Revolut Ultra Review 2024 -

Exclusive for individuals desiring luxury

Updated 06 Feb 2024

Enter the Revolut Ultra Plan - a service that presents itself as a top-tier financial companion for those with an appetite for luxury, travel, and investment. This review delves into whether the Ultra experience lives up to its premium positioning, ensuring you make an informed decision about this ultimate offering from Revolut.

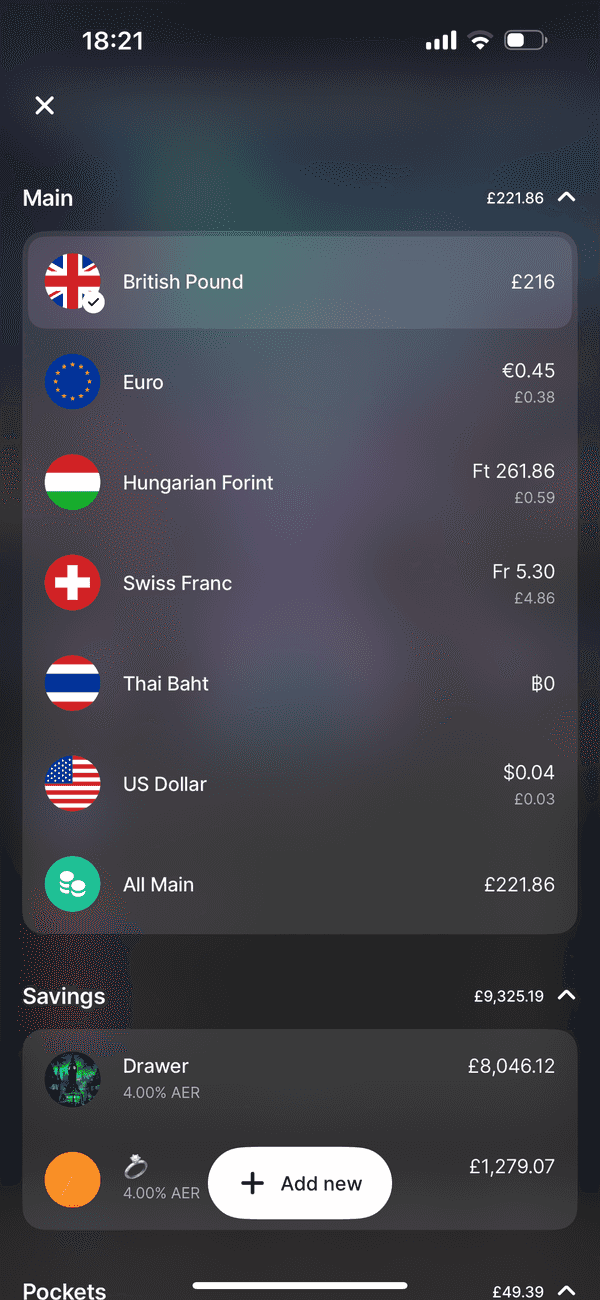

Bank Account

Company

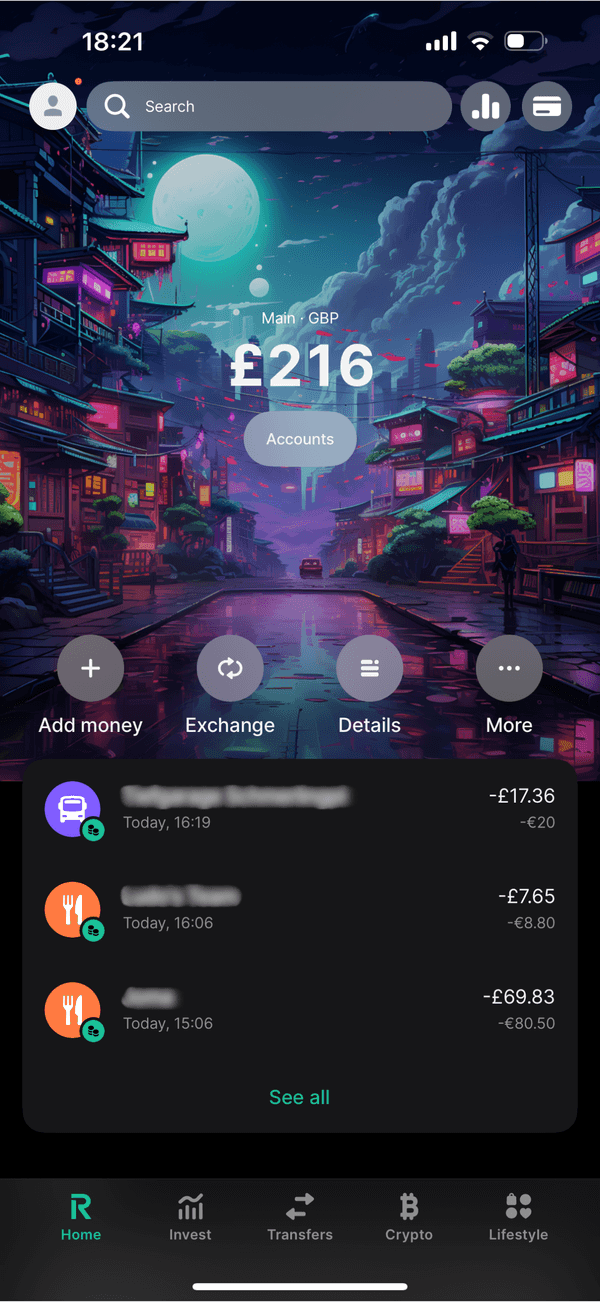

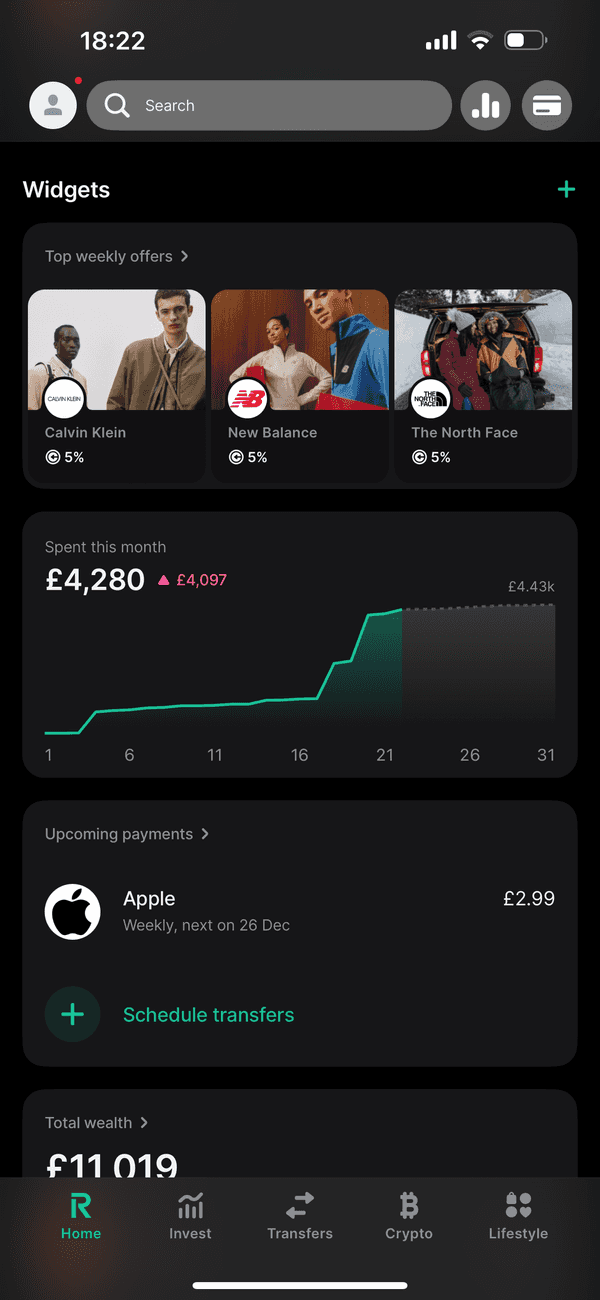

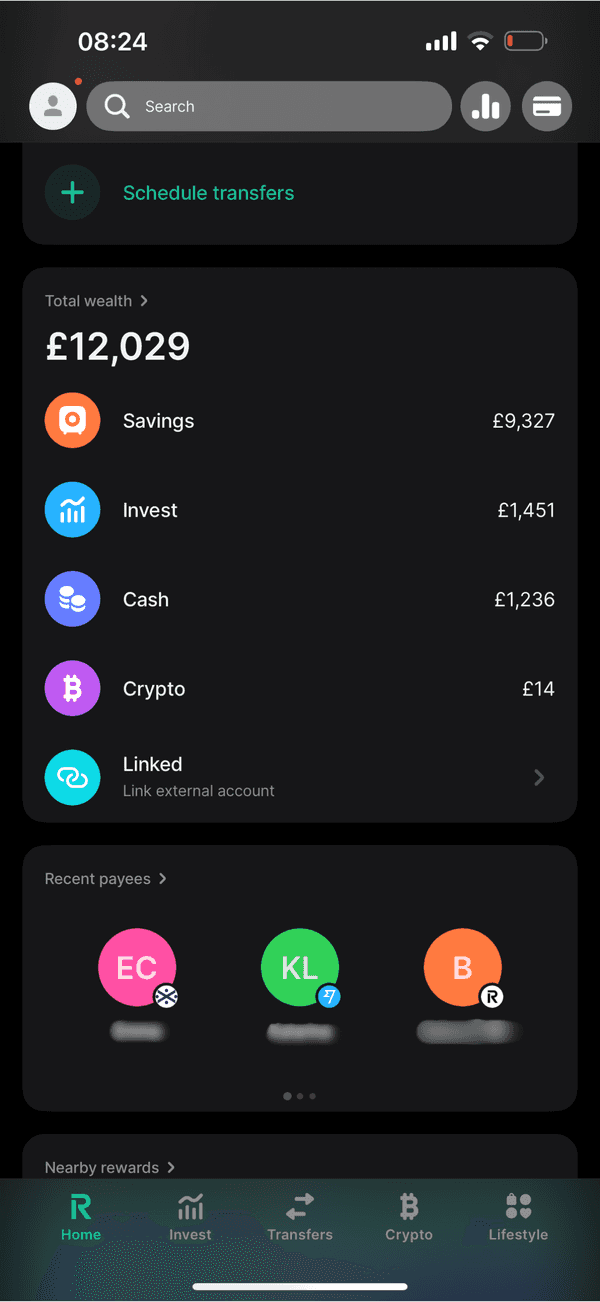

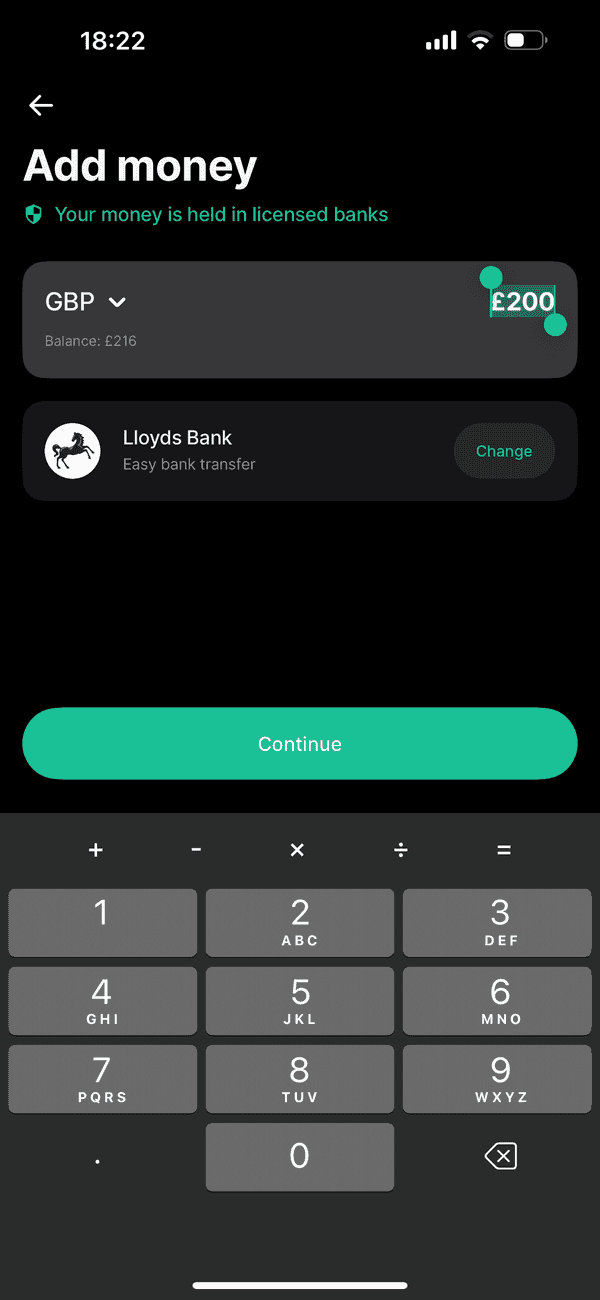

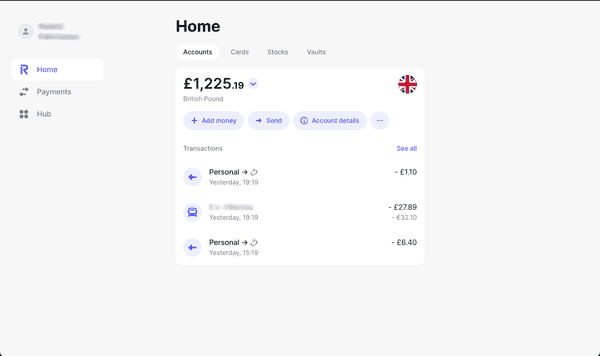

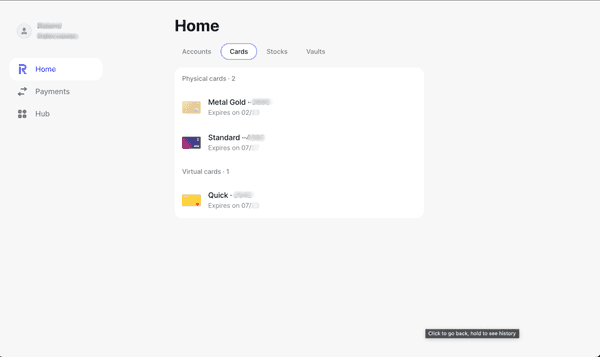

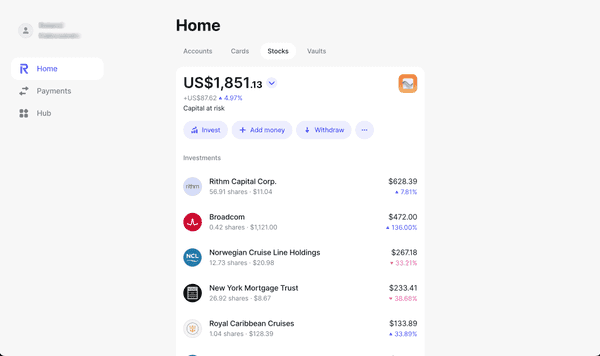

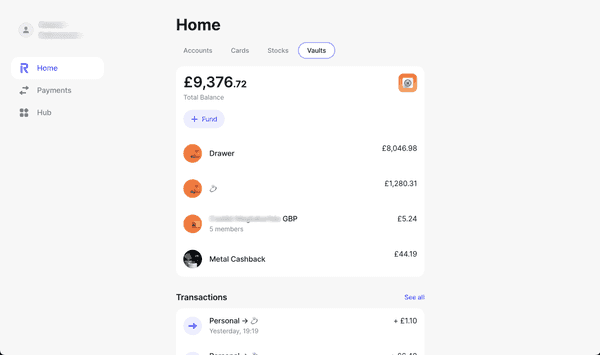

#Screenshots

#Pros & Cons

Pros

- The plan boasts unlimited access to over 1,400 airport lounges globally, a boon for frequent travelers.

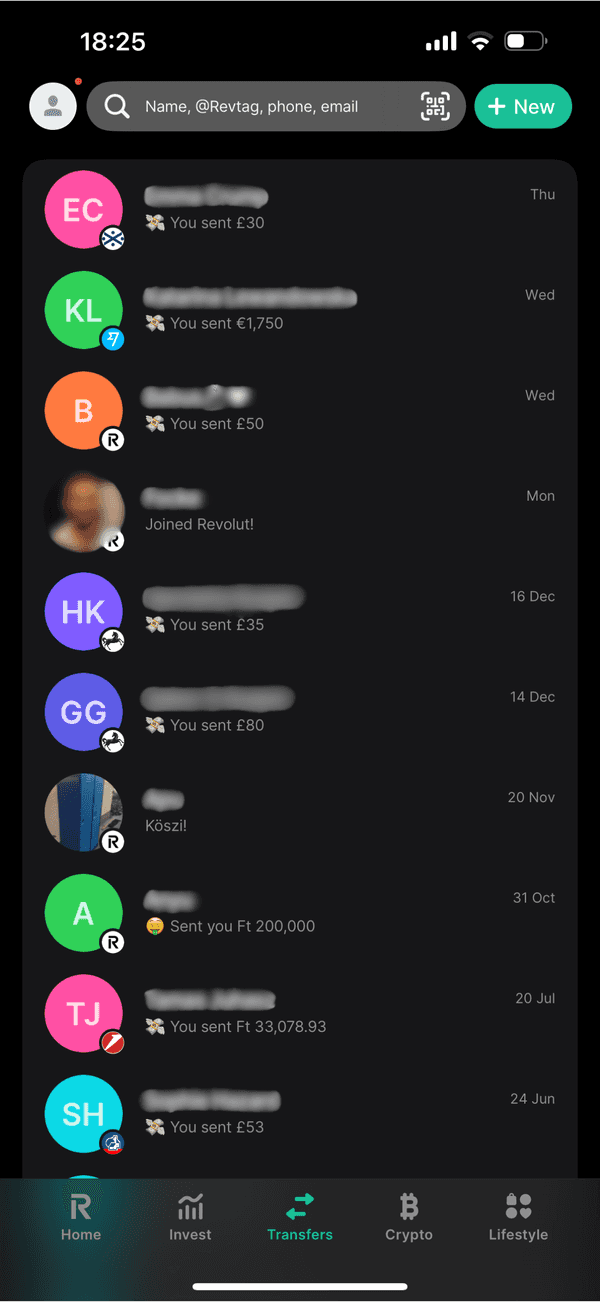

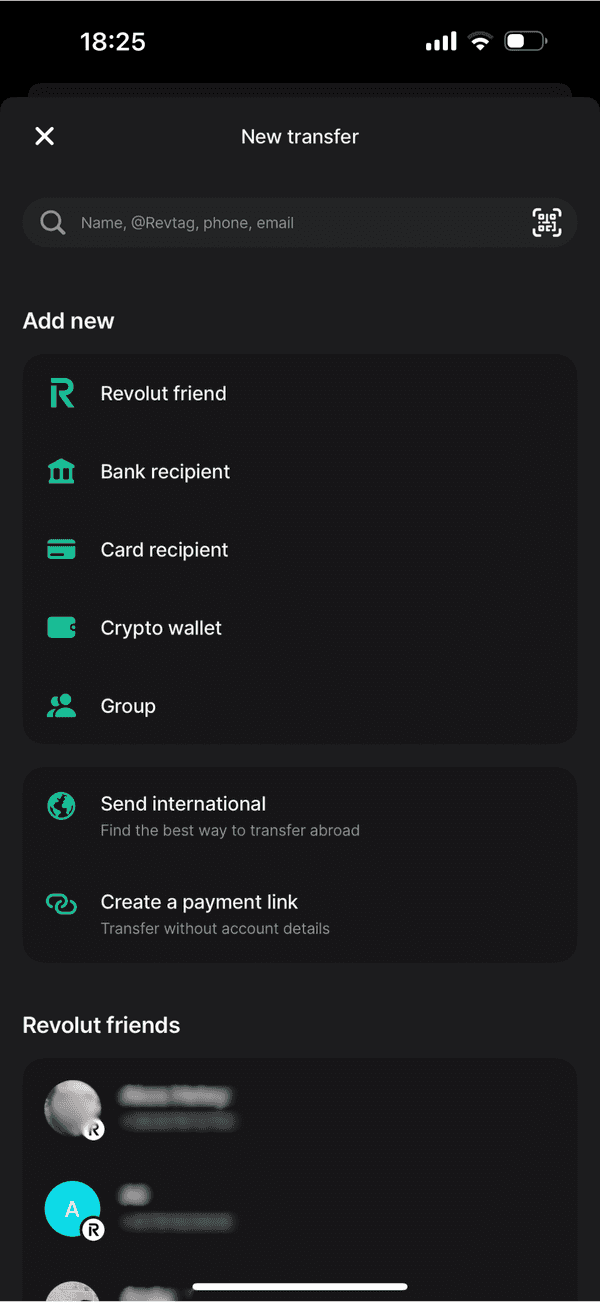

- Transferring money across borders is hassle-free with no fees, a feature that speaks to the global citizen.

- Ultra includes substantial trip, accommodation, and event cancellation reimbursements, reassuring users against non-refundable bookings.

- Ultra members enjoy access to an array of partner benefits, adding value to the everyday user experience.

Cons

- Currently, the Ultra plan is exclusively available in the UK and the EEA, which might be a disadvantage for customers elsewhere.

- With substantial perks come substantial fees - the Revolut Ultra plan is a premium offering with a matching price tag.

#Fees

Customers should keep a sharp eye on what happens after the promotional period, where standard pricing takes over, and whether the services justify the recurring cost. It’s also crucial to note the charges for downgrading or canceling the plan – something any prudent customer should consider.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

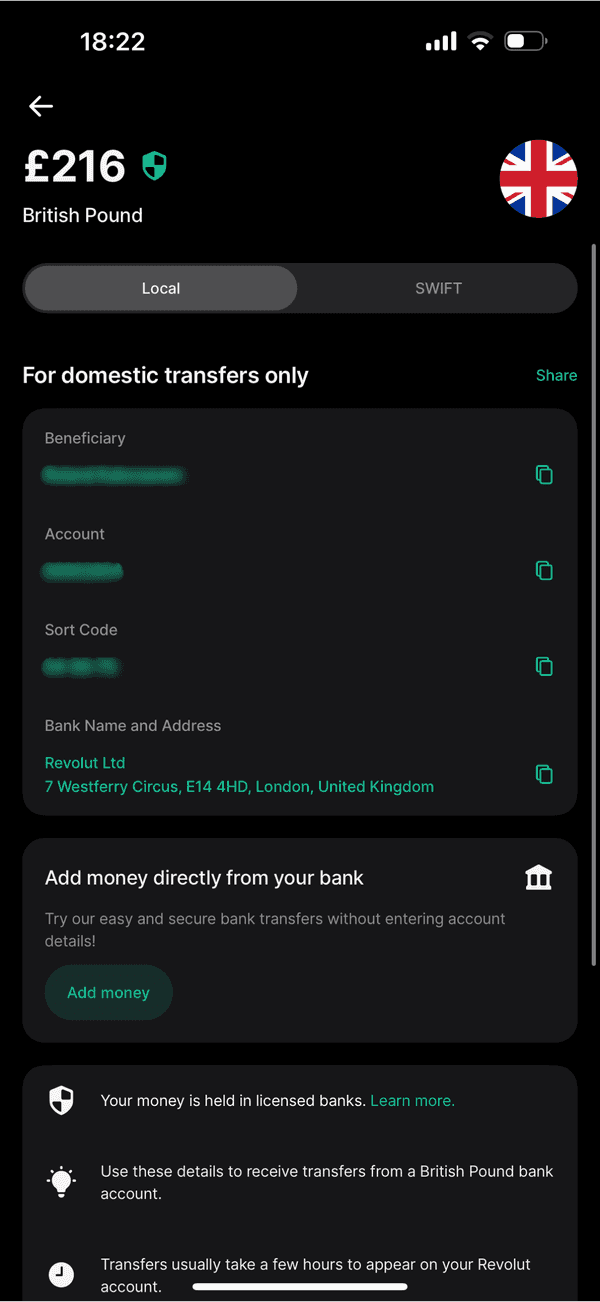

| LOCAL | Free | Free | Free | Free | £2,000.00 Free 2%(min. £1.00) |

| EUROPE | Free | Free | Free | Free | £2,000.00 Free 2%(min. £1.00) |

| INTERNATIONAL | Free | Free | Free | ~0% | £2,000.00 Free 2%(min. £1.00) |

Additional Information

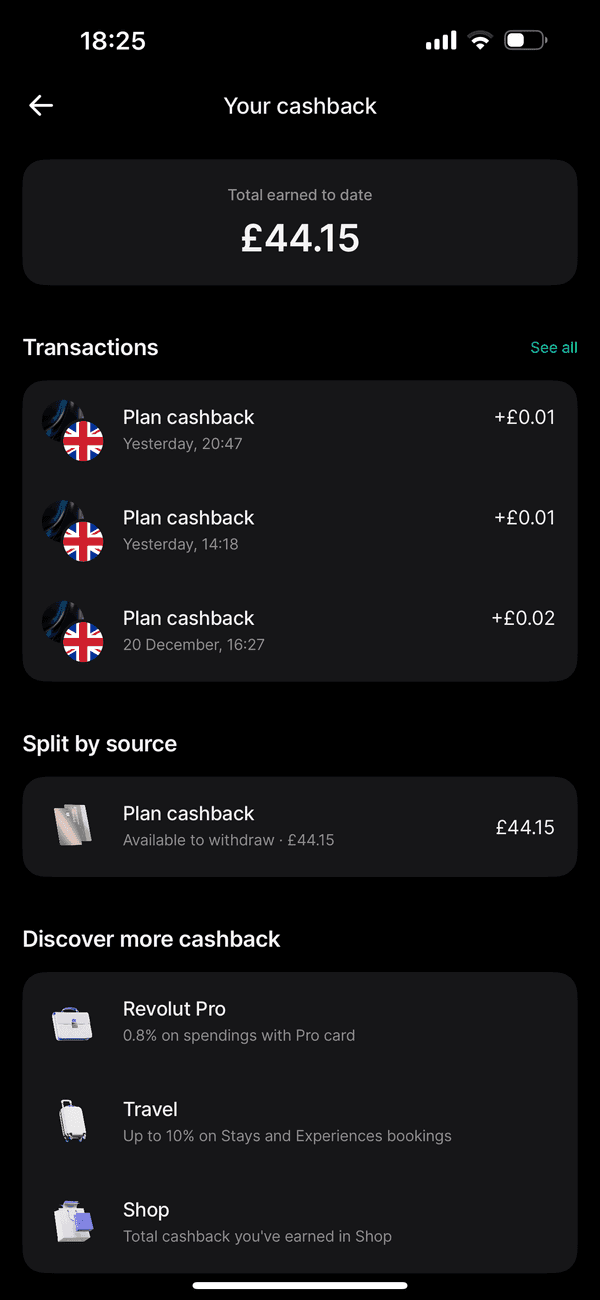

- Up to 0.1% cashback on all your transactions in Europe and the UK, and 1% everywhere

- Insurance on purchases

- Free instant transfers to other Revolut users

- Free local transfers in your country

- Free within Single European Payments Area (SEPA)

- Fee applies for card transfers

- 100% discount on international transfers.

- Receiving money is free.

- Adding money is free from UK or EEA card

- Fee charged form Commercial or US card or other counries

- Free withdrawals up to £2000, then a fee applies.

- That fee is 2% of the withdrawal, subject to a minimum fee of £1 per withdrawal.

Overdraft

#Perks

Perks

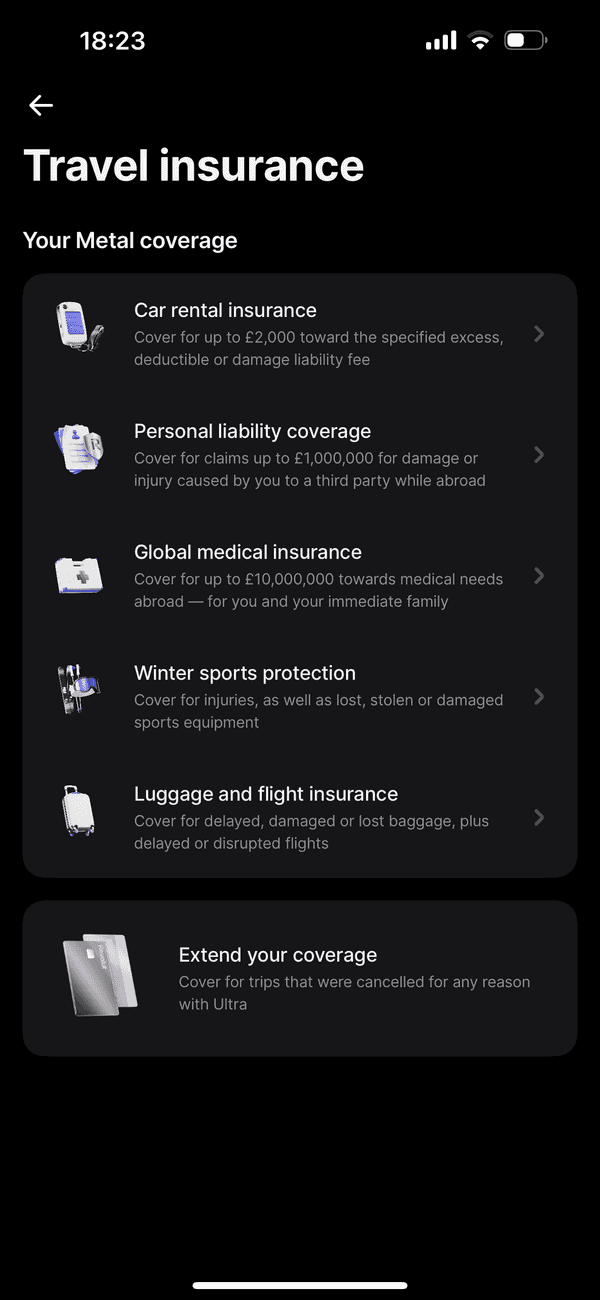

- Global Multi-Trip Family Travel Insurance by Chubb (90days, age 75)

- Car Hire Excess £2,000/y limit

- Unlimited Airport Lounge Access

- eSIM with 3Gb Global data per month

- Revolut Pro 1.2% Cashback

- 5 Revolut Junior Accounts

- Trip and Event Cancellation Insurance

- Currency Exchange - No exchange limit. Mon - Fri

- Up to 10% Cashback on Accomodations

- Winter Sports Insurance £3,000/y limit

- Delayed flight, lost or damaged luggage insurance £1,000/y limit

- Personal Liability Insurance £1m/y limit

- Commodity Exchange - 1.49% (minimum fee £1)

- Cryptocurrency Exchange - Variable Fee

- Financial Times - Premium Digital

- ClassPass - 20 credits per month

- NordVPN - Complete

- Deliveroo - Plus Silver

- Headspace - Subscription

- Headway - Premium

- Turo - £50 credits per month

- Sleep Cycle - Premium

- Freeletics - Coach

- Tinder - Gold

- Picsart - Gold

- WeWork - 3 credit per month

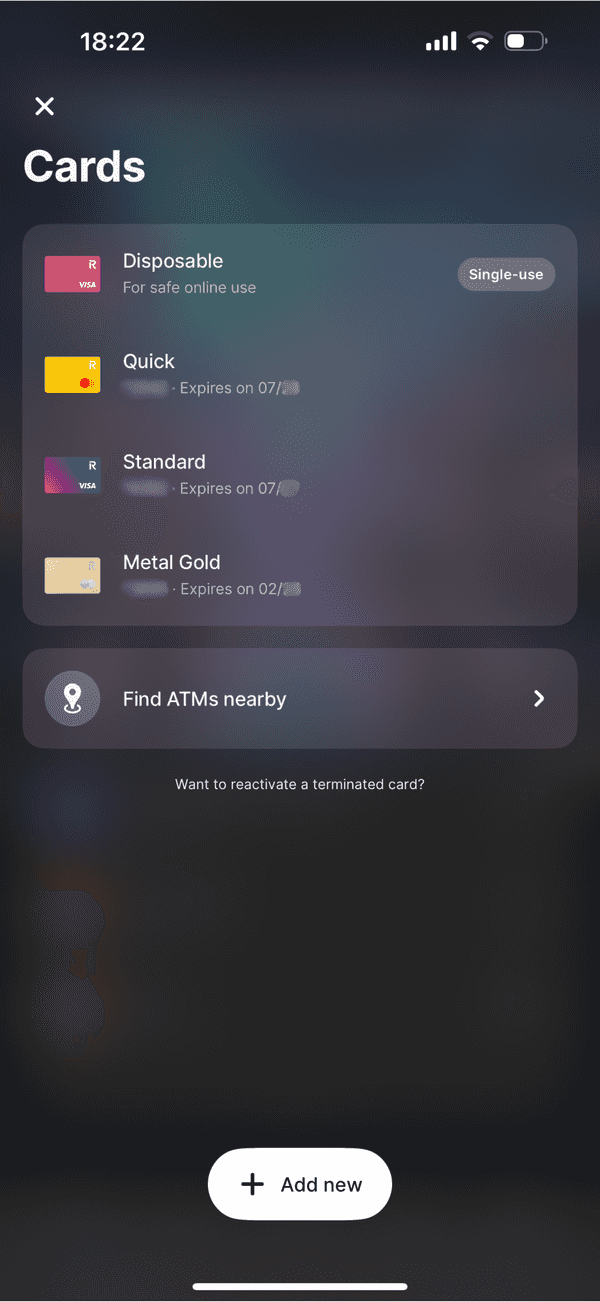

#Safety

Revolut takes the security of its customers seriously, employing industry-standard measures to ensure the safety of funds. They maintain high-security standards to safeguard your finances but there is no FSCS protection unless you keep your money in a Vault.

#Support

Revolut doesn’t take customer support lightly - assistance is provided 24/7 through their in-app customer support. For Ultra Plan users, priority callback support means quicker resolutions and possibly a more personalized experience.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

At £540 per year, Revolut positions the Ultra plan firmly in the premium category. When compared to other financial products in its class, the Ultra plan may seem steep, but for those looking to make the most of its extensive travel and lifestyle benefits, the price might just be worth it.

#Final thoughts

Balancing exclusivity against cost, the Revolut Ultra plan undeniably offers a suite of impressive features designed to cater to the discerning, frequent traveler and lifestyle enthusiast. If you identify with these traits and find the comprehensive benefits package appealing, the Ultra plan could serve as a valuable financial tool. Nevertheless, it’s imperative to weigh the cost-benefit scenario unique to your circumstances before diving in.

#FAQs

#Is Revolut Ultra worth it?

Depending on your travel frequency, lifestyle aspirations, and investment needs, Revolut Ultra's extensive benefits could prove valuable. However, for those who travel less or prioritize different areas of spending, evaluating the return on investment is crucial.

#What is Revolut Ultra?

Revolut Ultra is a premium plan offered by Revolut, designed to provide unparalleled benefits for travel, lifestyle, and investment, currently available to customers in the UK and EEA.

#How much is Revolut Ultra?

he standard price for Revolut Ultra is £540 per year, though there might be discounted rates available for selected customers during promotional periods.

#How to cancel Ultra Plan Revolut?

You can cancel your plan through the Revolut app. There might be fees associated with canceling your subscription, especially if you're within a specific period of your contract.