Monzo Plus Review 2024 -

For proactive budgeters, reward lovers

Updated 17 Feb 2024

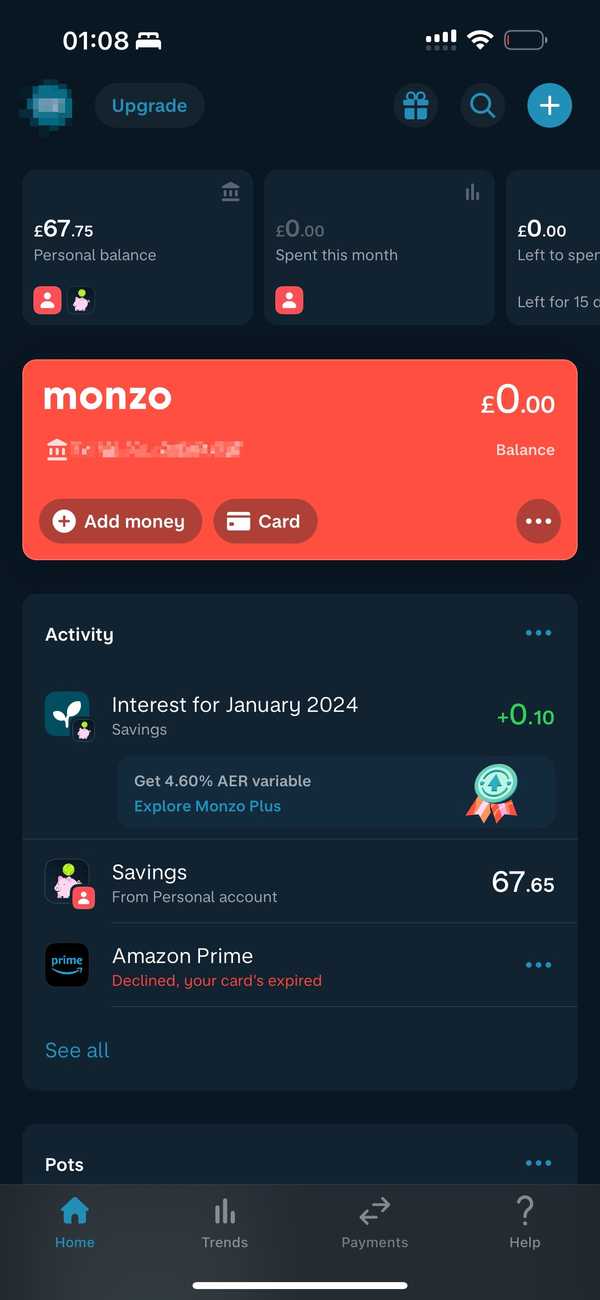

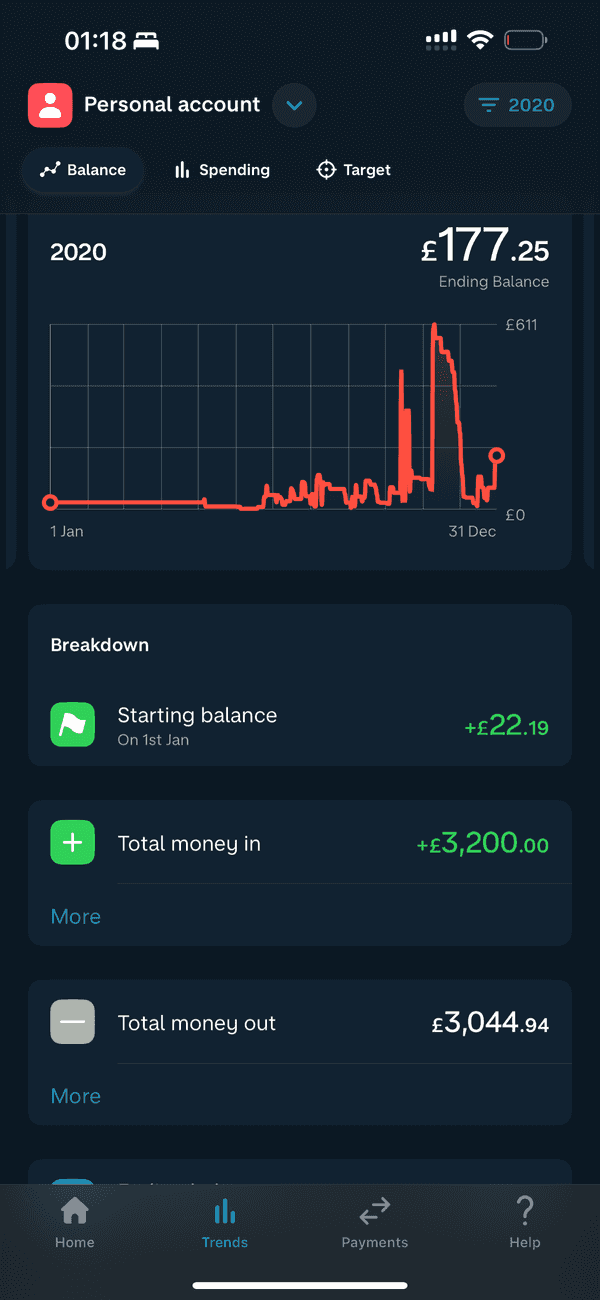

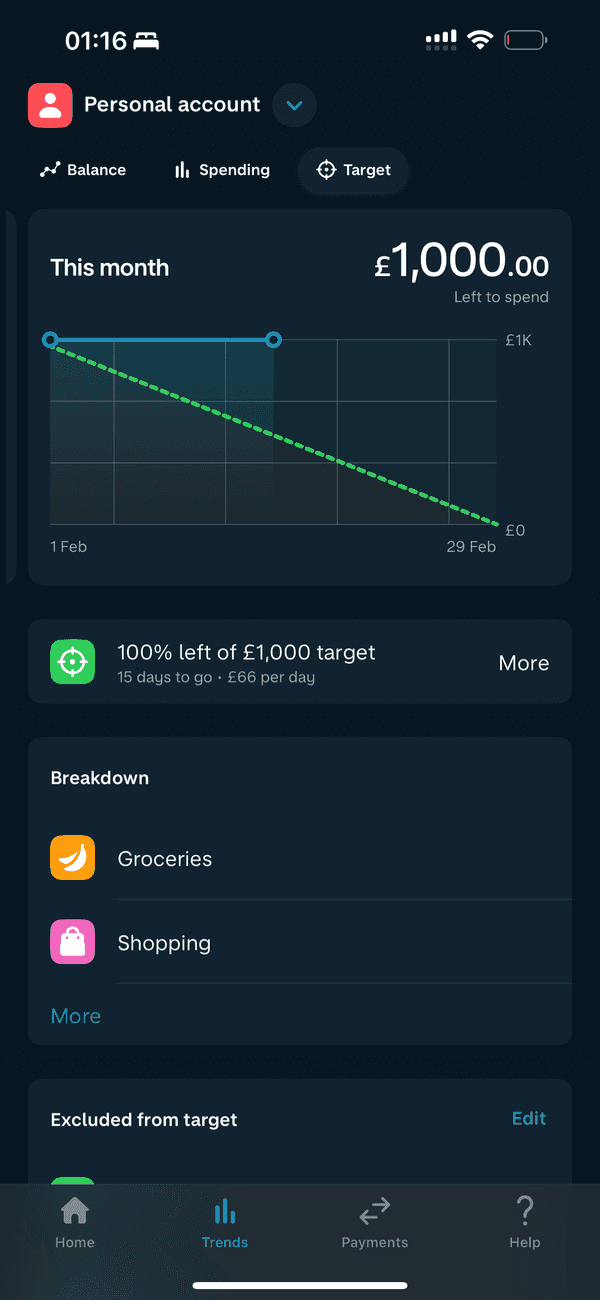

Monzo Plus is not just an account but a bundle of features wrapped in a financial package designed to enhance your banking experience. Ranging from budgeting tools to exclusive offers, Monzo Plus aims to cater to users who seek more from their bank account.

But is it worth the upgrade from the standard Monzo account?

Let’s delve into what Monzo Plus has to offer and find out if it justifies the hype and its cost.

Bank Account

Company

#Screenshots

#Pros & Cons

Pros

- FSCS protection up to £85,000 offers peace of mind for depositors

- Exclusive holographic card design unique to Monzo Plus holders

- Virtual cards for secure online transactions, reducing the risk of fraud on your physical card.

- Features like advanced roundups and Credit Tracker

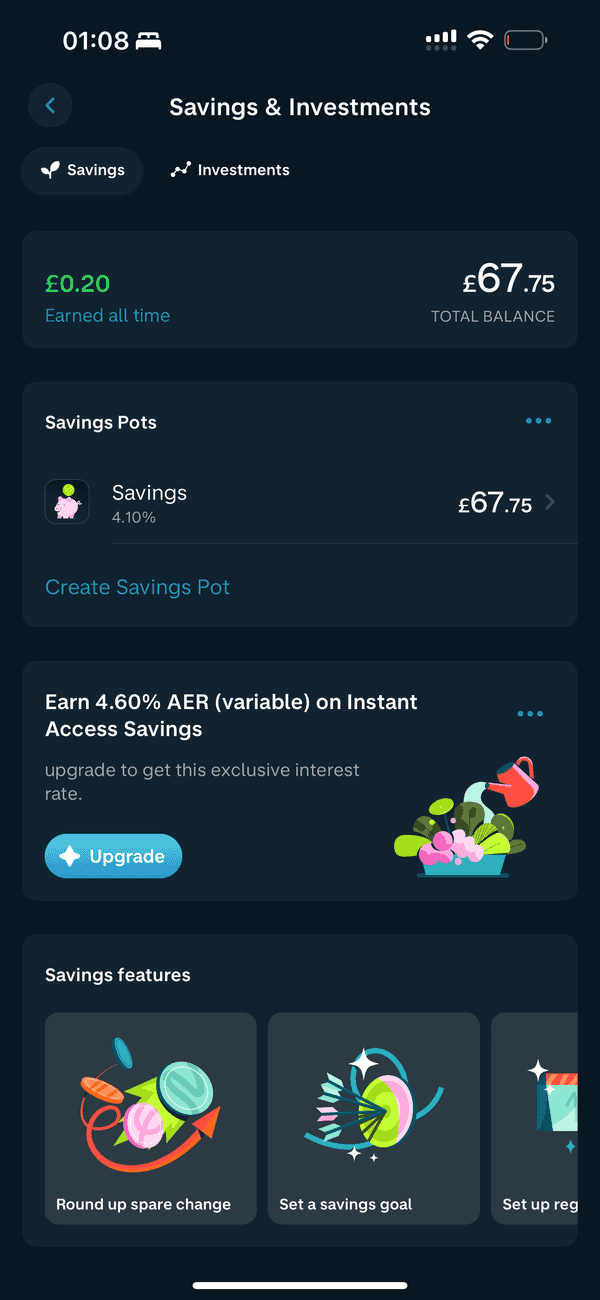

- Attractive interest rate on saving Pots

Cons

- If funds are insufficient to cover the monthly fee, the account holder could be taken into an unarranged overdraft, resulting in additional fees

- It requires a 3-month minimum commitment, which might deter those looking for flexibility

- Exchange fee applies when receiving payments in foreign currencies

#Fees

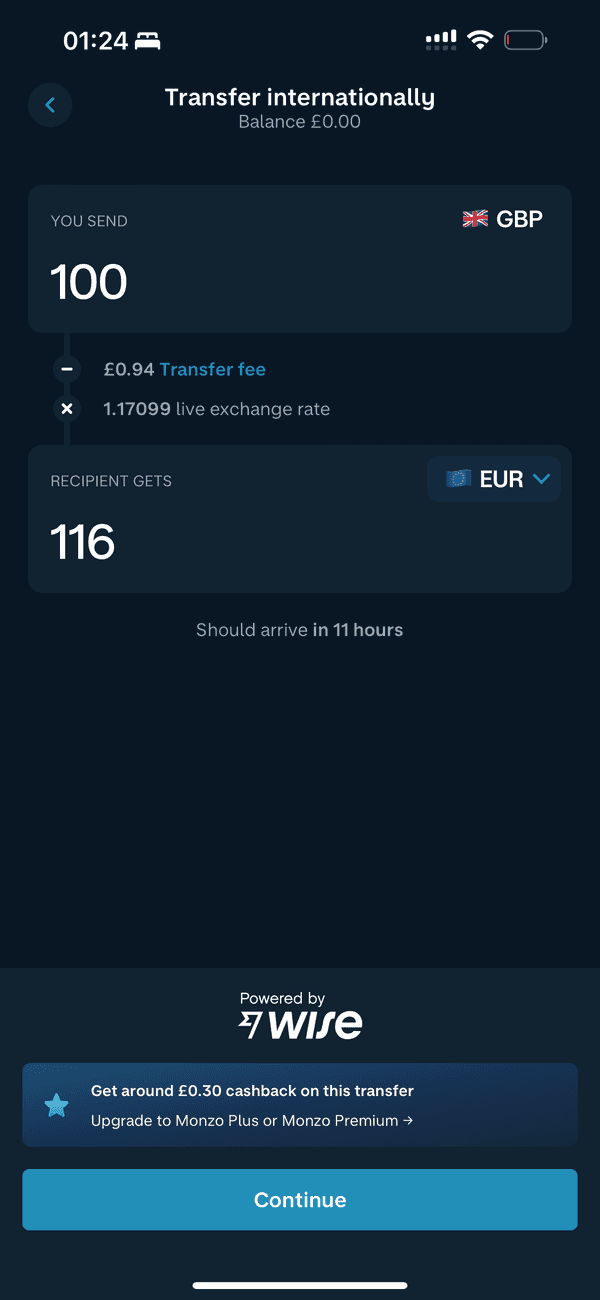

Account holders benefit from a doubled fee-free foreign cash withdrawal limit compared to regular accounts, leveling up to £400 every 30 days. This feature provides tangible savings for travelers who often face steep fees using other bank cards abroad.

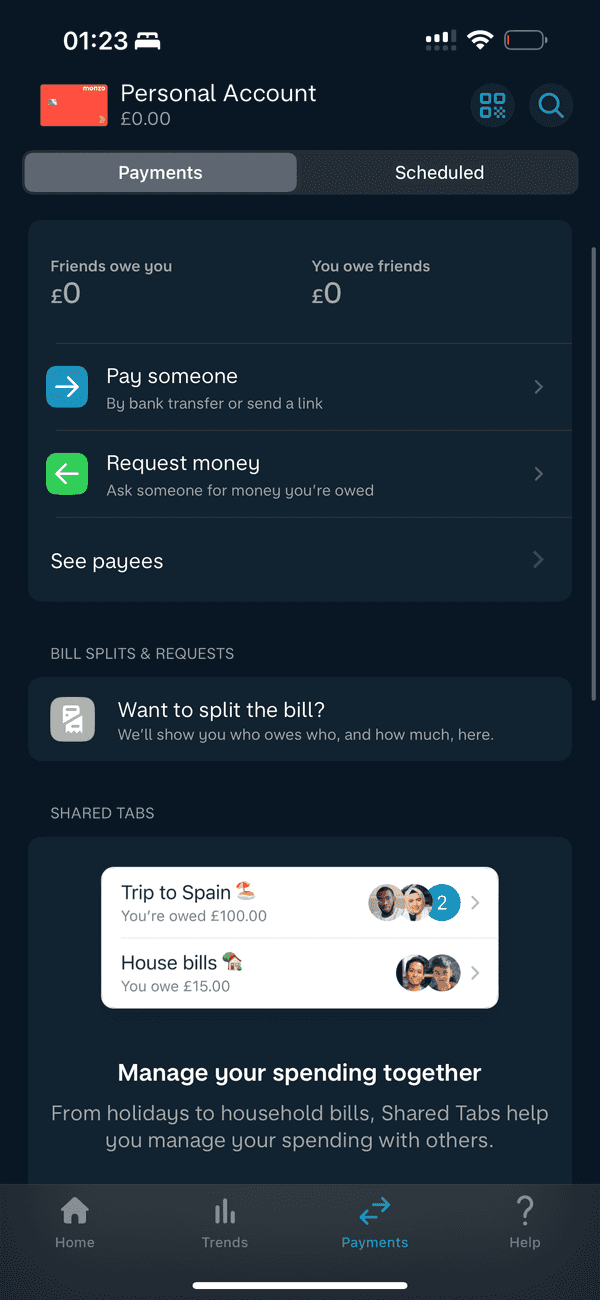

When it comes to domestic transfer fees and other standard transactional costs, Monzo keeps it transparent and competitive, often aligning with the industry’s best practices. The account doesn’t reinvent the wheel regarding everyday transactional fees, but its value proposition lies elsewhere - in its bundle of financial management tools.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

| LOCAL | Free | Free | Free | £1.00 | £400.00 Free Free |

| EUROPE | Free | Free | 1% | N/A | £400.00 Free Free |

| INTERNATIONAL | Free | ~0.6% | 1% | N/A | £400.00 Free 3% |

Additional Information

- Mastercard's exchange rate passed directly onto you

- Free local transfers in the UK

- International Transfers are powered by Wise

- Payments you receive in non-GBP currencies are converted to GBP before appearing in your account, incurring an associated conversion fee.

- Currency conversion fee is capped at £1000

- £1 per deposit to pay in cash at any PayPoint and Post Office

- 1 free cash deposit a month

- The 30-day period for allowances resets exactly 30 days after your first withdrawal, rather than at the start of a new month.

Overdraft

#Perks

Perks

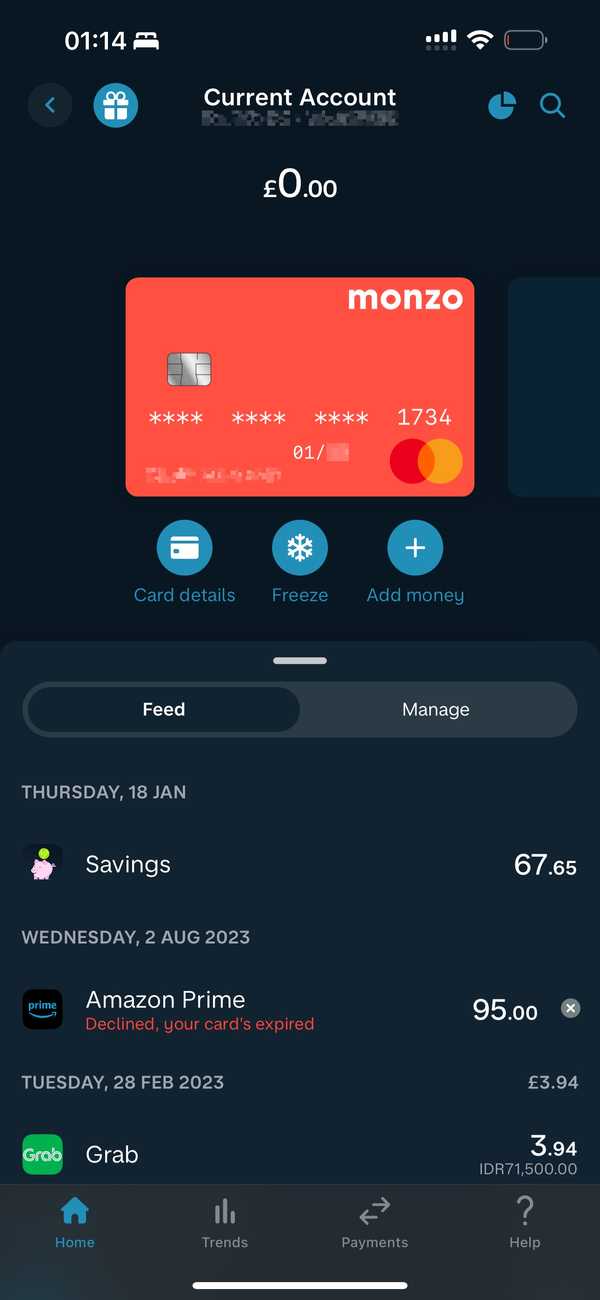

- Exclusive holographic card

- Stay safe online with virtual cards

- See your credit score in the app

- Pots with interest for organizing money

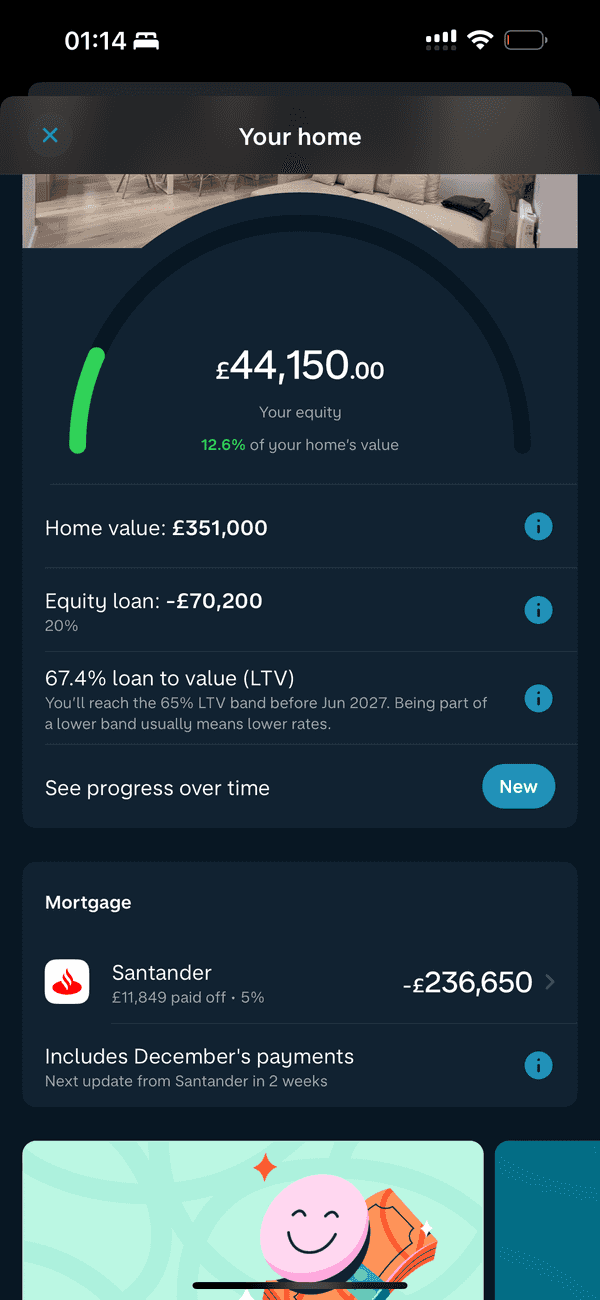

- Add your other bank accounts and credit cards in the Monzo app

- Advanced roundups to increase your savings

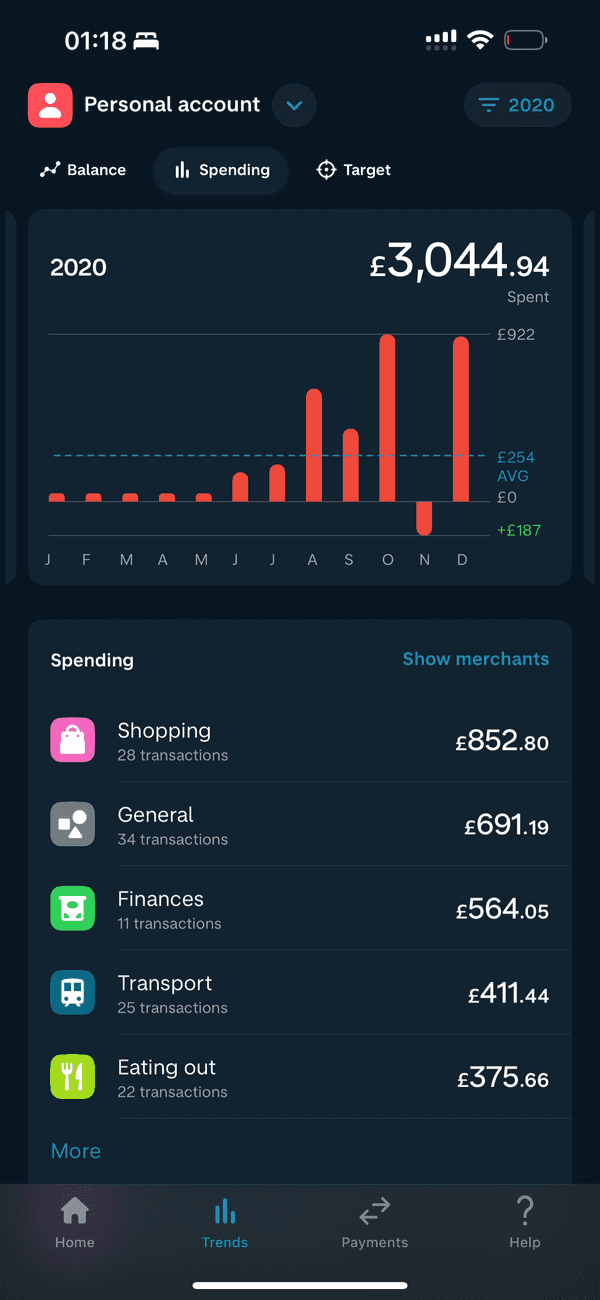

- Help in managing finances effectively with custom categories

- Loans up to £25,000 (eligibility check won't leave mark on your credit score)

- Additional cashback offers with partners like Laka, Fiit, Naked Wines, and Patch

#Safety

Security is a prime concern for any bank account holder. Monzo, known for its user-focused design, extends this principle to Monzo Plus by integrating features such as virtual cards which add an additional layer of security for online transactions, protecting users from fraud and unauthorized spending.

Backed by full authorization and regulation from the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA), Monzo reassures customers about the security and safety of their funds, protected up to £85,000 by The Financial Services Compensation Scheme (FSCS). For more details, explore Monzo’s regulatory status on the Financial Services Register

#Support

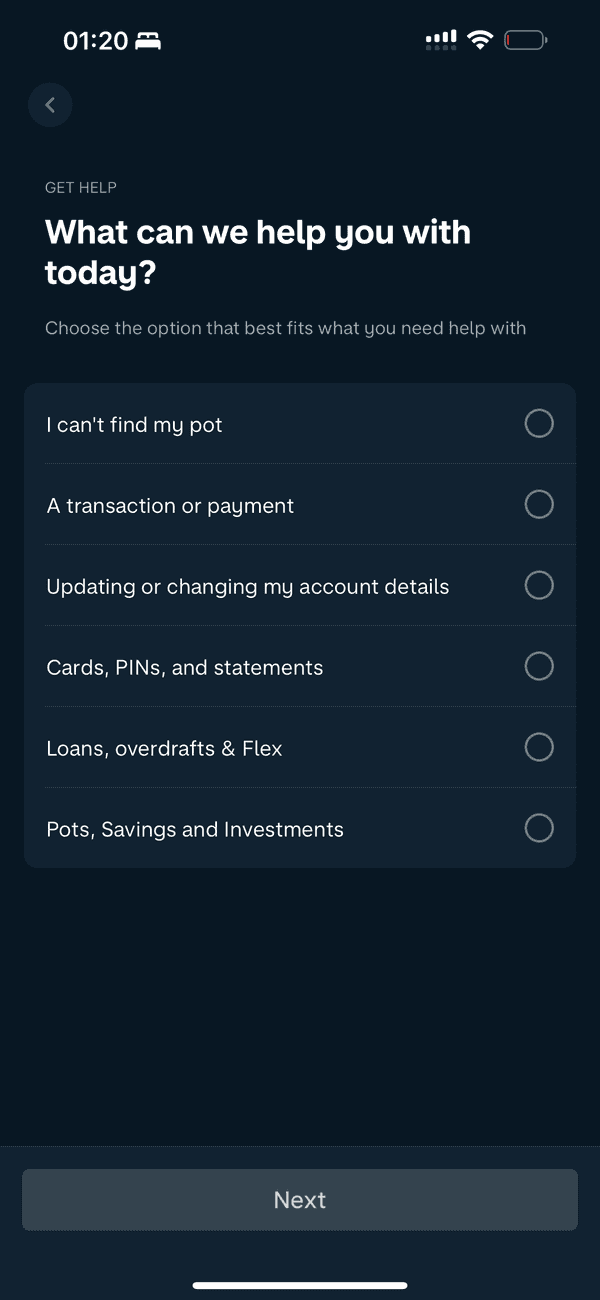

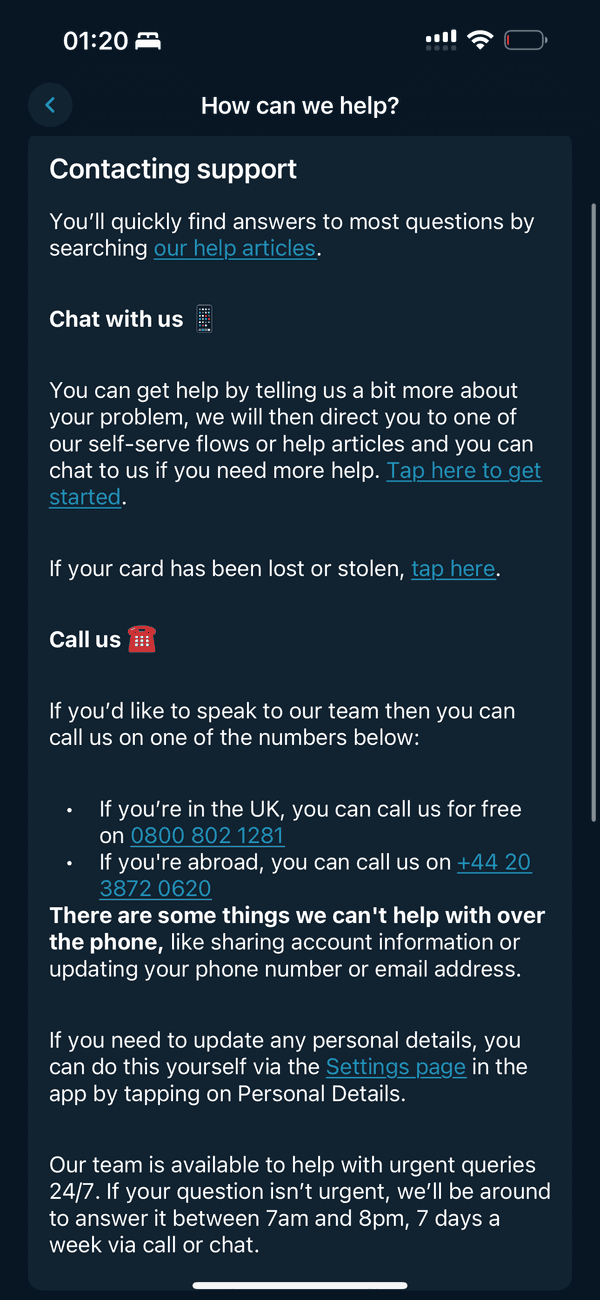

Monzo is known for its dedicated customer support, accessible through the application with a reputation for being user-friendly and efficient. Monzo Plus members have access to this same high standard of customer service, ensuring they can get assistance promptly whenever necessary.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

A noteworthy point regarding Monzo Plus is its fee structure. Users pay a monthly fee of £5 for Monzo Plus, and initially there is a three-month minimum term, meaning the user will pay at least £15 upon signing up.

After the initial term, the account continues on a rolling contract which can be canceled at any time without a cancellation fee. It is important to note that if the payment date falls on a date not included in a shorter month, the fee will be taken on the last day of that month instead. Should the account not have sufficient funds to cover the fee, this could result in an overdraft and additional charges

#Final thoughts

Considering what Monzo Plus offers for its price, it is a strong contender for those who desire enhanced features from their bank account. With innovative budgeting tools, shopping safety measures, and exclusive deals, it is a product that appears to stand up to its promises.

If you are considering an upgrade to your banking experience and believe you will utilize the included features, Monzo Plus may be worth the investment.

Remember to always review the terms and conditions of any financial product, and consider whether Monzo’s current account offerings are the right fit for your personal banking needs.

#FAQs

#Is Monzo Plus worth it?

It can be worth it for users who will actively utilize its features such as budgeting tools, offers, and virtual cards. However, for users with simpler banking needs, the standard Monzo account might suffice without incurring the monthly fee.

#What is Monzo Plus?

It is a banking service that offers a additional set of features beyond the standard Monzo account for a monthly fee. It is designed for users who want more control and additional benefits from their bank account.

#How to cancel Monzo Plus?

The plan can be canceled directly within the app. Within the first 14 days, cancellation ensures a full refund of the monthly fee, but a £5 charge is applied to cover the cost of the Monzo Plus card. After the initial 14 days, canceling may incur additional fees depending on the terms at the time of cancellation. Please read T&C for the most accurate information.

#How much is Monzo Plus?

It costs £5 per month with a mandatory three-month minimum term upon signing up. This results in an initial outlay of at least £15, after which the contract continues on a month-to-month basis that can be canceled anytime without a cancellation fee.