Kroo Current Account Review 2024 -

Ideal for savers & eco advocates

Updated 19 Feb 2024

The need for a dependable and efficient current account is more pressing than ever. The Kroo Current Account emerges as a compelling option, deserving an in-depth review for those considering a switch or opening a new account. With consumer behavior gravitating towards online banking, let’s dive into what Kroo has to offer.

Kroo has positioned itself as a challenger in the realm of digital banking, promising a current account that’s not just a vessel for your funds but a tool for smarter financial management.

Bank Account

Company

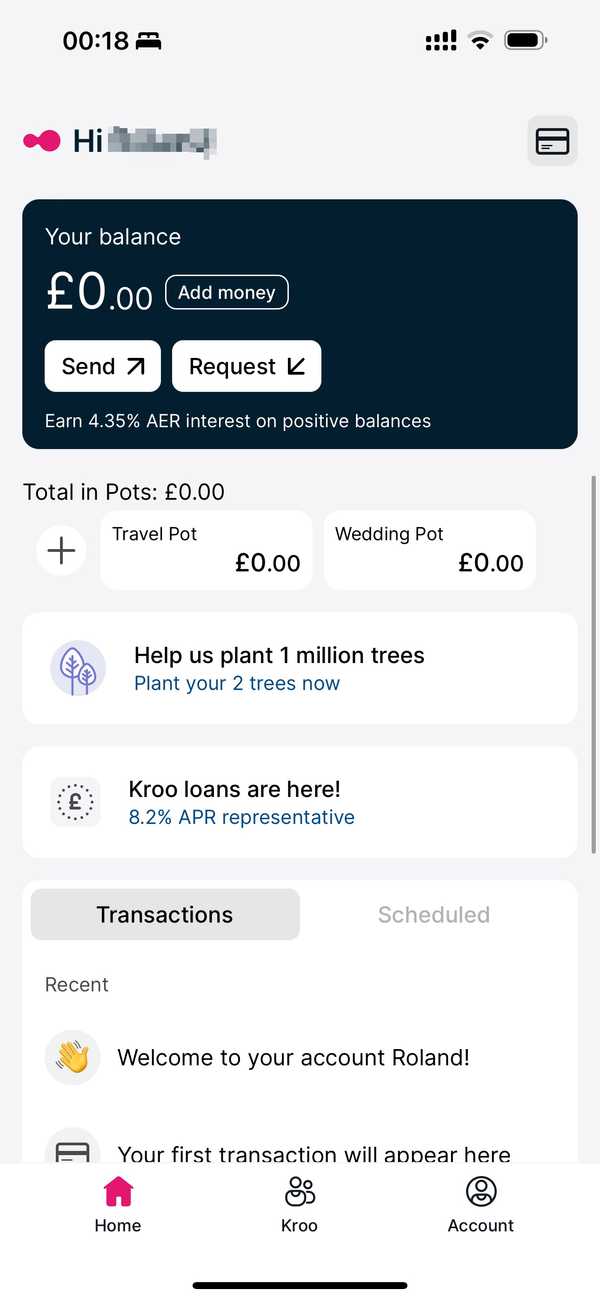

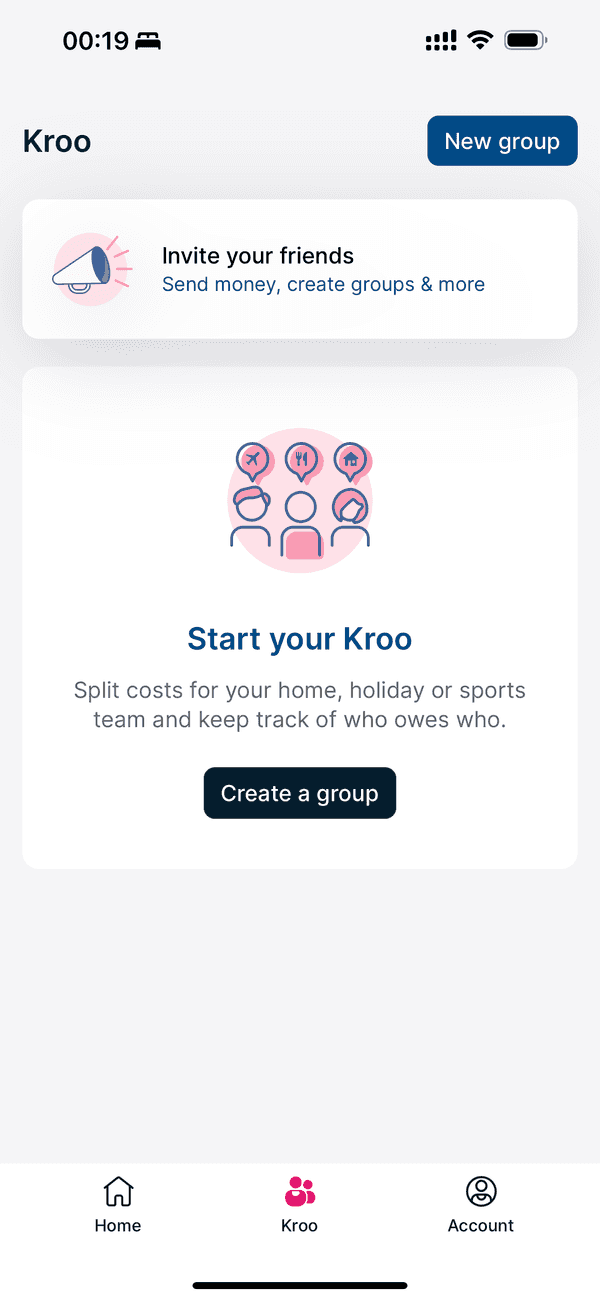

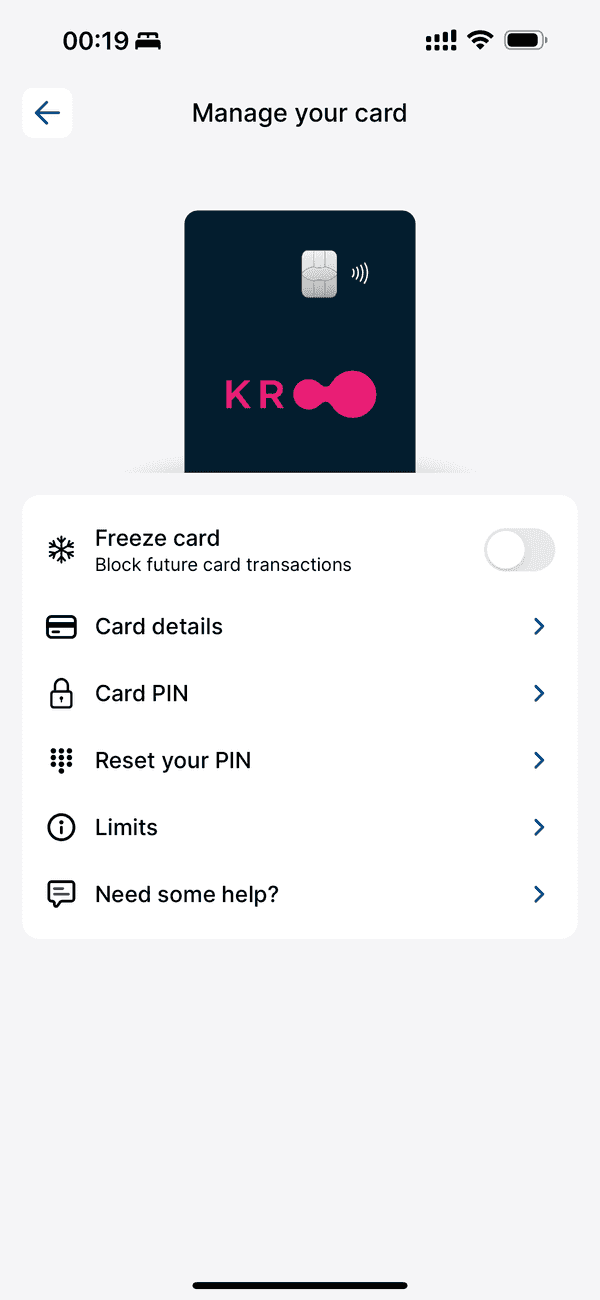

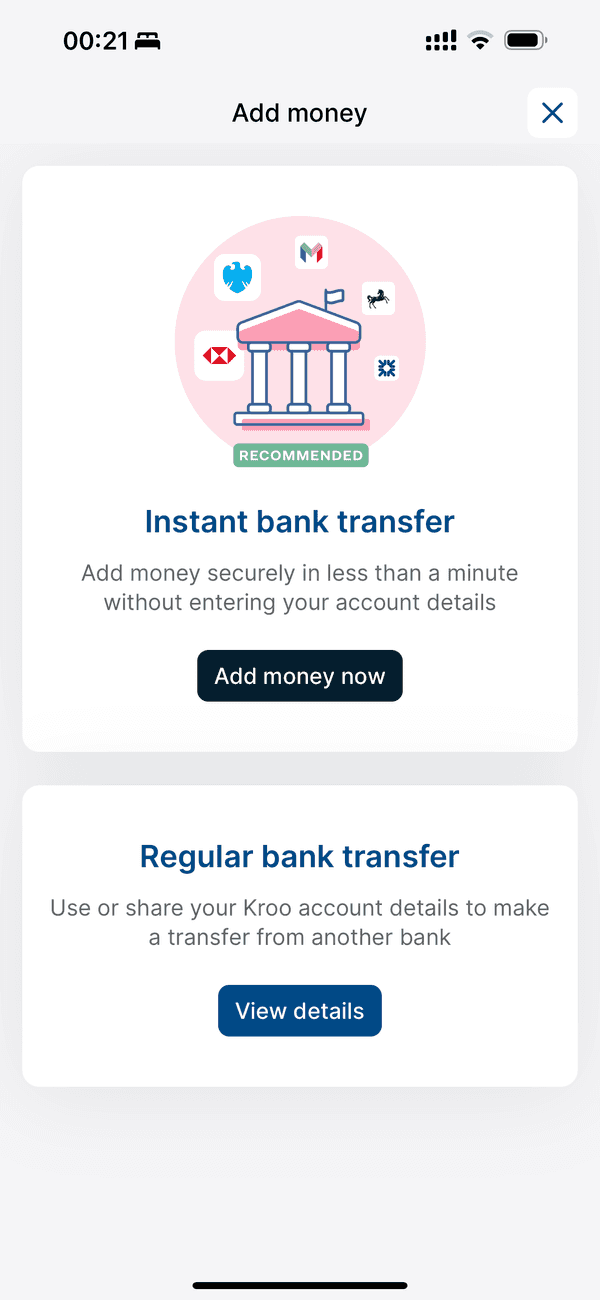

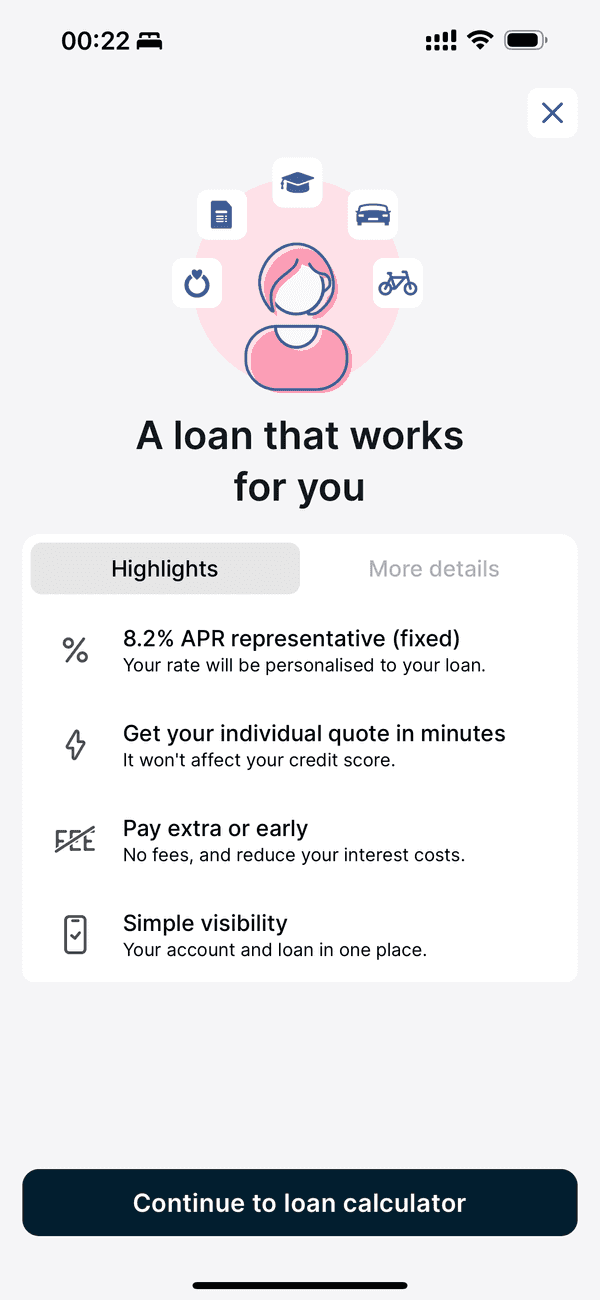

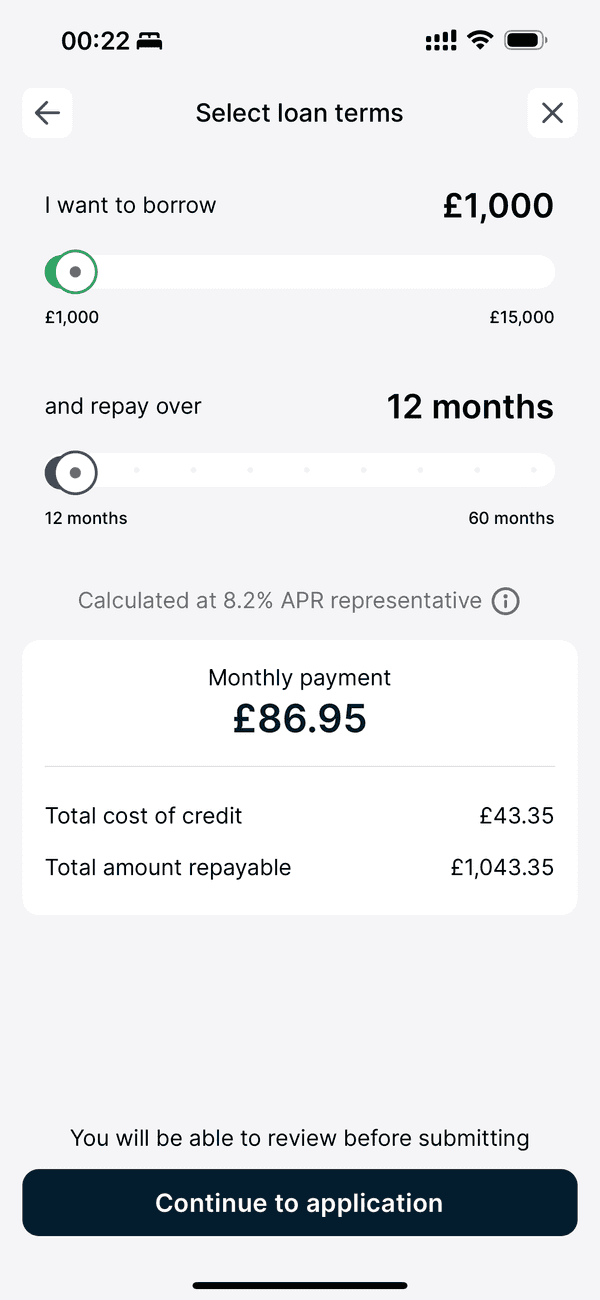

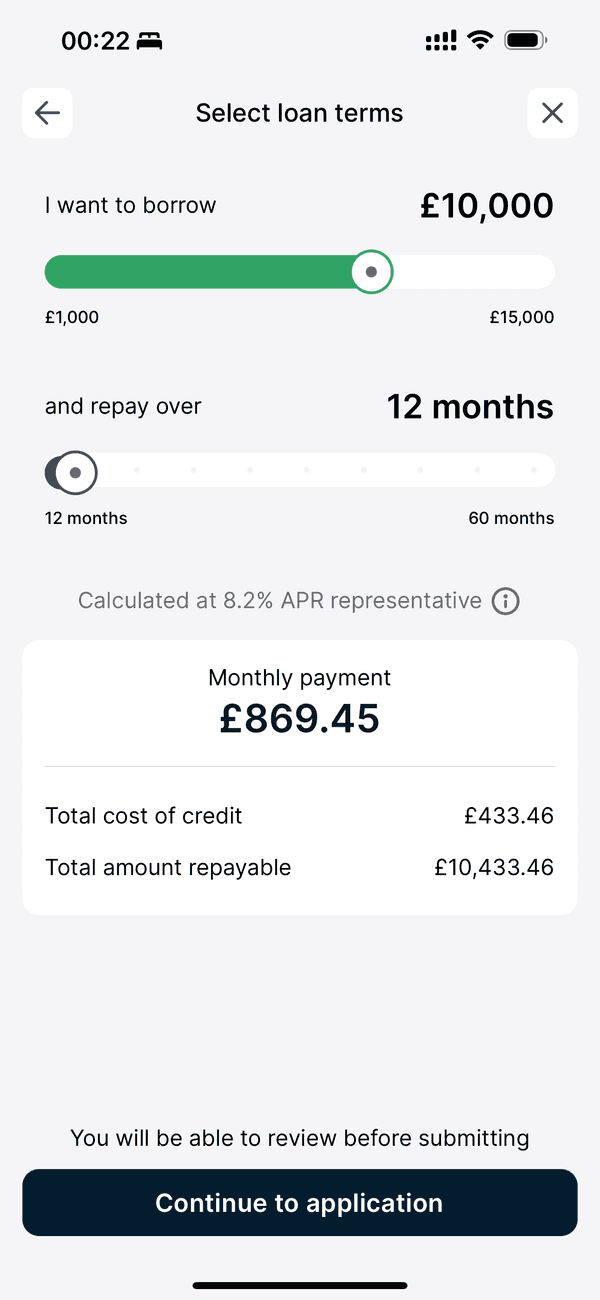

#Screenshots

#Pros & Cons

Pros

- Strong commitment to security with FSCS protection up to £85,000 per customer

- Attractive 4.35% AER on balances, one of the highest in the market

- No foreign transaction fees, making it ideal for travel

- Simple and transparent fee structure with no hidden costs

- Commitment to sustainability through partnership with One Tree Planted

Cons

- Lack of service for sending and receiving money outside the UK may not cater to international needs

- Overdrafts are offered by invitation only with a standard rate of 24.9% EAR/APR

- Delay-related issues as the main cause of customer complaints could indicate service speed improvements are necessary

#Fees

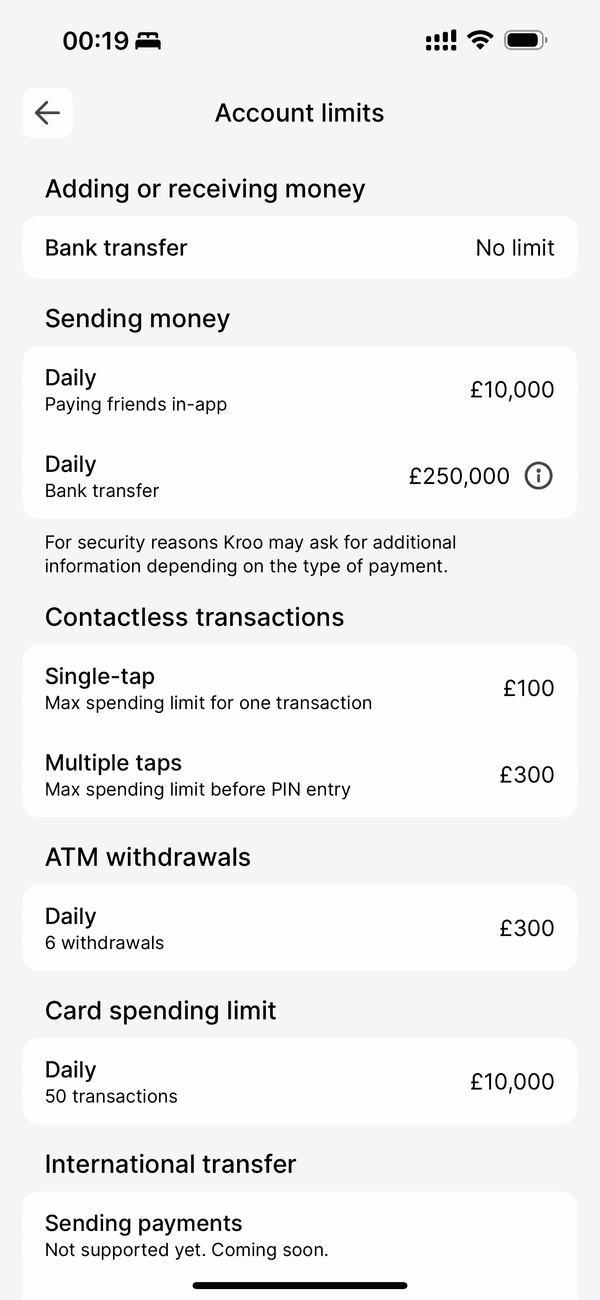

Kroo’s current account stands out with a fee structure that loudly screams ‘customer-first.’ The majority of the account services, from maintaining the account to UK-based transactions like Direct Debits and standing orders, are free of charge. Even cash withdrawals in pounds within the UK along with debit card payments in any currency are cost-free.

However, overseas cash withdrawals invite a 3% fee beyond a £200 monthly limit. When compared to industry standards, these fees are quite competitive, particularly for domestic services.

Kroo offers overdraft, representative APR of 24.9% (variable), however, it’s invitation only.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

| LOCAL | Free | Free | Free | N/A | £200.00 Free Free |

| EUROPE | Free | N/A | N/A | N/A | £200.00 Free 3% |

| INTERNATIONAL | Free | N/A | N/A | N/A | £200.00 Free 3% |

Additional Information

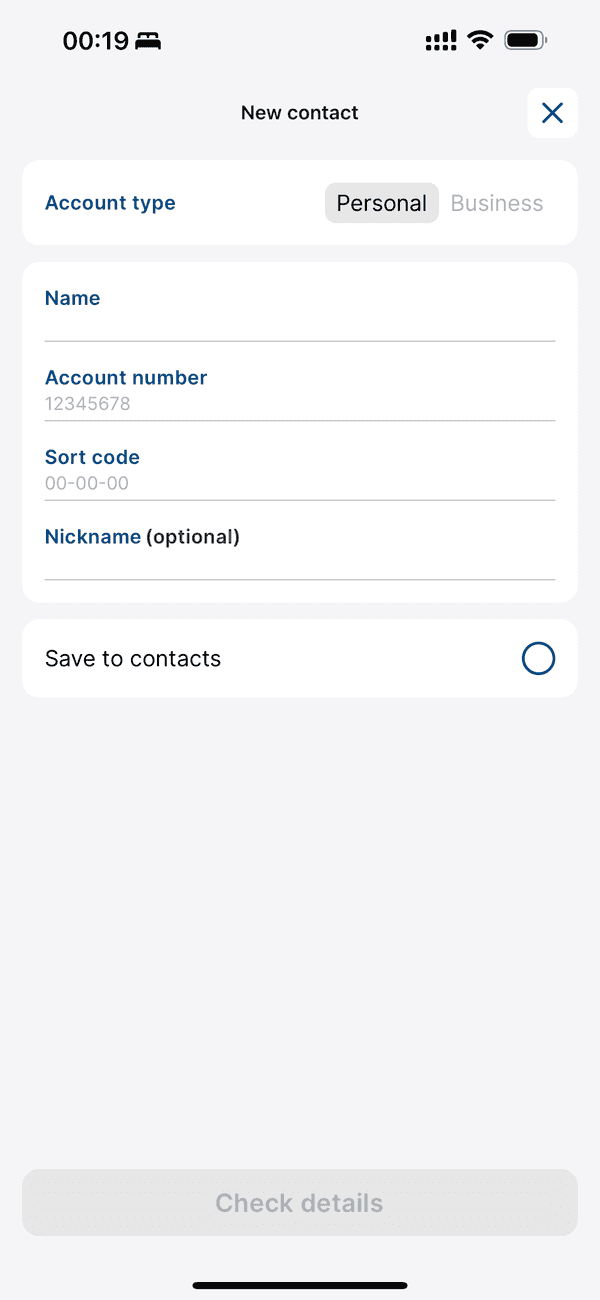

- Free local transfers in the UK

- CHAPS and Faster Payments are free

- Sending money outside the UK is not supported

- Receiving money from outside of the UK is not supported

- There is no charge for using ATMs overseas until 30 April 2024

Overdraft

#Perks

Perks

- Real-time spending insights in the app

- One of the standout perks is the high interest rate offered on balances

- Customers can calculate potential earnings through an interactive online calculator

- Supports Apple Pay

#Safety

Modern security measures like Face ID and in-app card freezing features are perfect examples of Kroo’s commitment to security.

Keeping your hard-earned money secure is a priority, and Kroo provides peace of mind with the Financial Services Compensation Scheme (FSCS), safeguarding deposits up to £85,000.

For more details, explore Kroo’s regulatory status on the Financial Services Registerd

#Support

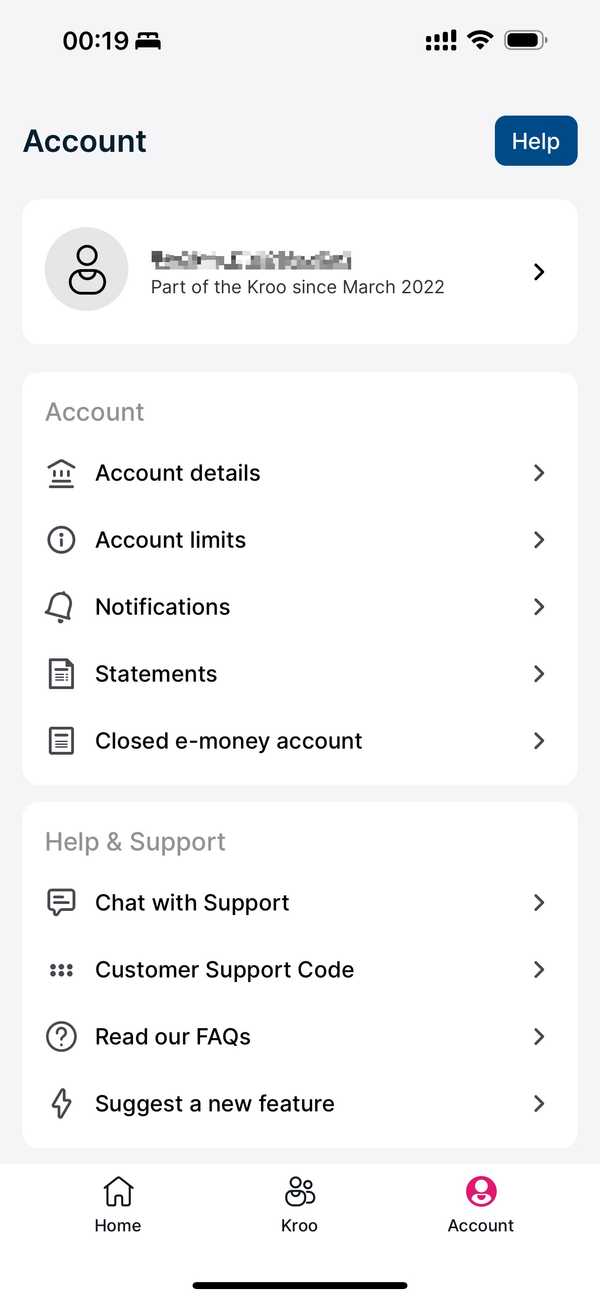

Their customer care system embraces digital touchpoints, including in-app support, in line with their tech-forward branding.

While the bank boasts an admirable complaint resolution rate, addressing all issues within 8 weeks, the prevalence of complaints related to delays highlights opportunities for enhancing response times and service quality.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

The unbeatable price of ‘free’ for account opening and maintenance, coupled with transparency in services that do incur charges, positions Kroo favorably in the market.

#Final thoughts

In sum, the Kroo Current Account is a promising contender on various fronts—be it interest rates, fees, or eco-conscious initiatives. If you can overlook the international transaction service gap and are not a globe-trotter exceeding the foreign withdrawal limit, Kroo’s comprehensive service suite presents a viable and financially savvy choice.

#FAQs

#Is Kroo a current account?

Yes, Kroo offers a current account with comprehensive features and competitive interest rates

#How long does it take to open a Kroo account?

Kroo prides itself on a simple application process that can be completed in minutes from your phone.

#Is Kroo a good bank?

With robust security, attractive interest rates, and a customer-focused approach, Kroo is building a reputation as a trustworthy and innovative bank.

#How to close a Kroo account?

Kroo provides its terms of use with detailed procedures on various account operations, including closure.

#How to get £10 with Kroo?

Kroo runs promotional offers that include incentives like a £10 sign-up bonus. Checking the latest offers on their website or app will provide the current details.