Revolut Standard Review 2024 -

Day-to-day banking needs without fees

Updated 06 Feb 2024

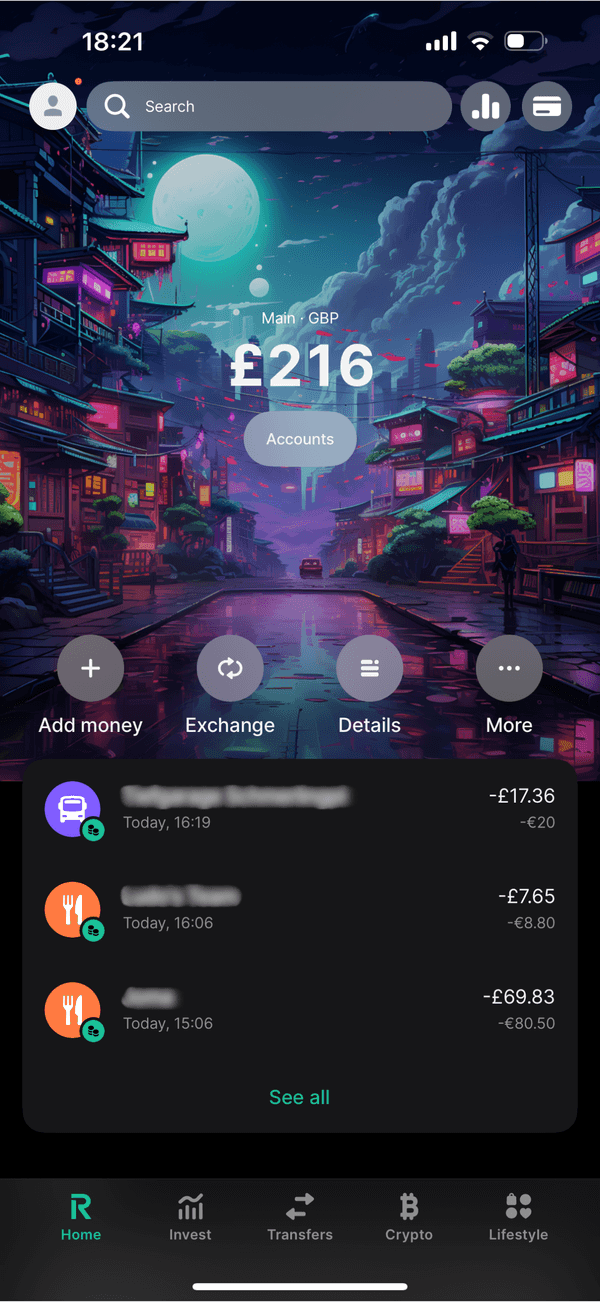

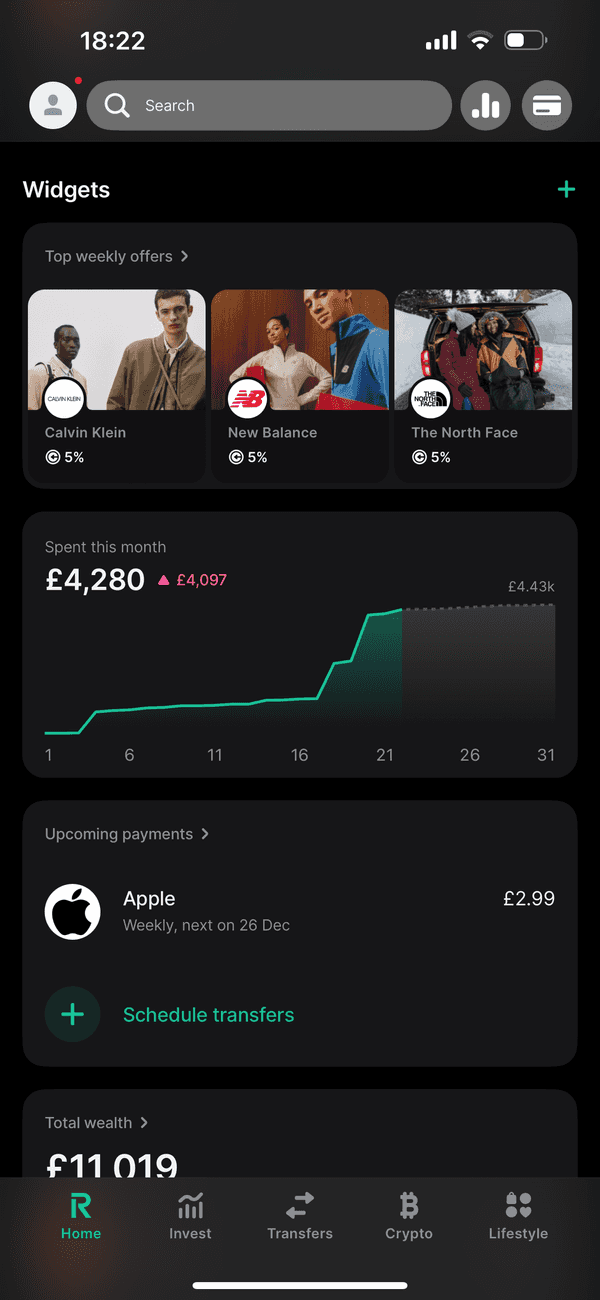

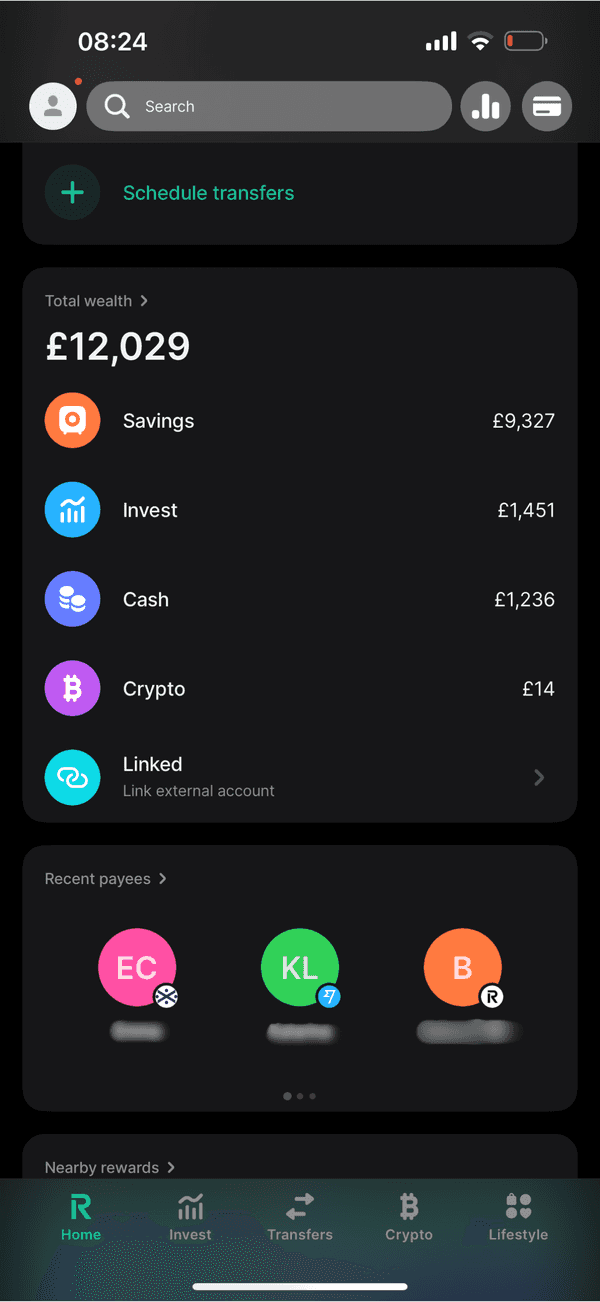

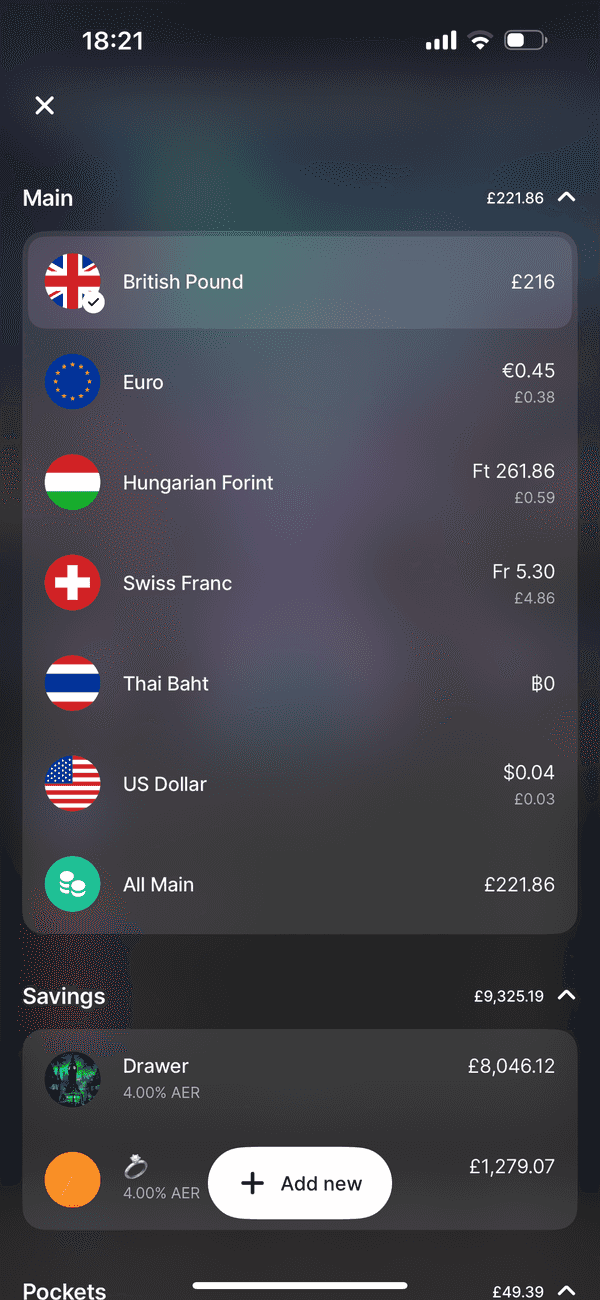

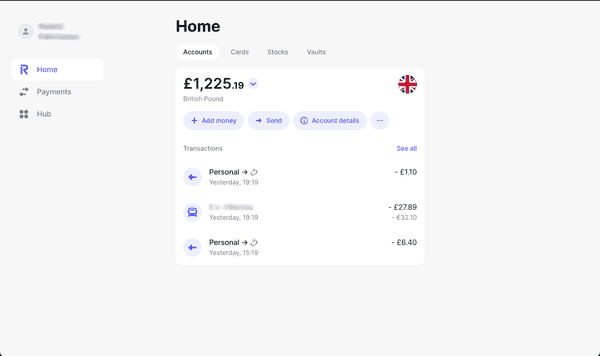

Revolut’s Standard plan is the entry-level offering from the fintech giant and serves as an enticing option for those seeking a free account with a multitude of financial tools. With a focus on budgeting, savings, and international spendings, such as foreign exchange and money transfer facilities, Revolut Standard positions itself as a versatile personal finance companion.

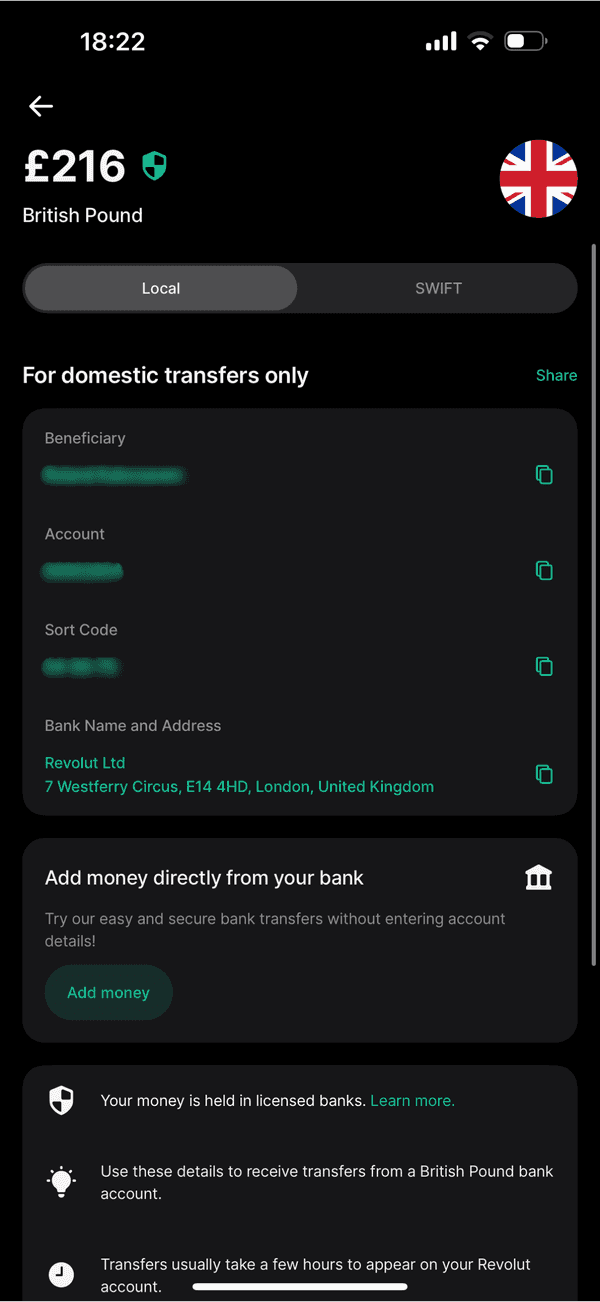

Bank Account

Company

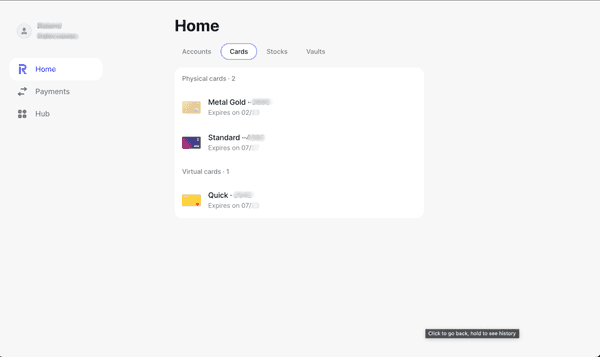

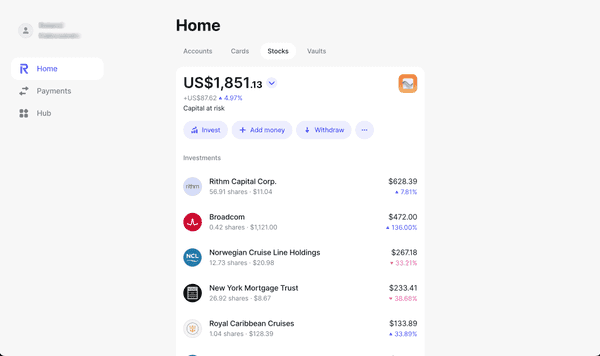

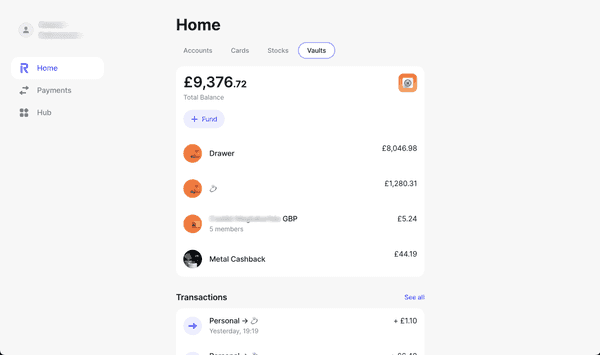

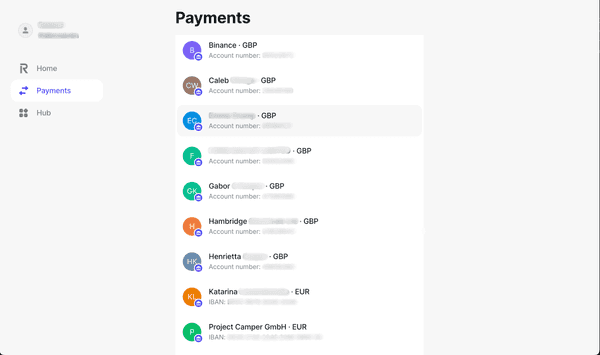

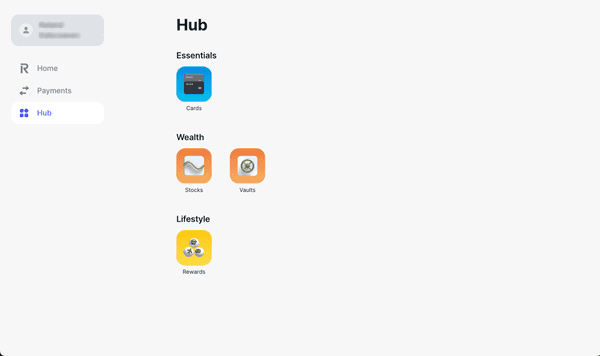

#Screenshots

#Pros & Cons

Pros

- No monthly fees for maintenance or card delivery

- Free access to essential financial services

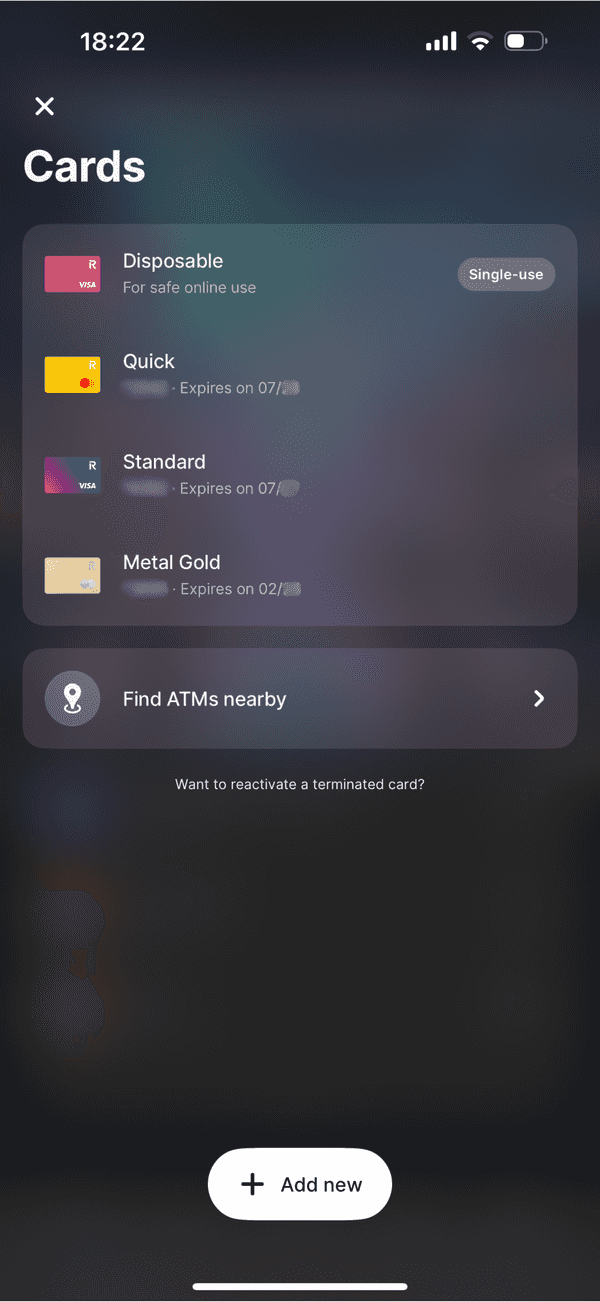

- Free virtual Revolut cards

- Free ATM withdrawals up to a generous limit

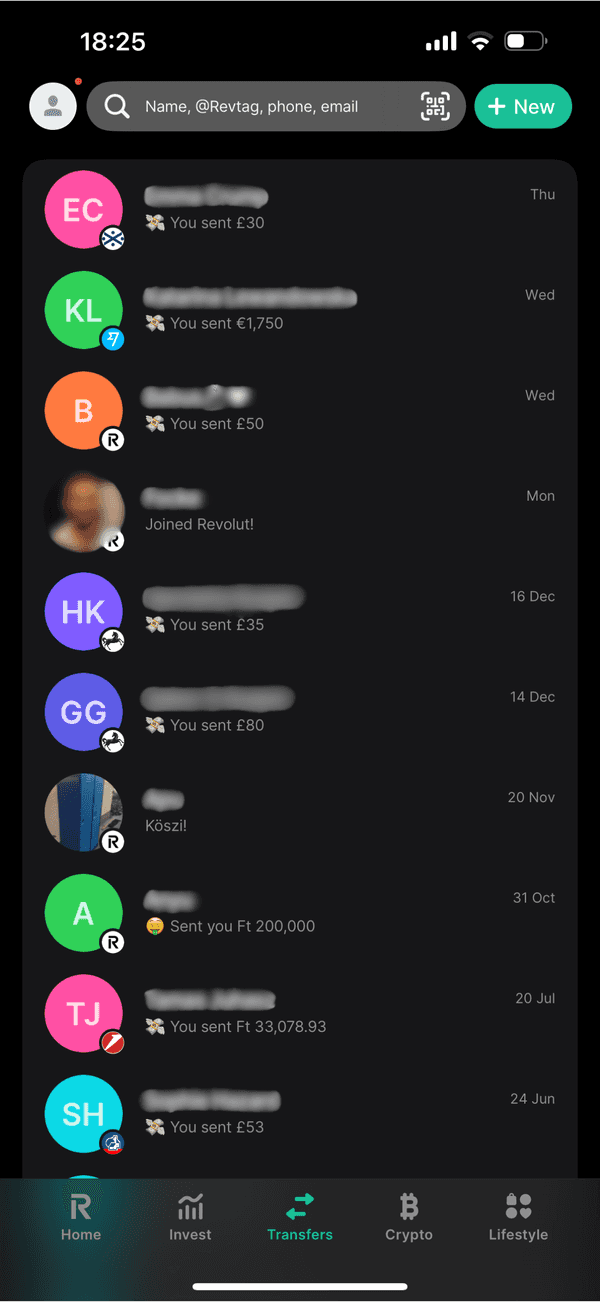

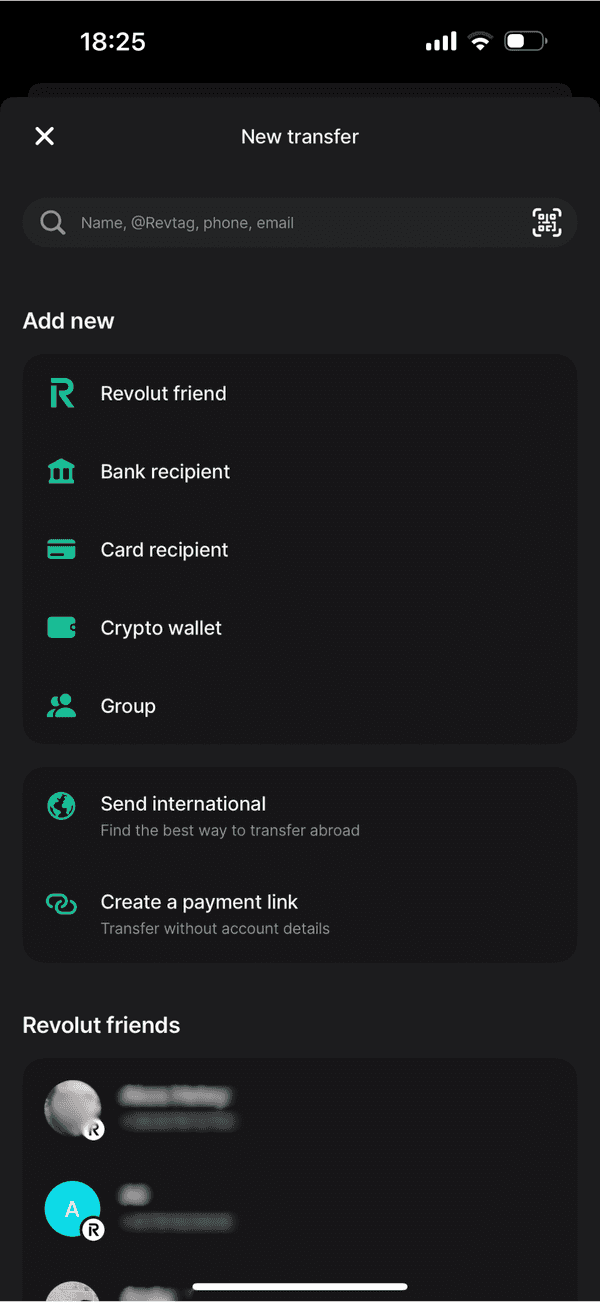

- Free instant transfers to other Revolut users globally

- Competitive foreign exchange rates with a fair monthly exchange limit

Cons

- Exchange limit of £1,000 per month; fair usage fee for exceeding this limit

- Fees apply for ATM withdrawals past the free limit

- Fee for replacement of Custom or Special Edition cards

- International payments may incur fees.

- Chargeback fees apply in case of disputed transactions

#Fees

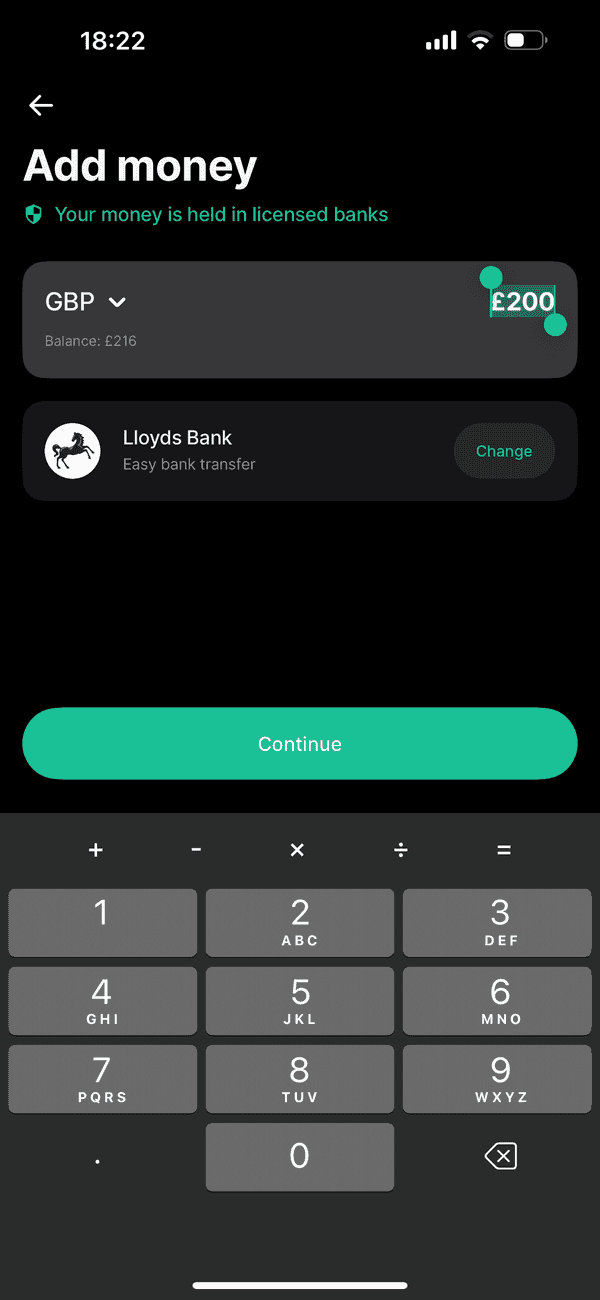

Revolut Standard card fees are appealing because the plan itself is free, meaning there is no recurring charge for basic services. For ATM withdrawals, Revolut offers a generous allowance before fees kick in. Beyond £200 (or five withdrawals within a 30-day rolling period), a fair usage fee is applied. This fee is minimal and transparent, displaying Revolut’s commitment to keeping costs low for its users. When compared to industry standards, these fees are competitive, especially considering the zero monthly cost.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

| LOCAL | Free | Free | Free | Free | £200.00 Free 2%(min. £1.00) |

| EUROPE | Free | Free | Free | Free | £200.00 Free 2%(min. £1.00) |

| INTERNATIONAL | Free | ~0% | Free | ~0% | £200.00 Free 2%(min. £1.00) |

Additional Information

- Free instant transfers to other Revolut users

- Free local transfers in your country

- Free within Single European Payments Area (SEPA)

- Fee applies for card transfers

- Receiving money is free.

- Adding money is free from UK or EEA card

- Fee charged form Commercial or US card or other counries

- Free withdrawals up to £200 or 5 withdrawals, then a fee applies.

- That fee is 2% of the withdrawal, subject to a minimum fee of £1 per withdrawal.

Overdraft

#Perks

Perks

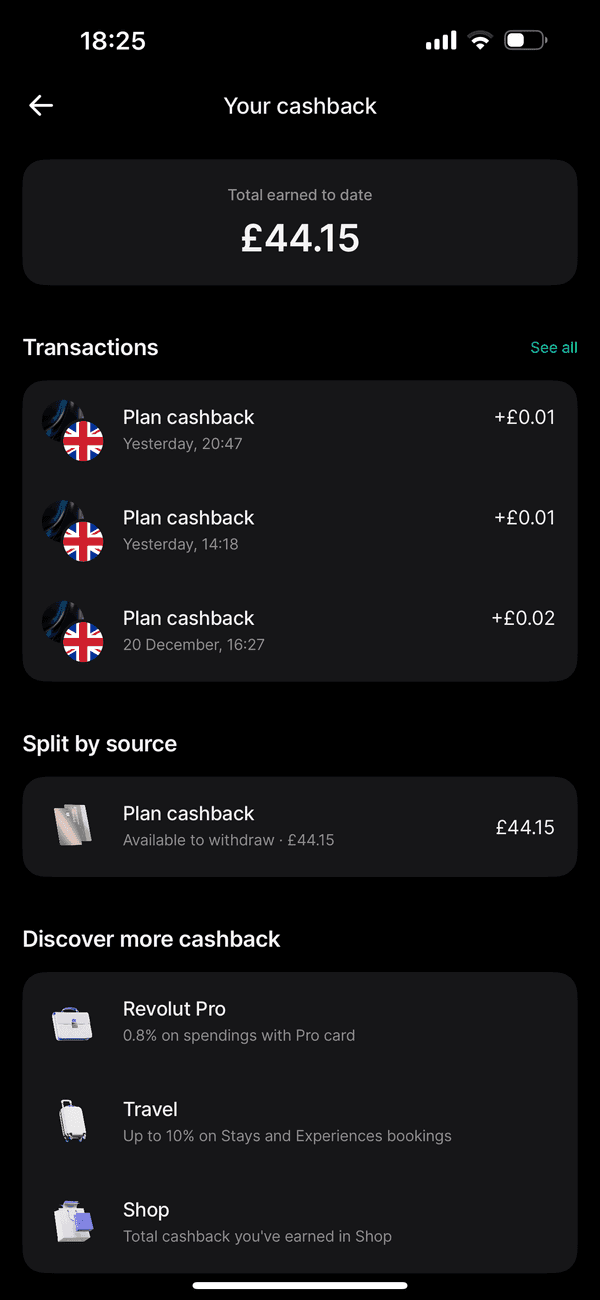

- Revolut Pro 0.4% Cashback

- 1 Revolut Junior Accounts

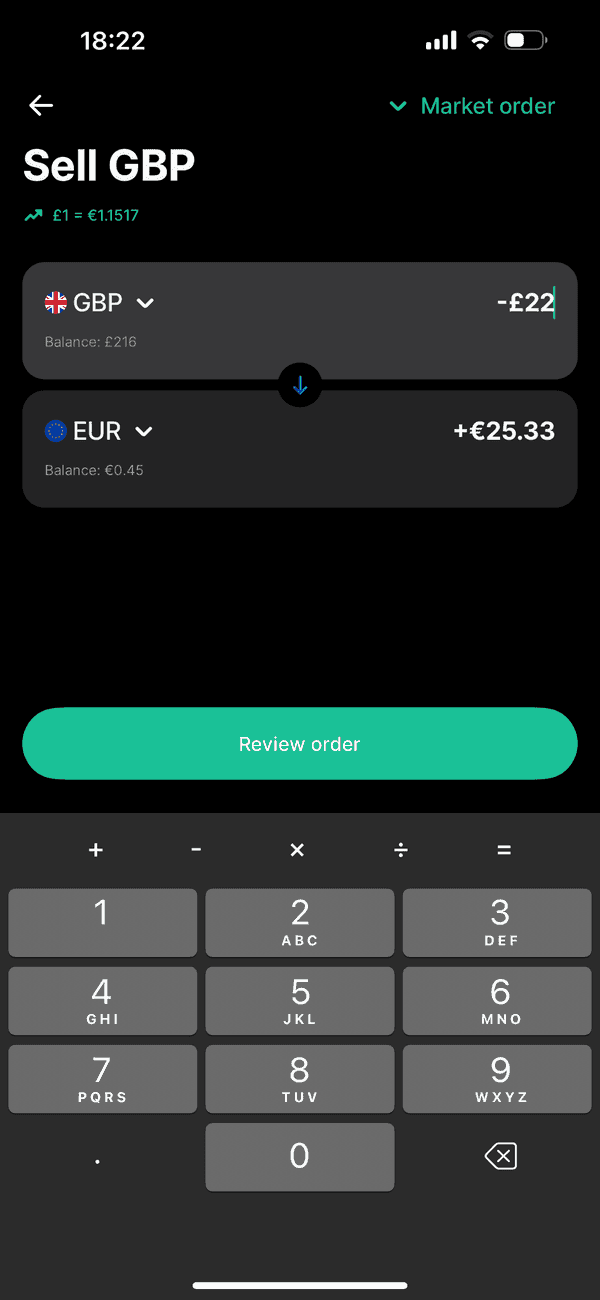

- Currency Exchange - £1000/month exchange limit. Mon - Fri

- Up to 3% Cashback on Accomodations

- Commodity Exchange - 1.99% (minimum fee £1)

- Cryptocurrency Exchange - Variable Fee

#Safety

On the safety spectrum, Revolut maintains high-security standards to safeguard your finances. The inclusion of features like instant card freezing and unfreezing from the app, as well as customizable security settings, provides peace of mind for the modern user.

#Support

Customer support is accessible directly through the Revolut app, offering convenience and timely assistance. While Revolut Standard does not offer priority support like some of the higher-tier plans, the available support is adequate for everyday banking inquiries and troubleshooting.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

While there’s no price to pay for the plan itself, it’s essential to recognize the fees that come into play under specific circumstances, such as ATM withdrawals beyond the free limit and international money transfers. However, even these costs are competitively priced and often lower than traditional banking options, reflecting Revolut’s commitment to affordable banking.

#Final thoughts

The Revolut Standard plan is an impressive offering in the free banking service space. With no monthly fees, a free card, and a host of valuable financial management features, it presents a compelling case for those looking to streamline their finances into a modern, digital interface. For the everyday user, the benefits of this plan seem to outweigh the costs associated with certain services. The potential fees are transparent, reasonable, and in line with Revolut’s ethos of fair and affordable banking.

Before making the switch to the Standard plan, it’s crucial to consider your financial habits, particularly how often you withdraw cash or engage in foreign currency transactions, to ensure that this plan will meet your needs without incurring frequent additional charges.

Revolut has managed to offer services that cater to a diverse user base, from the globetrotting adventurer to the savvy saver. It stands firm as a testament to the power of fintech, challenging traditional banking norms and providing an accessible financial platform that empowers users worldwide.

#FAQs

#Is Revolut card free?

Yes, the Revolut Standard card comes without a monthly fee, making it an appealing choice.

#How to order a Revolut card for free?

You can order a card directly from the Revolut app. There may be a delivery fee, which you'll be shown before you confirm your order

#Is Revolut Standard card contactless?

Yes, the Standard card comes with contactless payment capabilities, making your transactions quick and convenient.

#Can I use my Standard Revolut card abroad?

Absolutely, all Revolut cards can be used abroad, offering excellent foreign exchange rates up to a certain limit without any extra fees.

#How much is Revolut Standard Plan ATM withdrawal?

The plan allows for free ATM withdrawals up to £200 (or 5 withdrawals) in a 30-day rolling period. Post that, a small fee applies.