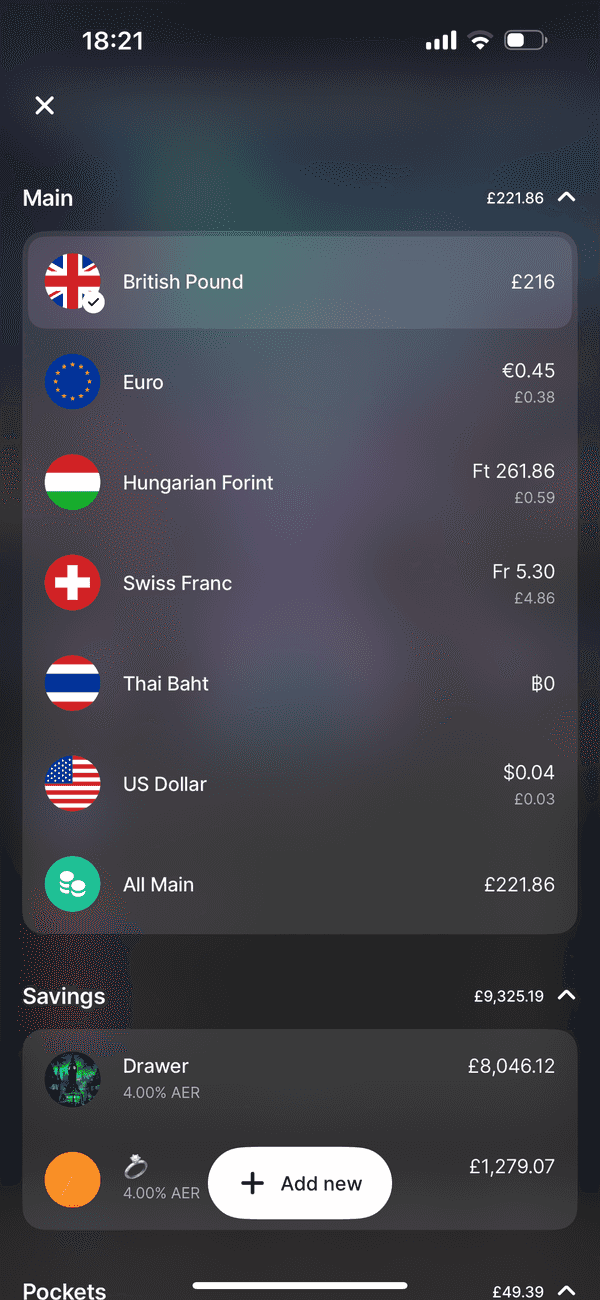

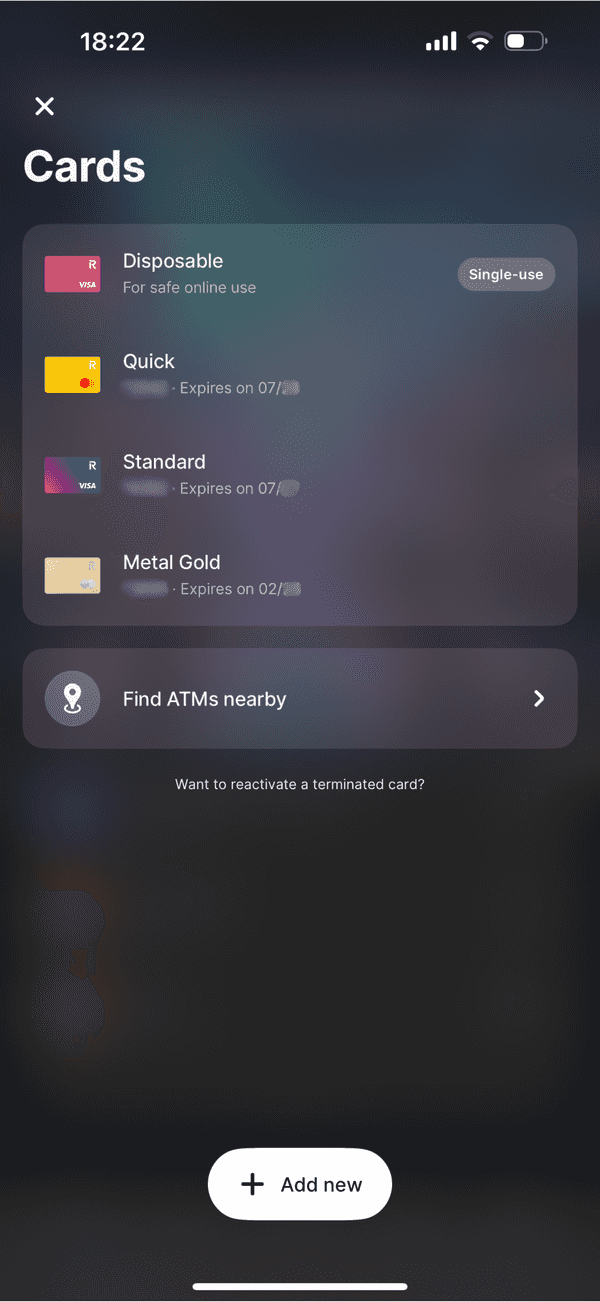

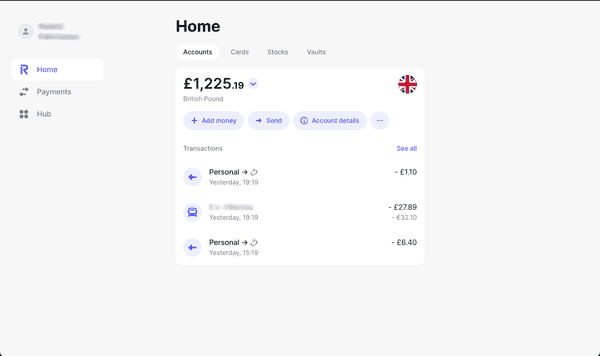

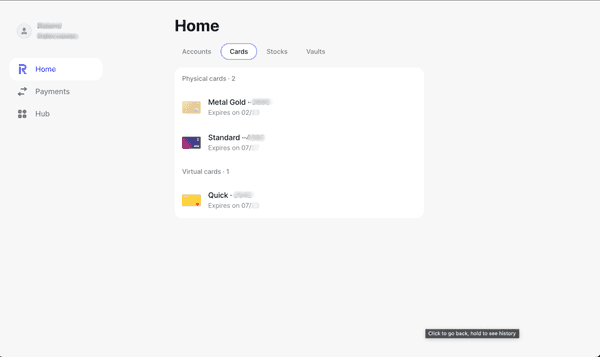

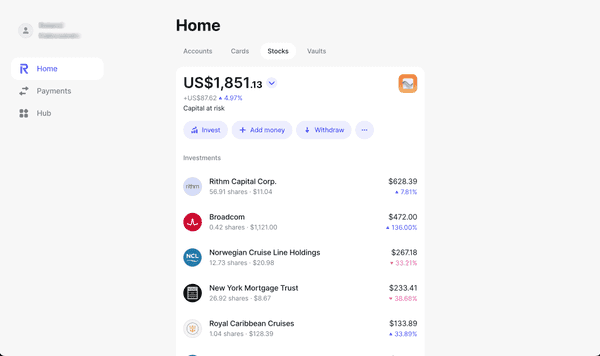

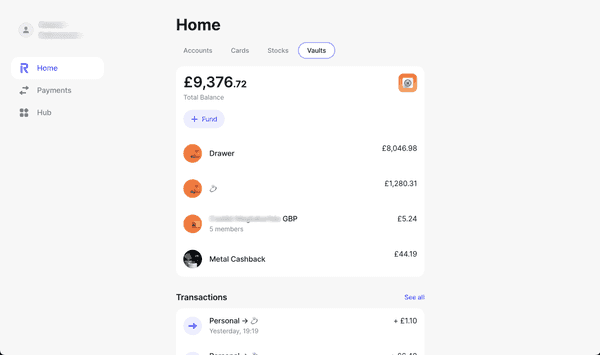

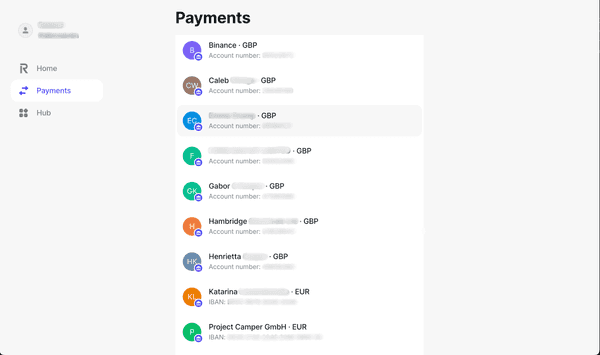

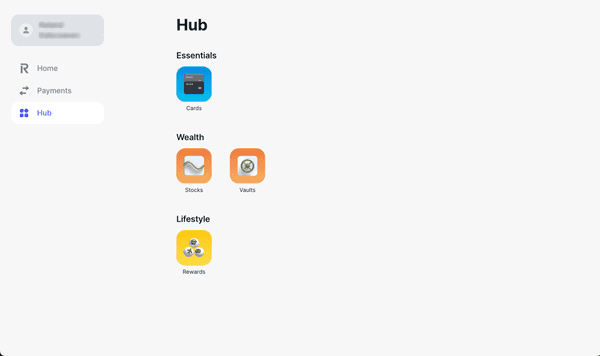

#Screenshots

#Pros & Cons

Pros

- Two free cards and a complimentary replacement card annually

- Privilege to open and manage up to 2 Revolut Junior accounts

- Favorable interest rates for Savings Vaults in comparison to the Standard Plan

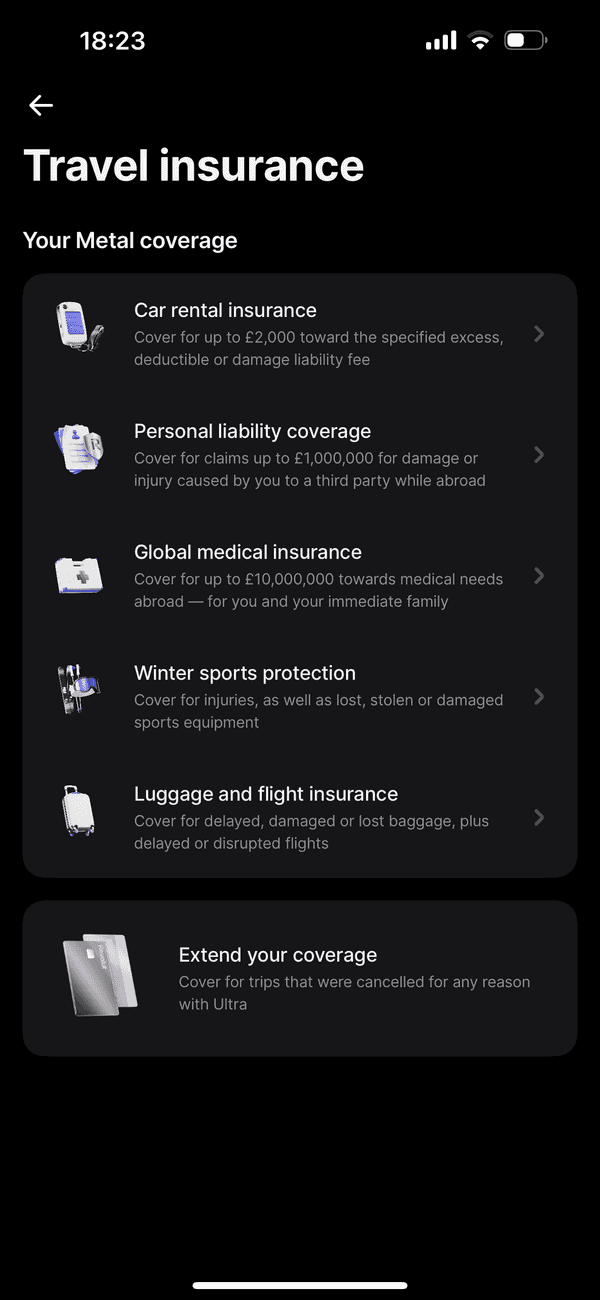

- Insurance benefits for purchase protection, refund protection, and ticket cancellation coverage.

- Priority customer support through in-app chat

Cons

- A monthly fee which might not be ideal for users who don't utilize additional benefits

- The insurance coverage comes with caveats and an excess that needs to be thoroughly understood.

#Fees

Venturing beyond the free standard option, the Revolut Plus plan fee stands at £3.99 per month or a budget-friendly £40 annually. Taking into account it serves as a bridge between frugality and functionality, fitting for users who find themselves needing more than the basics without stepping into the premier territory.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

| LOCAL | Free | Free | Free | Free | £200.00 Free 2%(min. £1.00) |

| EUROPE | Free | Free | Free | Free | £200.00 Free 2%(min. £1.00) |

| INTERNATIONAL | Free | ~0% | Free | ~0% | £200.00 Free 2%(min. £1.00) |

Additional Information

- Insurance on purchases

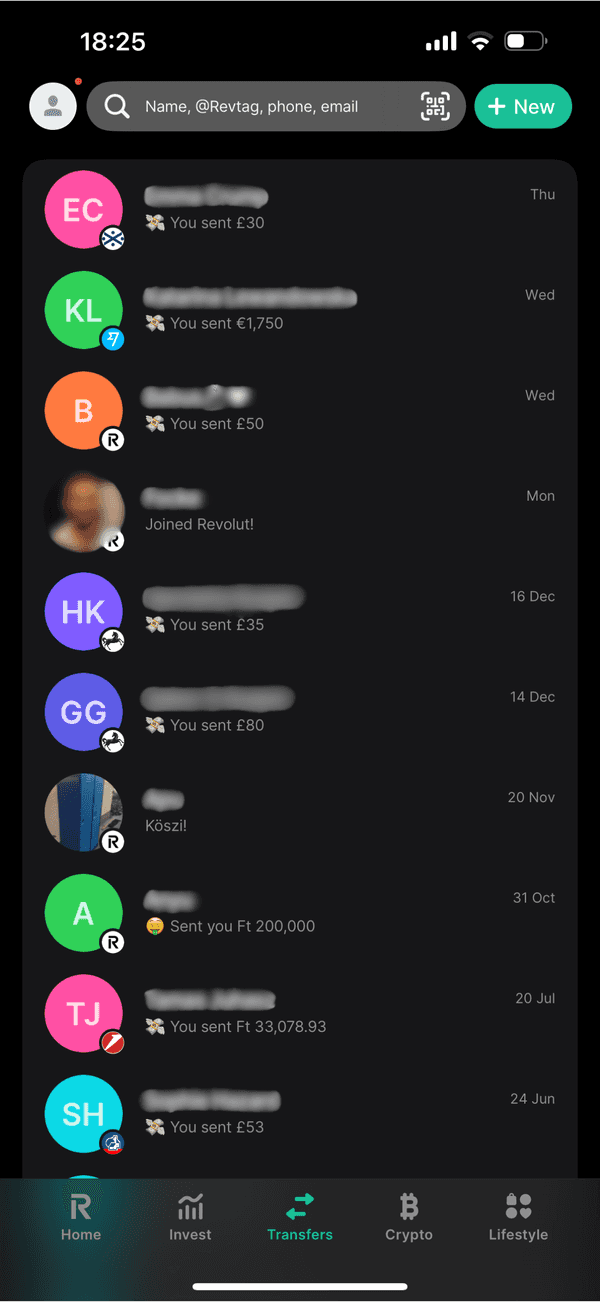

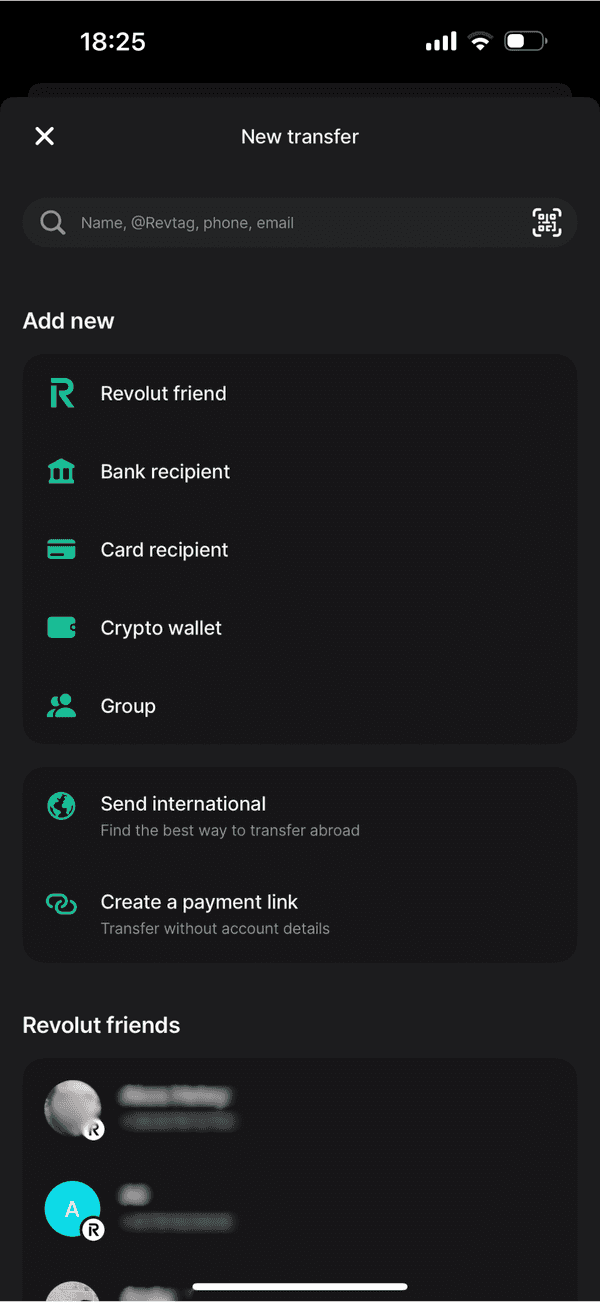

- Free instant transfers to other Revolut users

- Free local transfers in your country

- Free within Single European Payments Area (SEPA)

- Fee applies for card transfers

- Receiving money is free.

- Adding money is free from UK or EEA card

- Fee charged form Commercial or US card or other counries

- Free withdrawals up to £200, then a fee applies.

- That fee is 2% of the withdrawal, subject to a minimum fee of £1 per withdrawal.

Overdraft

#Perks

Perks

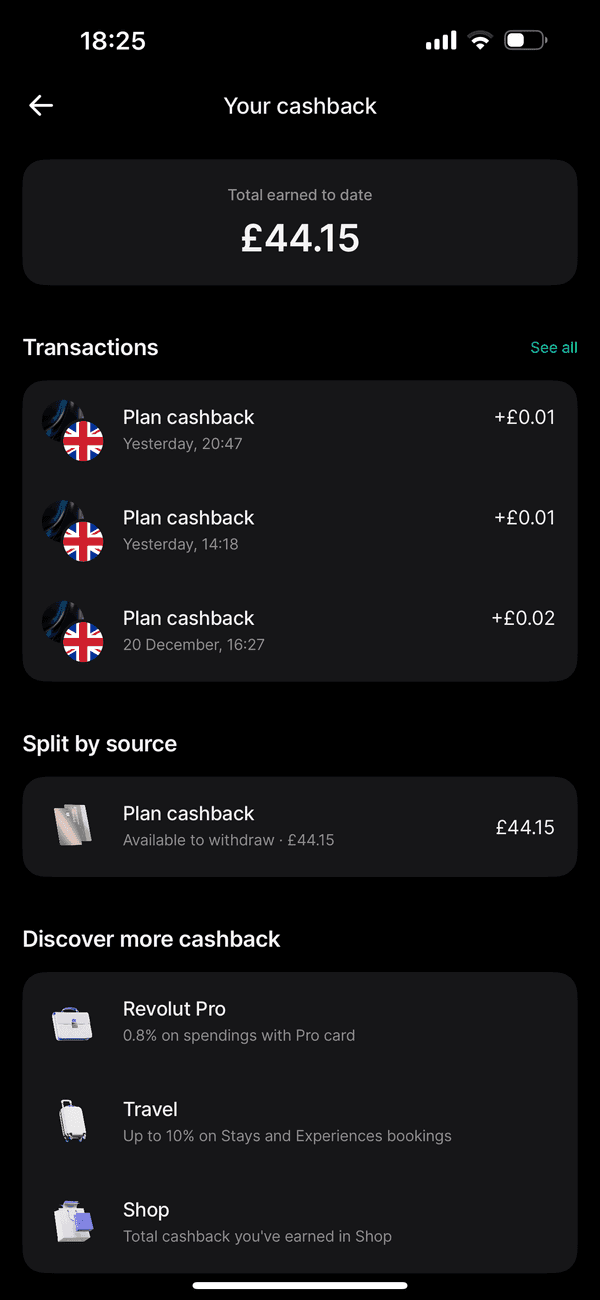

- Revolut Pro 0.4% Cashback

- 2 Revolut Junior Accounts

- Currency Exchange - £3000/month exchange limit. Mon - Fri

- Up to 3% Cashback on Accomodations

- Commodity Exchange - 1.99% (minimum fee £1)

- Cryptocurrency Exchange - Variable Fee

#Safety

Revolut maintains high-security standards to safeguard your finances but there is no FSCS protection unless you keep your money in a Vault. Features like instant card freezing and unfreezing from the app, as well as customizable security settings, provides peace of mind for the modern user.

#Support

It extends beyond typical user support by offering prioritized customer service, particularly through its in-app chat function.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

The price to feature ratio paints this plan as an appealing option for users yearning for a blend of cost-efficiency and value-adding features.

#Final thoughts

The Revolut Plus plan treads a middle path in the spectrum of digital banking products offered by Revolut. For customers who are easing into the realms of digital financial management or existing users considering an upgrade, the Plus Plan strikes an inviting balance. Its mixture of day-to-day banking necessities and premium advantages, all for a moderate outlay, underscores its potential as a financial solution.

#FAQs

#Is Revolut Plus worth it?

Depending on your usage but if the added protection and higher savings rates interests you, then the plan offers a solid value proposition.

#What is Revolut Plus Plan?

It is a paid plan within Revolut's digital banking services, providing expanded features such as multiple physical cards, enhanced savings rates, and extensive insurance coverage.

#How to cancel Revolut Plus?

Plus customers can cancel directly through the Revolut app's subscription settings or by getting in touch with their customer support.

#How much is Revolut Plus

The plan is priced at £3.99 per month or can be obtained for an annual fee of £40, offering a budget-friendly option to users.

#Can I use my Plus Revolut card abroad?

Yes, the Plus Revolut card can be used internationally, with advantages in currency exchange that bolster its utility for travel.

#Does Revolut Plus come with Travel Insurance?

While the plan includes ticket cancellation insurance, comprehensive travel insurance is not offered as part of the plan.