Revolut Metal Review 2024 -

Best for those seeking elite services

Updated 06 Feb 2024

The Metal Plan isn’t just about carrying a stylish card; it’s a comprehensive financial toolkit designed for the discerning customer who values both the aesthetics and functionalities of a premium banking service.

It is a step above Revolut’s standard offerings, aimed particularly at those who are frequent travelers or engaged in higher volume financial transactions. As a premium service, it promises exclusive benefits that go beyond the basics of banking, providing enhanced features such as higher withdrawal limits, attractive cashback options in various currencies, and significant travel-related perks.

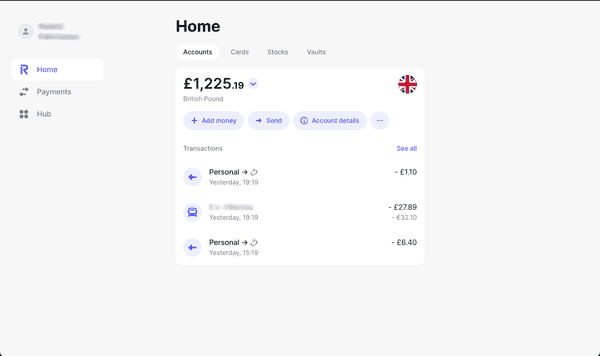

Bank Account

Company

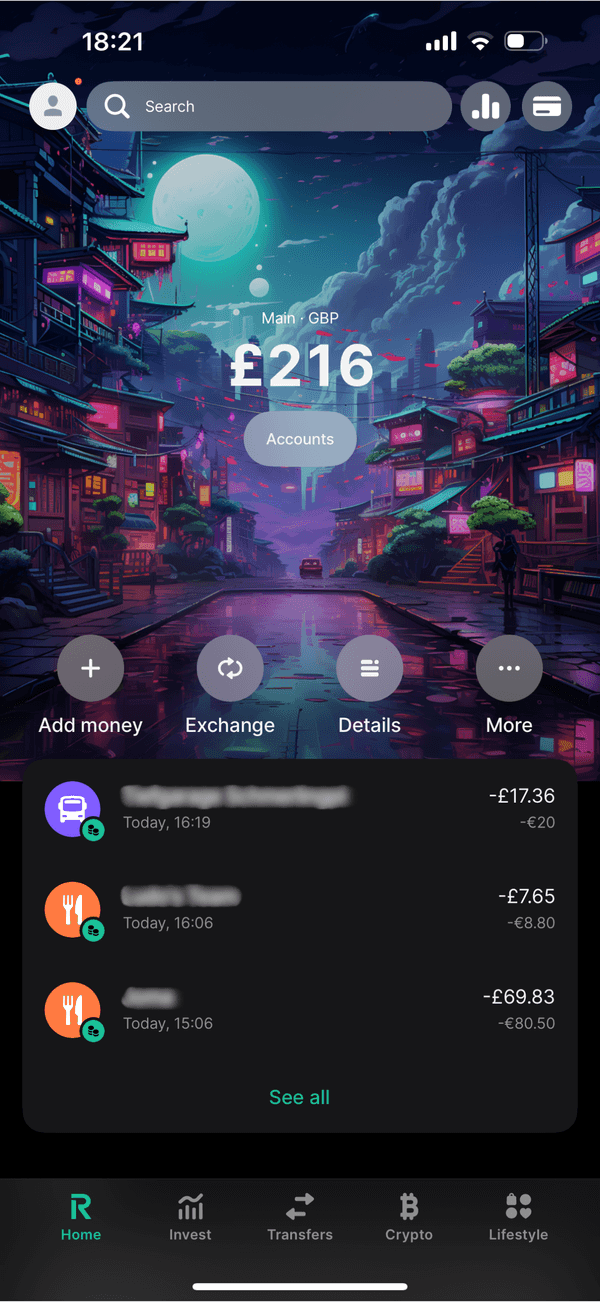

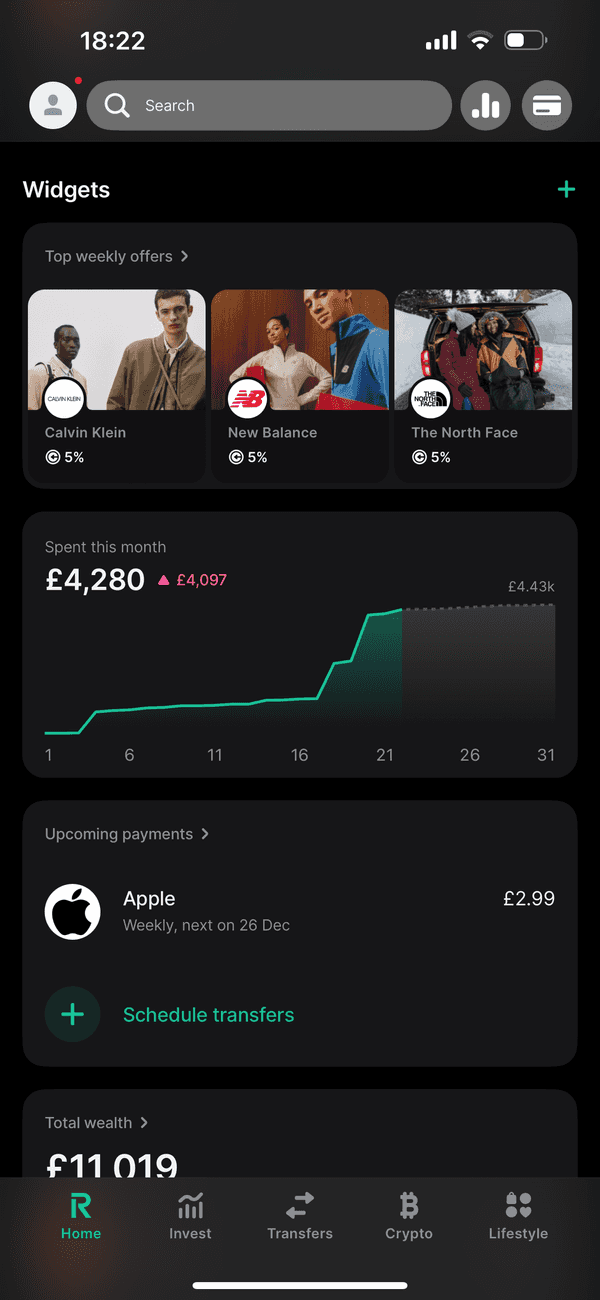

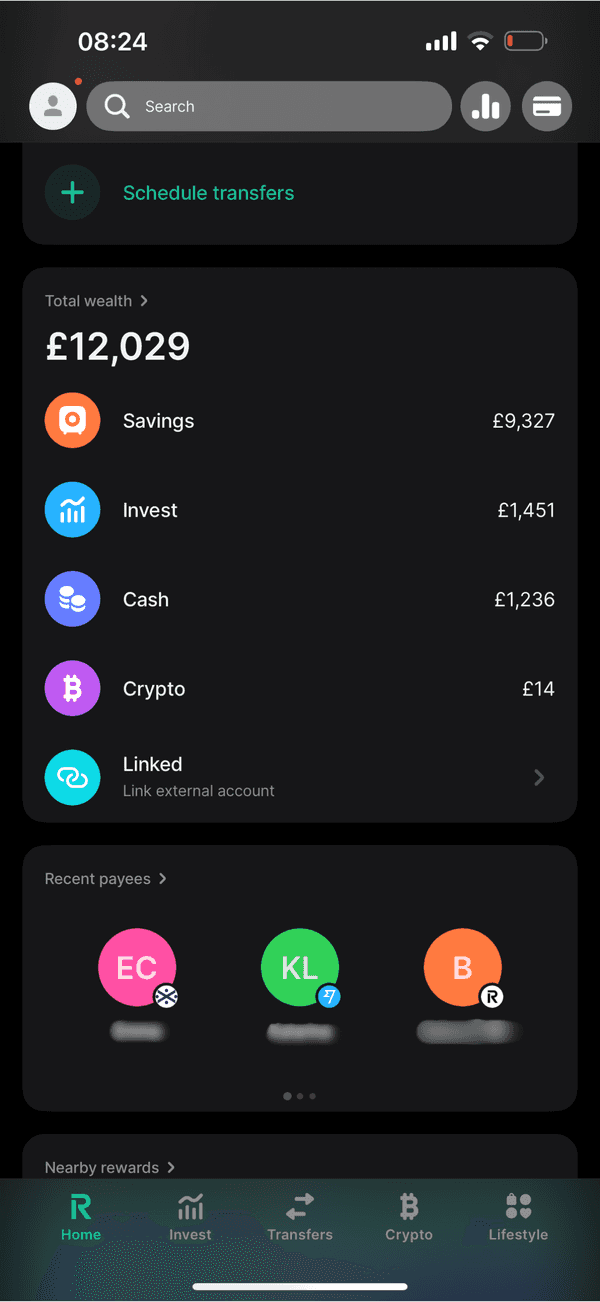

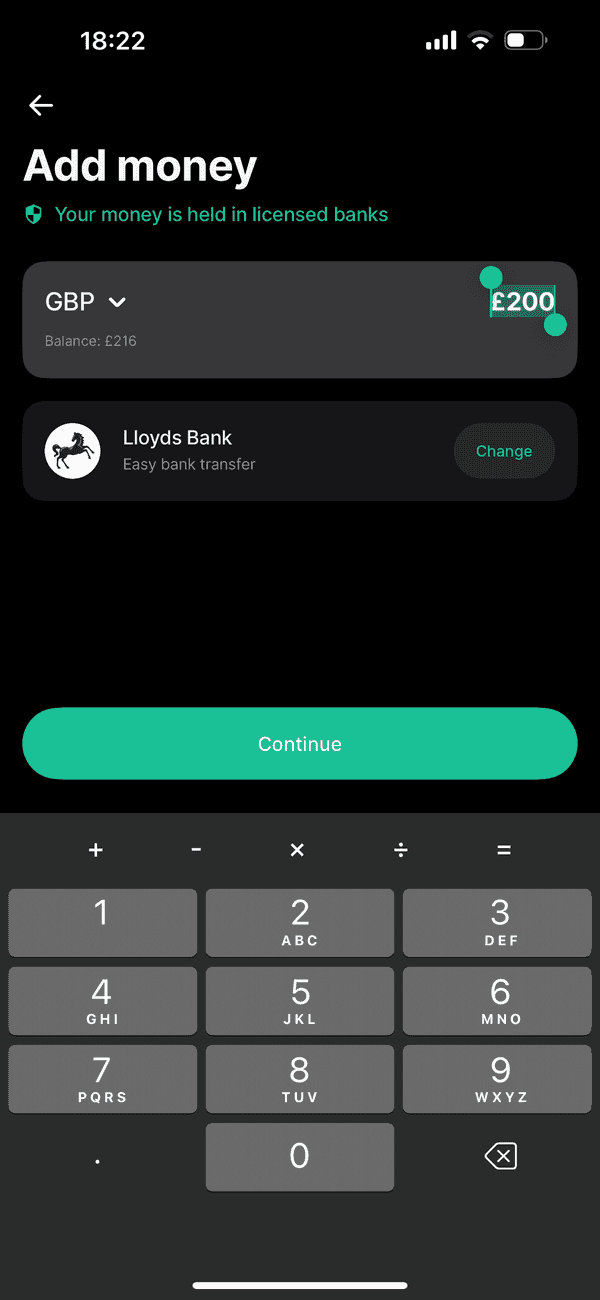

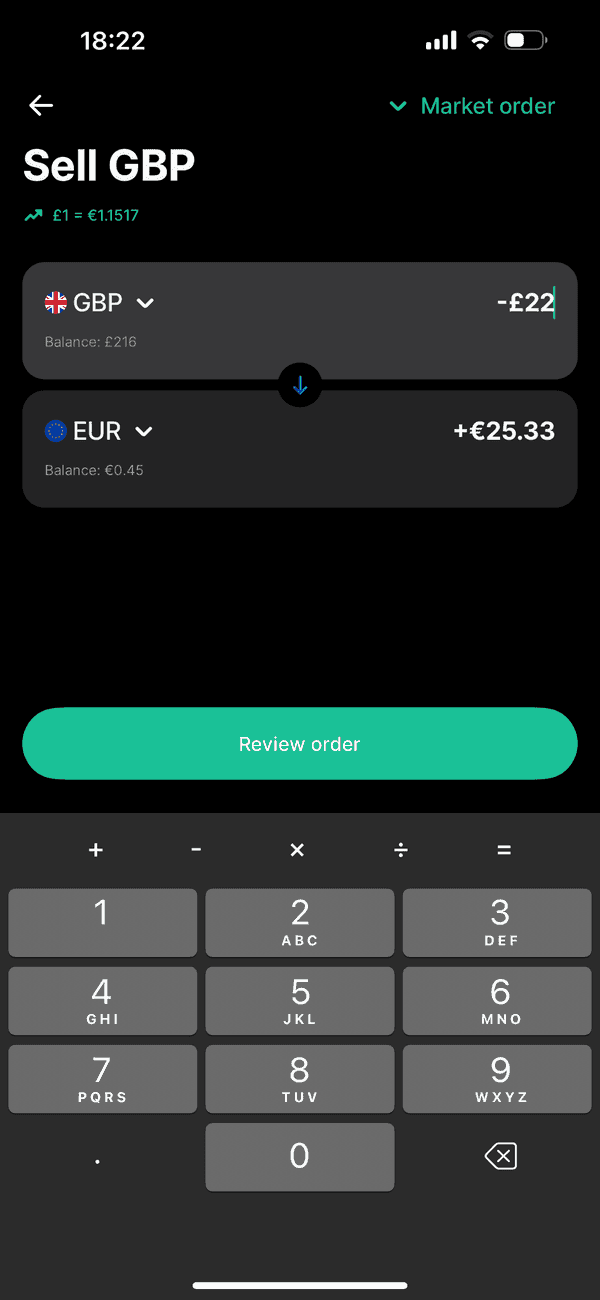

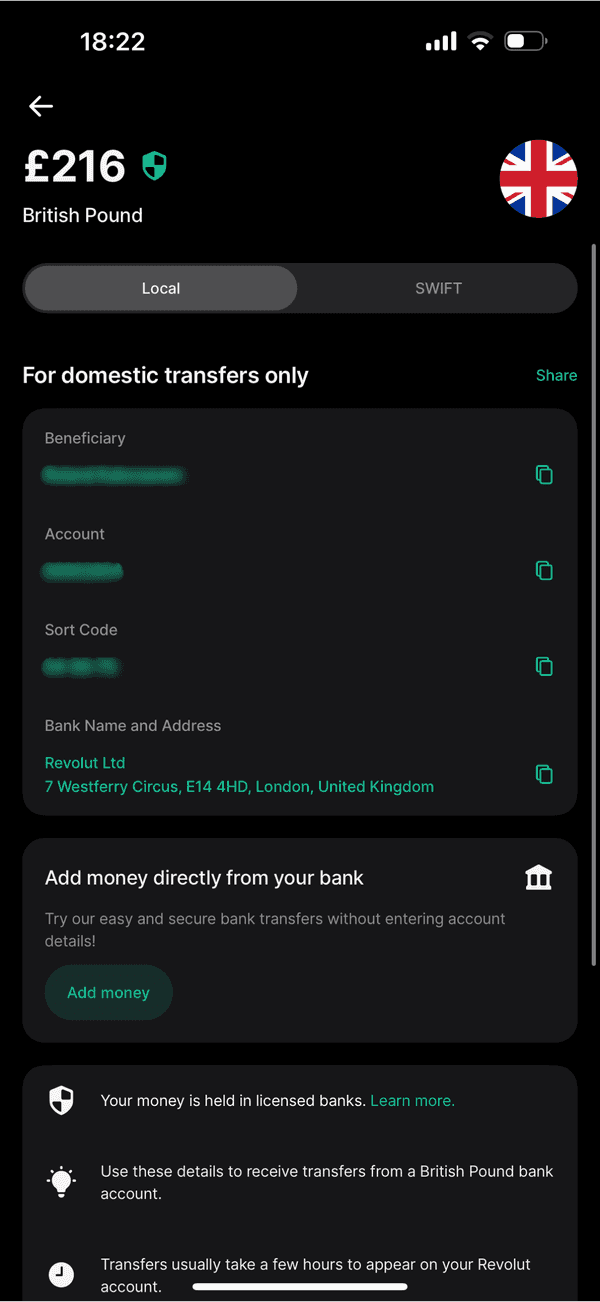

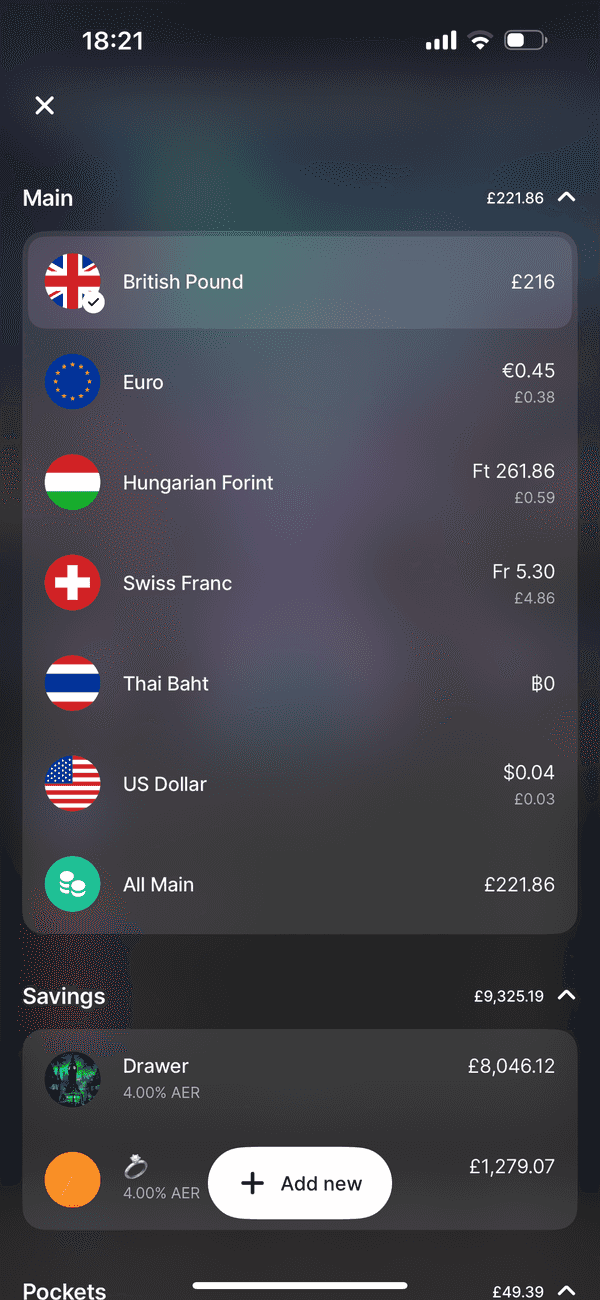

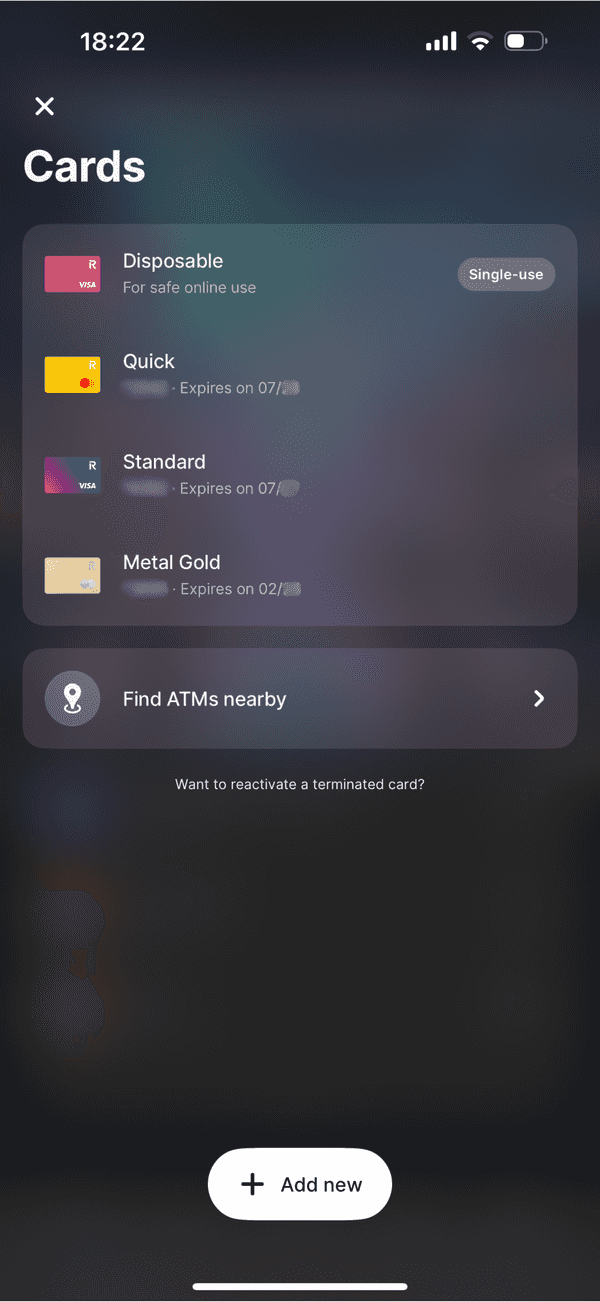

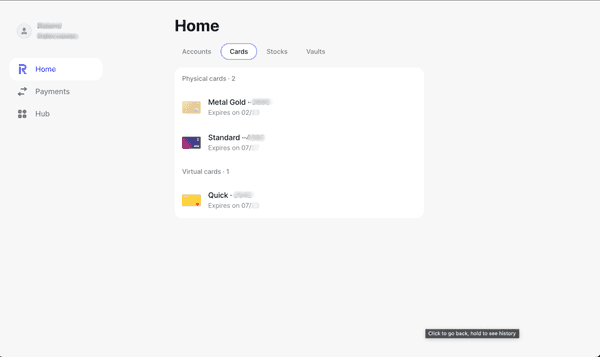

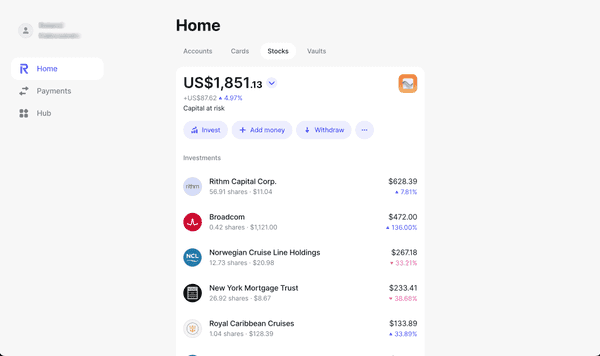

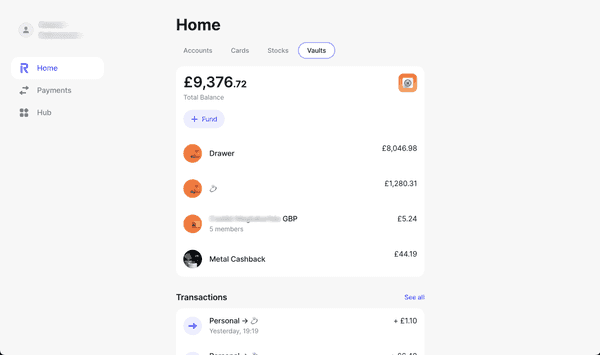

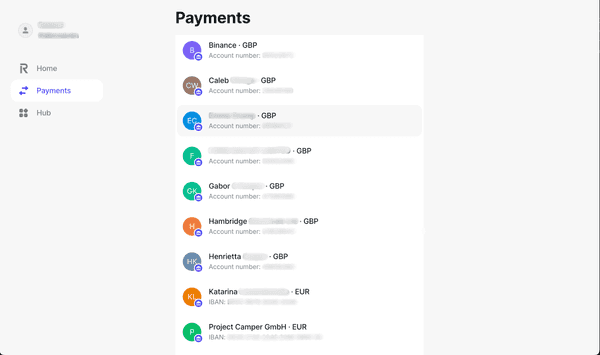

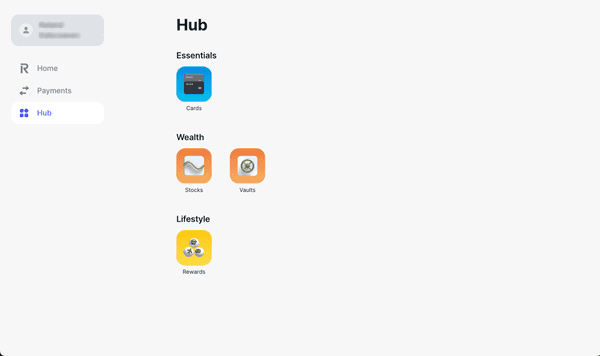

#Screenshots

#Pros & Cons

Pros

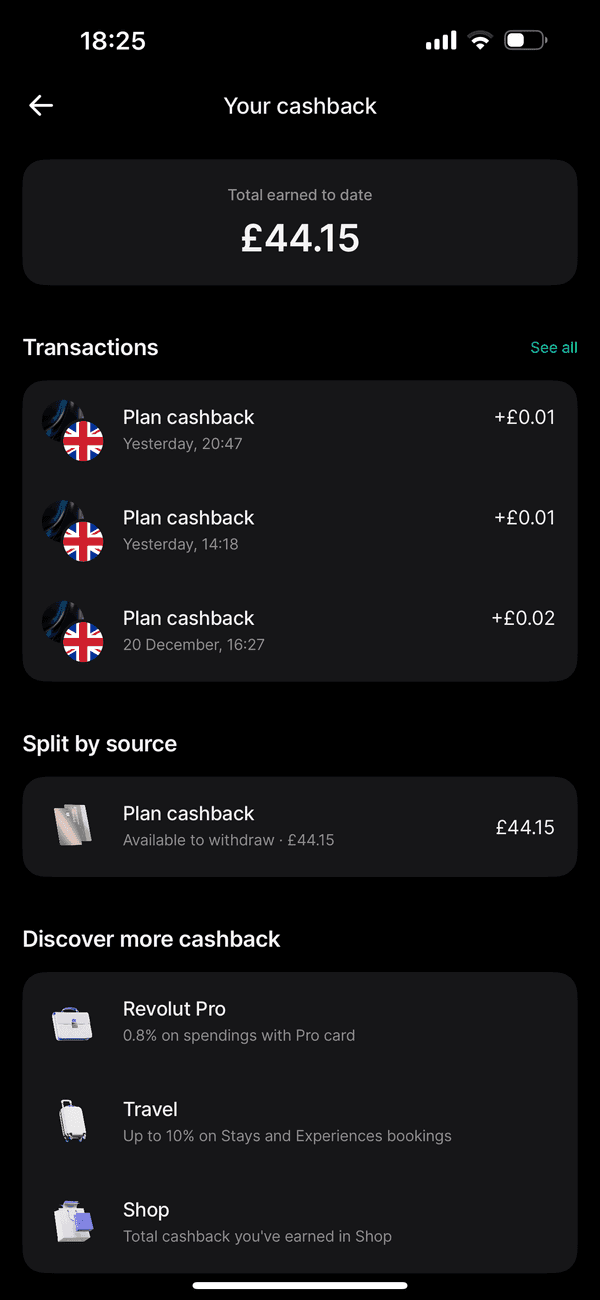

- Attractive cashback offerings on spending

- A generous ATM withdrawal limit four times that of standard options

- A hefty 40% discount on international payments

- Competitive higher interest rates for Savings Vaults

- Support for managing up to 5 Revolut Junior accounts

- A range of evolving benefits that get added over time.

Cons

- The premium nature of the plan means a higher cost compared to basic accounts

- Travel insurance terms are set to change, which could affect the coverage

- Downgrading from the Metal Plan to a lower-tier plan could incur a fee.

#Fees

Revolut strives to make sure the fees are as transparent as possible. The plan includes one free stainless steel Revolut Metal card and offers perks such as cashback in various currencies, precious metals, or cryptocurrencies.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

| LOCAL | Free | Free | Free | Free | £800.00 Free 2%(min. £1.00) |

| EUROPE | Free | Free | Free | Free | £800.00 Free 2%(min. £1.00) |

| INTERNATIONAL | Free | ~0% | Free | ~0% | £800.00 Free 2%(min. £1.00) |

Additional Information

- Up to 0.1% cashback on all your transactions in Europe and the UK, and 1% everywhere

- Insurance on purchases

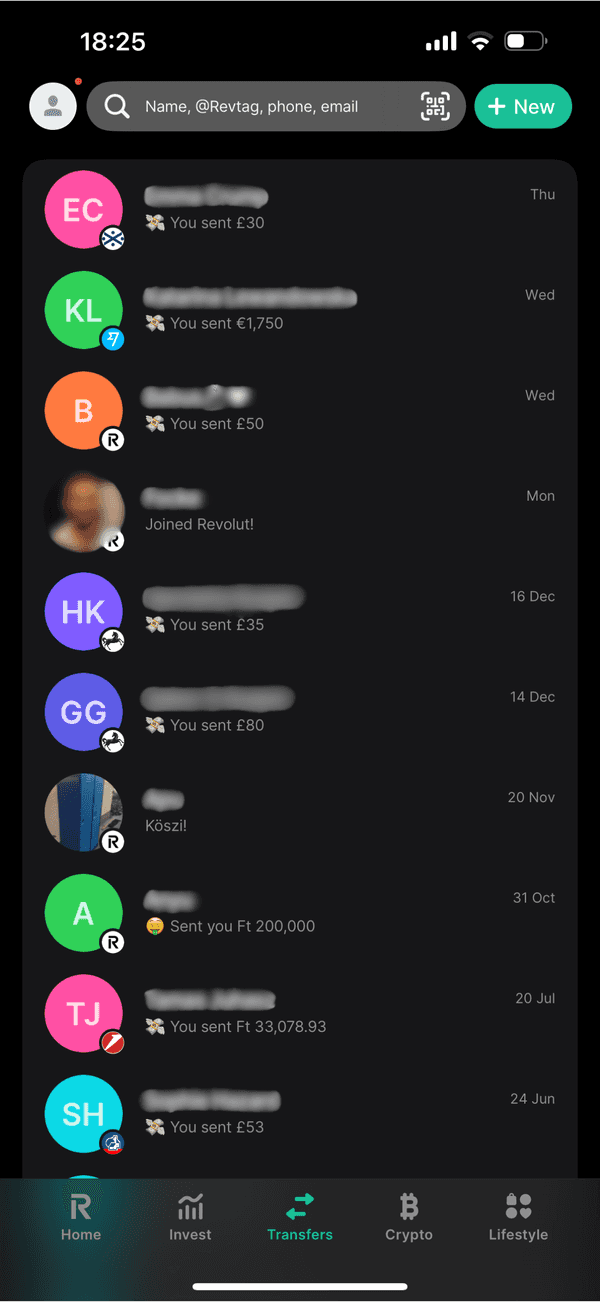

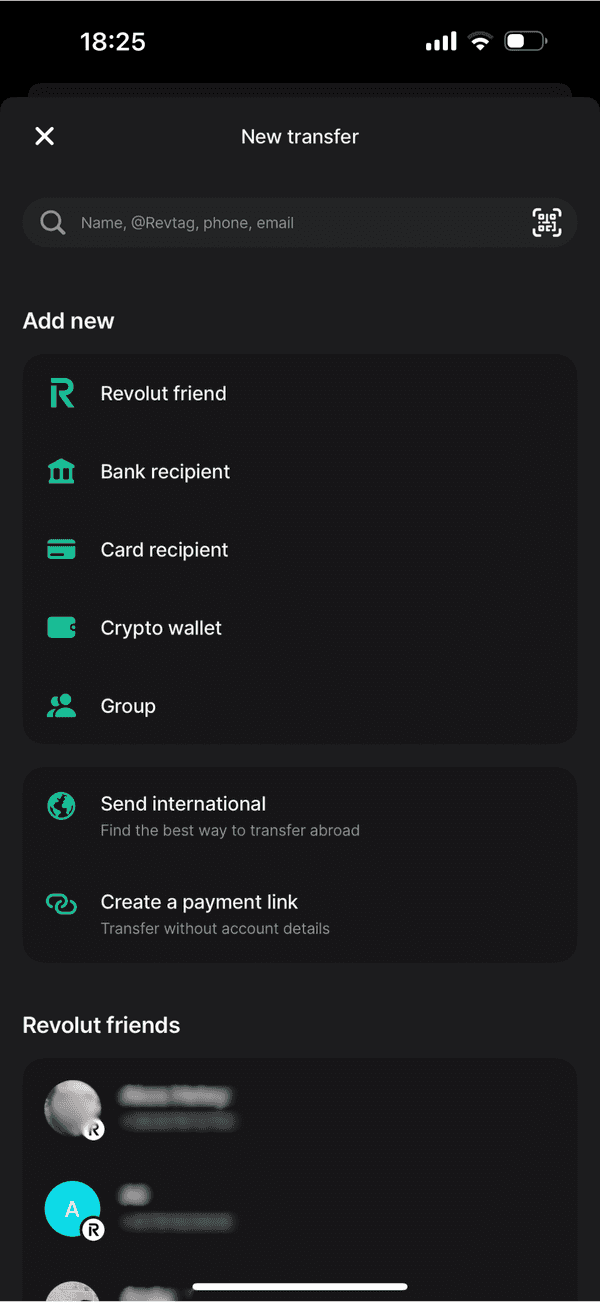

- Free instant transfers to other Revolut users

- Free local transfers in your country

- Free within Single European Payments Area (SEPA)

- Fee applies for card transfers

- 40% discount on international transfers.

- Receiving money is free.

- Adding money is free from UK or EEA card

- Fee charged form Commercial or US card or other counries

- Free withdrawals up to £800, then a fee applies.

- That fee is 2% of the withdrawal, subject to a minimum fee of £1 per withdrawal.

Overdraft

#Perks

Perks

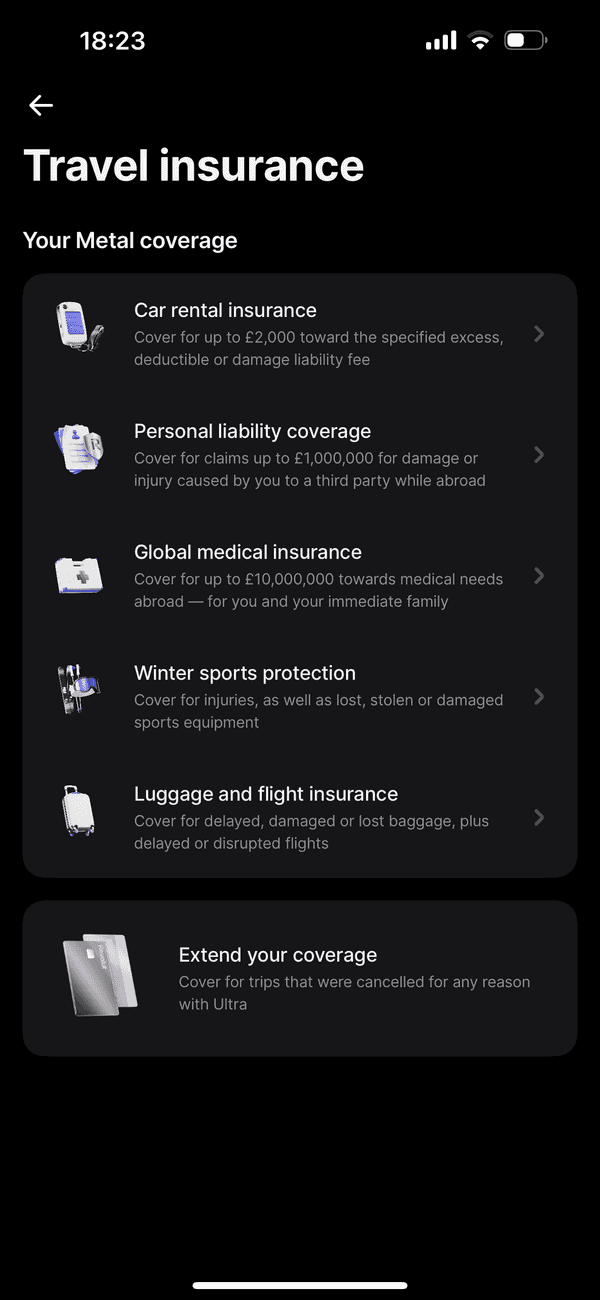

- Global Multi-Trip Family Travel Insurance by Chubb (90days, age 75)

- SmartDelay: 4 FREE lounge passes (1h+ flight delay)

- Car Hire Excess £2,000/y limit

- Revolut Pro 0.8% Cashback

- 5 Revolut Junior Accounts

- Discounted Airport Lounge Access

- Currency Exchange - No exchange limit. Mon - Fri

- Up to 10% Cashback on Accomodations

- Winter Sports Insurance £3,000/y limit

- Delayed flight, lost or damaged luggage insurance £1,000/y limit

- Personal Liability Insurance £1m/y limit

- Commodity Exchange - 1.49% (minimum fee £1)

- Cryptocurrency Exchange - Variable Fee

- Financial Times - Standard Digital

- ClassPass - 10 credits per month

- NordVPN - Plus

- Deliveroo - Plus Silver

- Headspace - Subscription

- Sleep Cycle - Premium

- Freeletics - Coach

- Tinder - Gold

- Picsart - Gold

- WeWork - 1 credit per month

#Safety

Revolut takes the security of its customers seriously, employing industry-standard measures to ensure the safety of funds. They maintain high-security standards to safeguard your finances but there is no FSCS protection unless you keep your money in a Vault.

#Support

Customer service support is crucial for any premium financial service. Revolut’s Metal subscribers have access to dedicated customer support, ensuring that any concerns or inquiries are handled with a premium touch.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

The plan is priced competitively, it reflects the suite of premium services it offers.

#Final thoughts

Revolut Metal is not just a luxury card; it’s a doorway into a more refined banking experience. For those who find themselves frequently in-transit, or who engage with diverse currencies, the Revolut Metal Plan could be an investment that pays for itself. The combination of a powerful app, top-tier customer support, and a range of financial benefits, all packaged in a tailor-designed, sleek metal card, certainly makes a compelling case.

It is worth weighing the cost against the perks before making a decision. If the exclusive benefits align with your financial activities and lifestyle, the Metal plan could provide unmatched value.

#FAQs

#What are the benefits of Revolut Metal?

Cashback on a variety of currencies, increased ATM withdrawals, higher savings interest rates, discounts on international payments and a free contactless stainless steel card.

#Does Revolut metal pay for itself?

It pays for itself only if you extensively use the features and benefits it offers. For some users, especially those who travel frequently, engage in foreign transactions, or utilize the entire suite of Metal features, the costs can indeed be neutralized by the savings and rewards.

#What is the ATM limit for Revolut Metal?

Free ATM withdrawals up to £800, then a 2% fee applies. Subject to a minimum fee of £1 per withdrawal.

#What about Revolut Metal Card colours?

Revolut offers their Metal cards in a variety of colours: Gold, Black, Space Grey, Rose Gold and Lavender

#Is Revolut Metal worth it?

It depends on your personal financial situation and how you can utilize the exclusive benefits like higher cashback, increased withdrawal limits, and comprehensive travel insurance

#How much is Revolut Metal?

The pricing reflects the substantial perks, price at £14.99 per month or £140 annually.

#What is Metal Card Revolut?

It is a premium-tier financial service offered by Revolut, a paid plan, which includes an exclusive stainless steel debit card and enhanced benefits.

#What is Metal Cashback Revolut?

Metal cashback is a feature that allows metal customers to earn cashback on spending in various currencies.

#How to cancel Metal Plan Revolut?

Customers can cancel their Metal Plan through the Revolut app or by contacting their support directly. A fee may apply depending on when the cancellation is made after subscription.