Monzo Premium Review 2024 -

For travelers valuing insurance, perks

Updated 17 Feb 2024

Monzo, the beloved online bank, has been a game-changer in mobile banking, offering a slew of intuitive and customer-centric services. With its vibrant coral cards becoming an iconic symbol of a new way of managing money, Monzo isn’t stopping there. The ‘Monzo Premium’ account takes things up a notch, combining the convenience of digital banking with premium benefits that could sway the most traditional bank loyalists.

In this Monzo Premium review, we’ll delve into what the account offers, its benefits, and downsides, and ultimately help you assess whether this gleaming bank account upgrade is worth the investment.

The premium account distinguishes itself with an exclusive metal card, turning heads every time it’s placed on the counter. Beyond aesthetics, the account adds a substantial layer of comfort provided by comprehensive phone and worldwide travel insurance, making it a potential ally for the frequent traveler.

Bank Account

Company

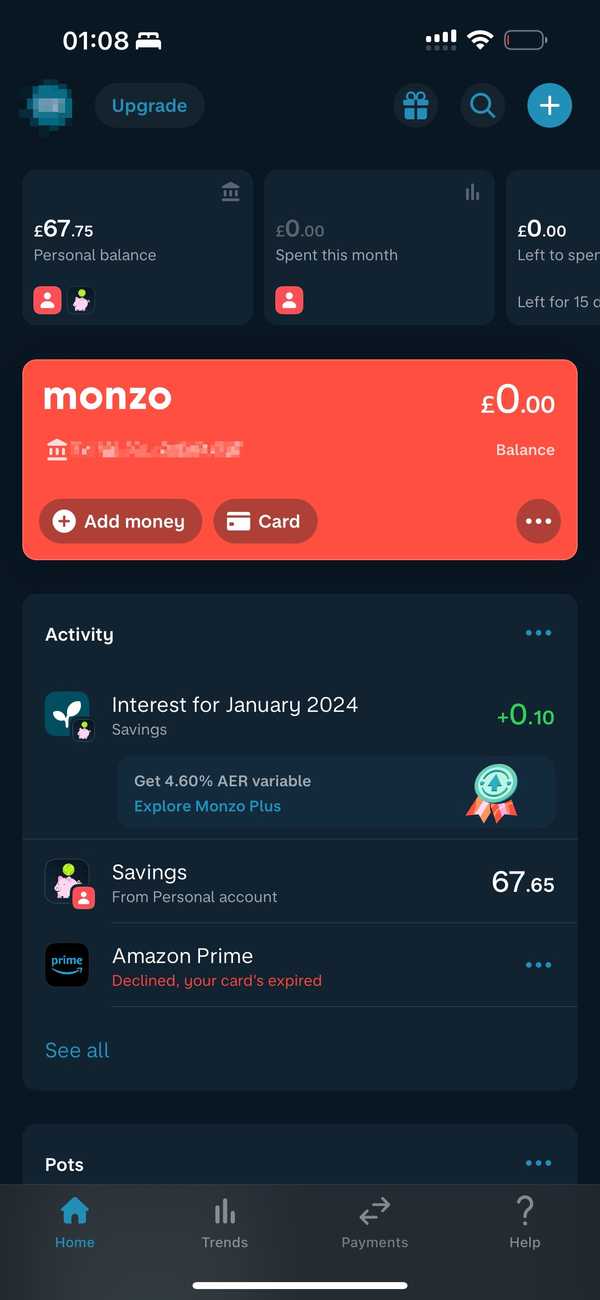

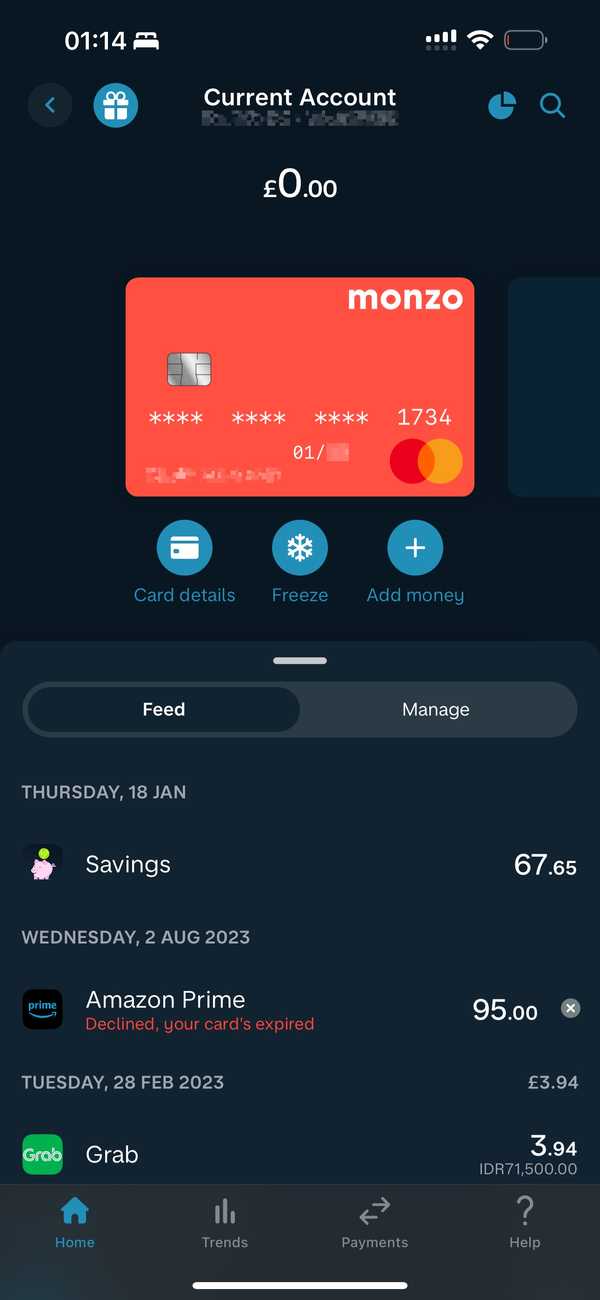

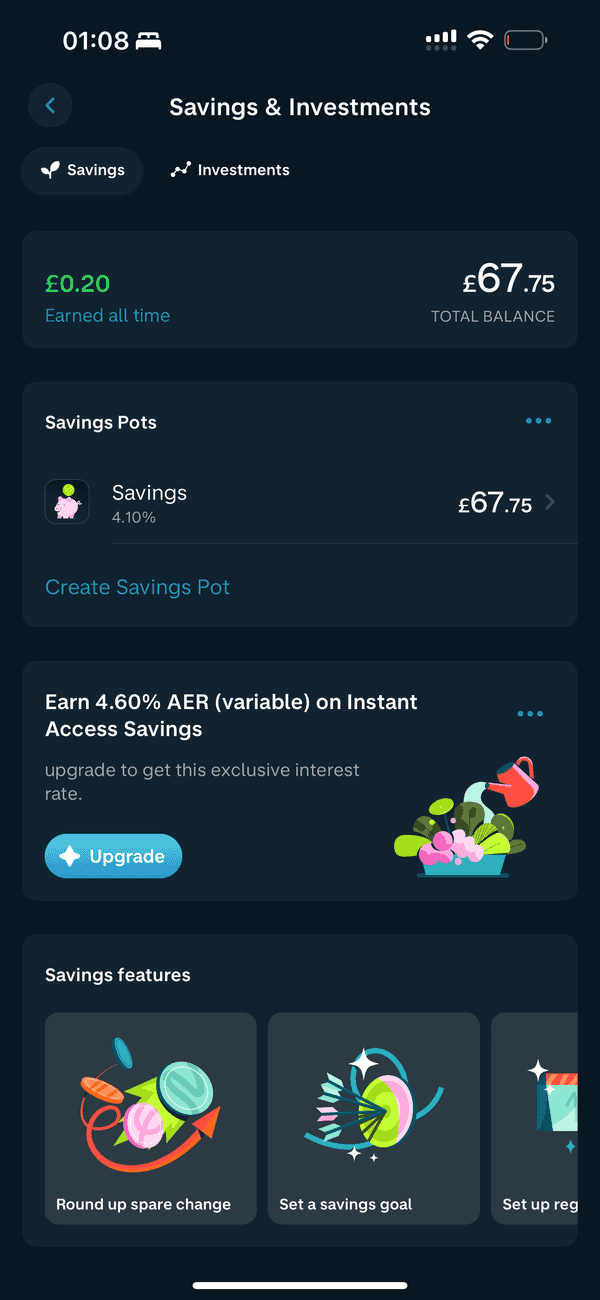

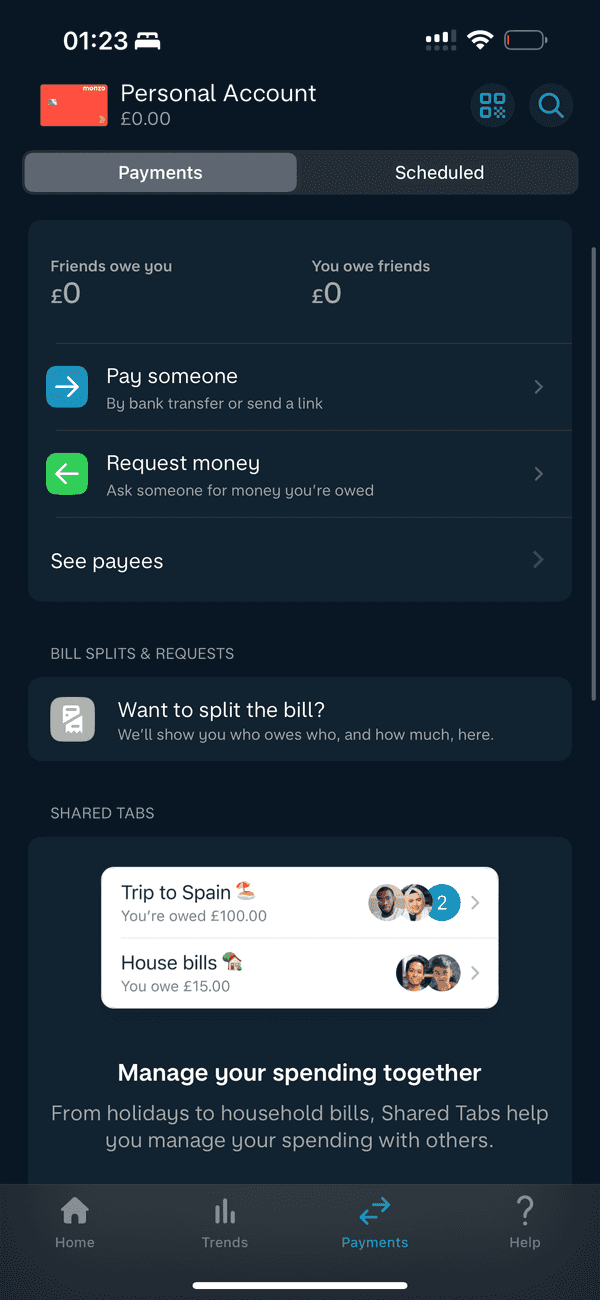

#Screenshots

#Pros & Cons

Pros

- FSCS protection up to £85,000 offers peace of mind for depositors

- White metal card made from a single sheet of steel, symbolizing luxury and exclusivity

- Extensive phone and travel insurance policies covering theft, loss, accidental damage, and more

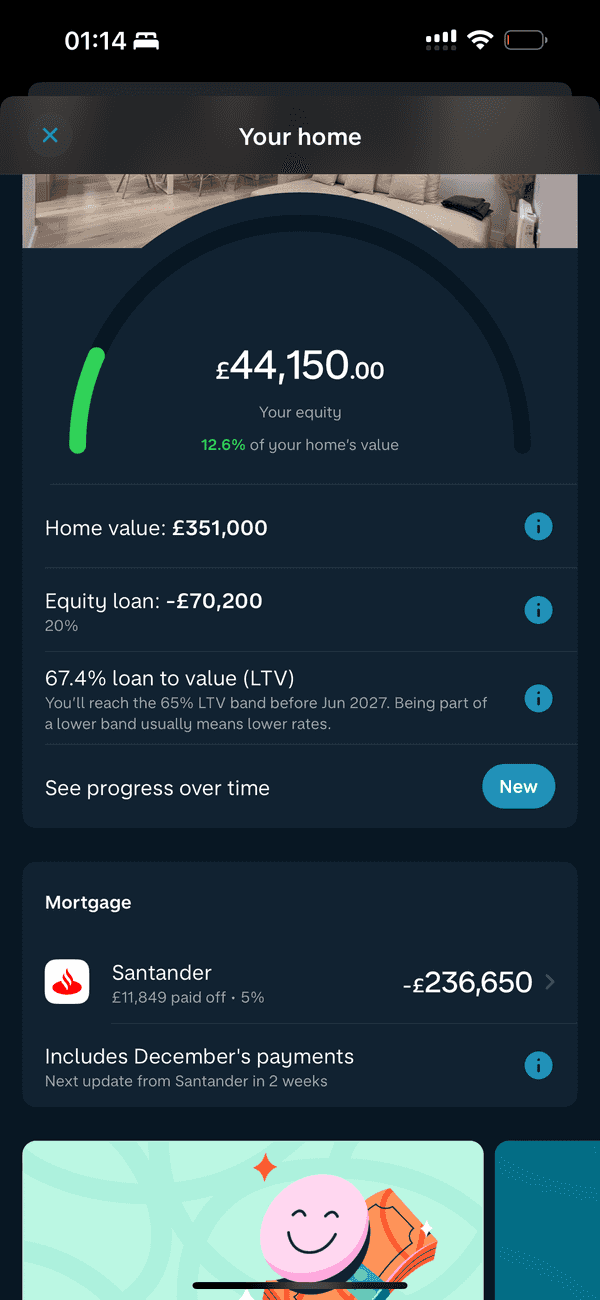

- Features like advanced roundups, Credit Tracker, mortgage tracker

- Enhanced cash deposit limits suitable for higher transactions

- Competitive interest rate on balances and regular Pots

Cons

- Six-month minimum commitment can be a barrier for those seeking flexibility

- Age restriction means it is not available to customers over 69 years of age

- Insurance excess fees apply, which could add up in the event of multiple claims

- If there aren't enough funds to cover the monthly fee, the account holder may enter an unarranged overdraft, incurring extra charges

- Exchange fee applies when receiving payments in foreign currencies

- Airport lounge access is discounted, not free.

#Fees

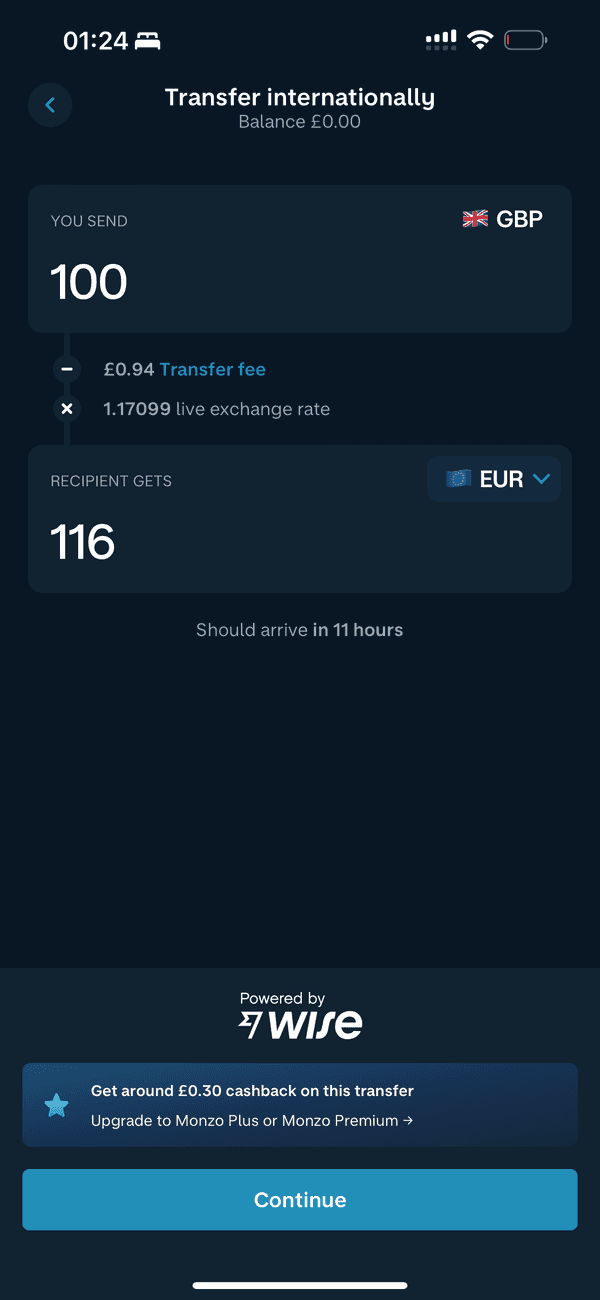

For avid travelers, the absence of foreign transaction fees is your ticket to seamless spending anywhere on the globe, thanks to Monzo using Mastercard’s exchange rate directly. For those taking their Monzo card on adventures within the EEA, the convenience of unlimited fee-free cash withdrawals is a game-changer. Even outside the Euro-zone’s embrace, users are permitted up to £600 every 30 days without fees.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

| LOCAL | Free | Free | Free | £1.00 | £600.00 Free Free |

| EUROPE | Free | Free | 1% | N/A | £600.00 Free Free |

| INTERNATIONAL | Free | ~0.6% | 1% | N/A | £600.00 Free 3% |

Additional Information

- Mastercard's exchange rate passed directly onto you

- Free local transfers in the UK

- International Transfers are powered by Wise

- Payments you receive in non-GBP currencies are converted to GBP before appearing in your account, incurring an associated conversion fee.

- Currency conversion fee is capped at £1000

- £1 per deposit to pay in cash at any PayPoint and Post Office

- 5 free cash deposit a month

- The 30-day period for allowances resets exactly 30 days after your first withdrawal, rather than at the start of a new month.

Overdraft

#Perks

Perks

- Worldwide Multi-Trip Family Travel Insurance by Zurich (45days)

- Phone insurance - covers loss, damage, theft, and cracks

- Over 1,100 airport lounges discounted

- Metal card exclusive to Monzo Premium

- Add your other bank accounts, mortgages and credit cards in the Monzo app

- See your credit score in the app

- Stay safe online with virtual cards

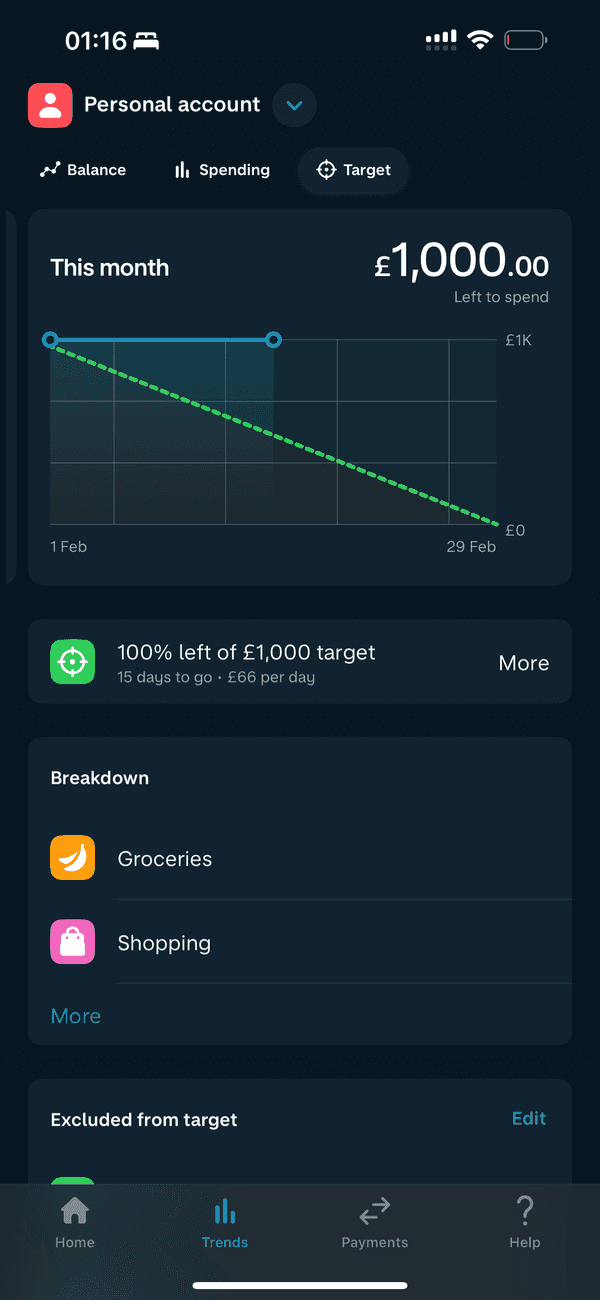

- Advanced roundups to increase your savings

- Pots with interest for organizing money

- Additional cashback offers with partners like Laka, Fiit, Naked Wines, and Patch

#Safety

As with its entire offering, Monzo takes security very seriously. Your deposits are safe, and your financial peace of mind is supported by the latest in banking technology safeguards.

Backed by full authorization and regulation from the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA), Monzo reassures customers about the security and safety of their funds, protected up to £85,000 by The Financial Services Compensation Scheme (FSCS). For more details, explore Monzo’s regulatory status on the Financial Services Register

#Support

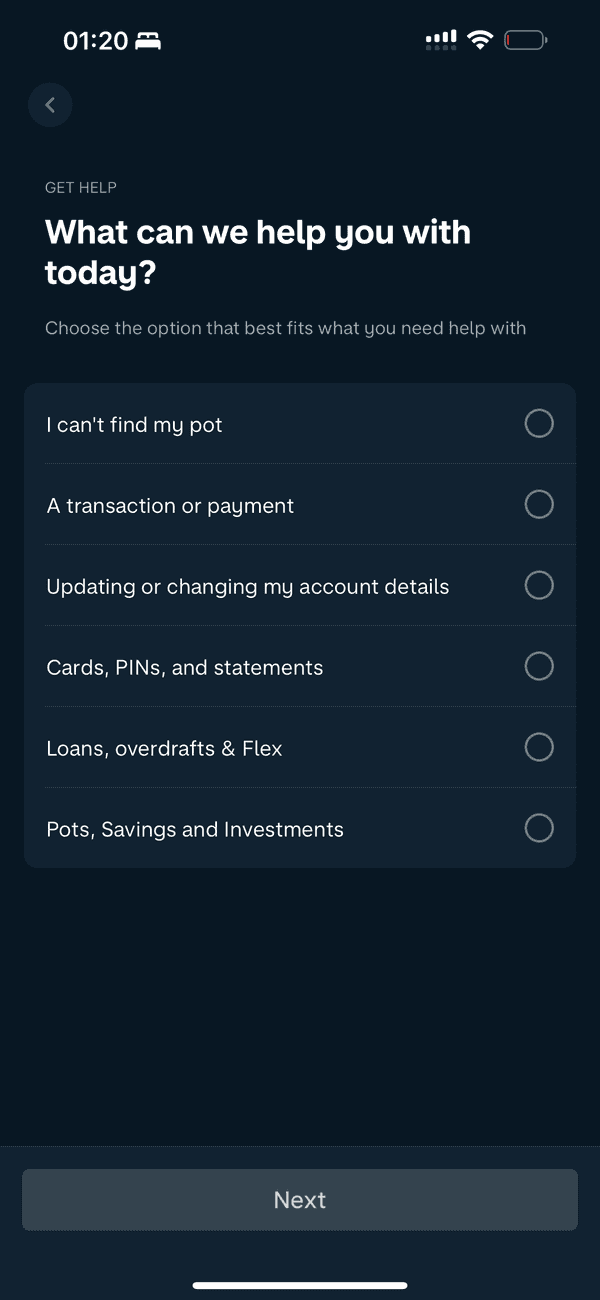

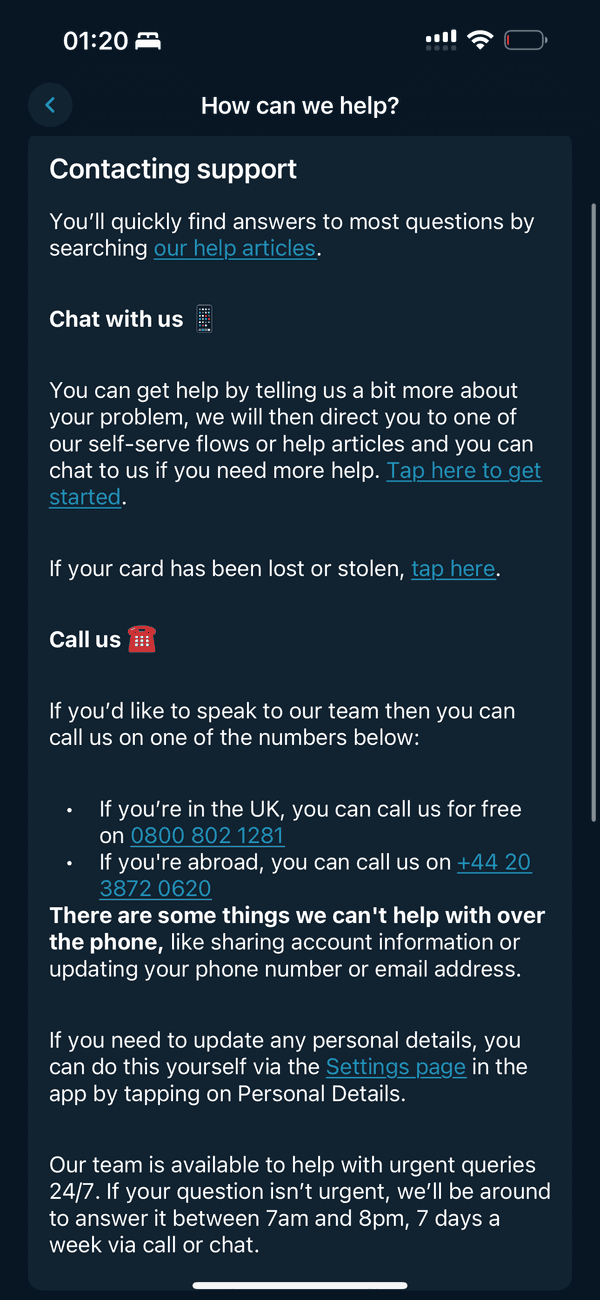

Monzo takes pride in offering award-winning customer support, a core tenet accessible through the user-friendly app. This dedication to service quality is not diminished at the premium level, ensuring that higher-paying customers receive the support tier commensurate with their investment.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

When evaluating the Monzo Premium, the bottom line revolves around its value for the price. While the £15 monthly charge is not insignificant, the value packed within—characterized by insurance covers, elevated interest rates, and travel luxuries—positions it as a financially appealing prospect for the well-heeled, or those wanting more from their bank.

#Final thoughts

Monzo Premium differentiates itself with a host of attractive features combined with the aesthetic appeal of a metal card. For those who will meaningfully benefit from the bundle of insurance coverages, elevated interest rates, and advanced financial management tools, Monzo Premium represents a compelling proposition. Nevertheless, it’s prudent for consumers to weigh the cost against the perceived value and consider their own financial lifestyles before committing.

If the glint of a metal card, alongside the lure of travel benefits and digital-first banking, speaks to your soul, then the Monzo Premium account could be a worthy partnership on your financial journey.

Remember to always review the terms and conditions of any financial product, and consider whether Monzo’s current account offerings are the right fit for your personal banking needs.

#FAQs

#Is Monzo Premium worth it?

For individuals who actively utilize the extended list of benefits and who appreciate the finer details in their banking experience, Monzo Premium can be a worthwhile investment.

#How much is Monzo Premium?

The plan costs £15 per month and requires a six-month minimum sign-up period, making it a considered decision for potential account holders.

#What is Monzo Premium?

It is a luxury bank account offering a premium white metal card, above-average interest rates on savings, comprehensive insurance packages, and advanced money management features

#How to cancel Monzo Premium?

Cancellation procedures are outlined in the Monzo app, with the provision to end the service in line with terms and conditions agreed upon at the inception of the account.