Revolut Premium Review 2024 -

Best for travelers needing global benefits

Updated 06 Feb 2024

This review takes a closer look at what the Revolut Premium plan offers, helping you determine whether it’s the quintessential financial companion for your lifestyle.

Since its inception in 2018, the Revolut Premium plan has been undergoing continuous enhancements to meet customers’ needs more effectively. Recently, Revolut orchestrated a significant revamp of its Premium and Metal plans, signifying its ongoing commitment to innovation and customer satisfaction.

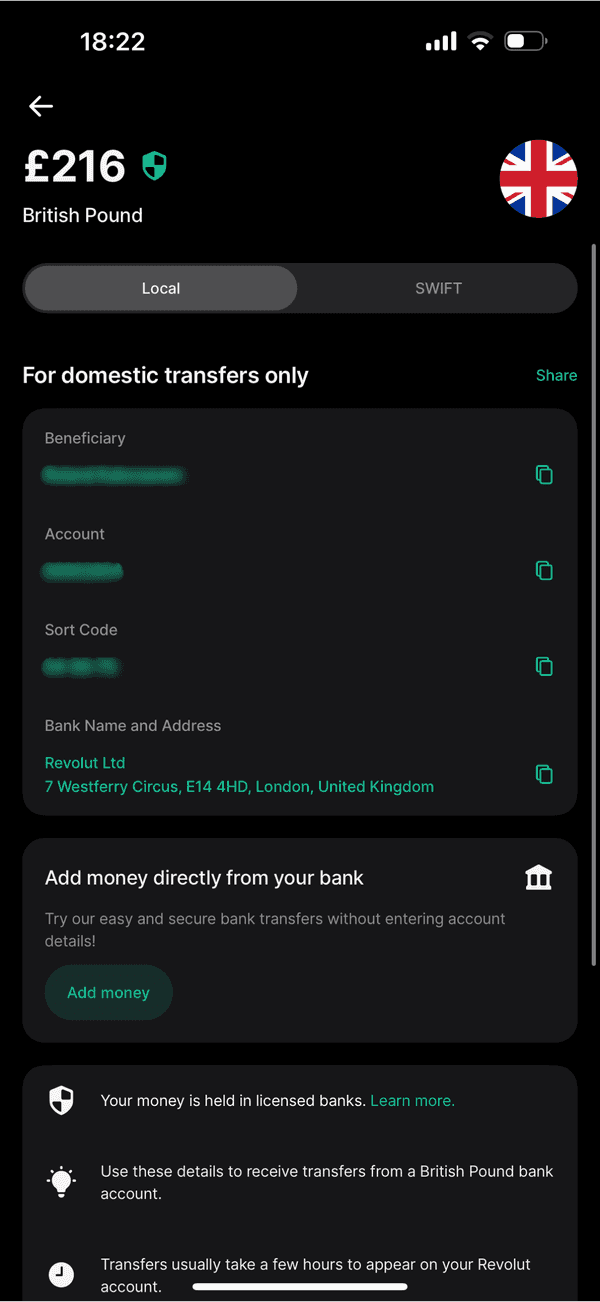

Bank Account

Company

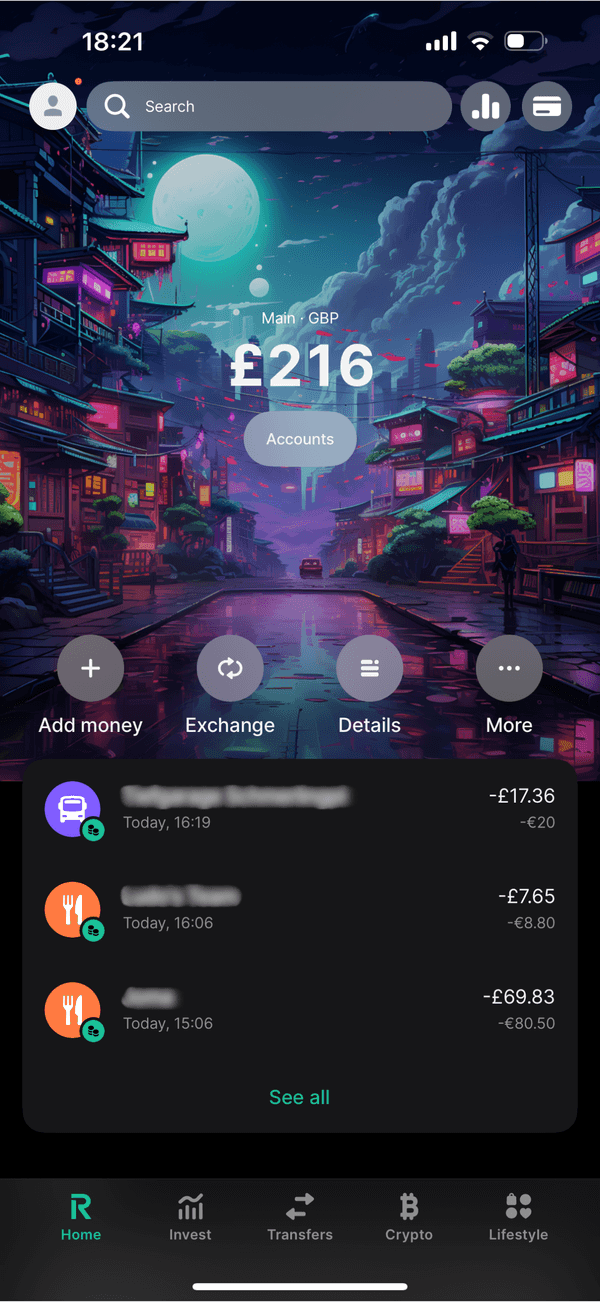

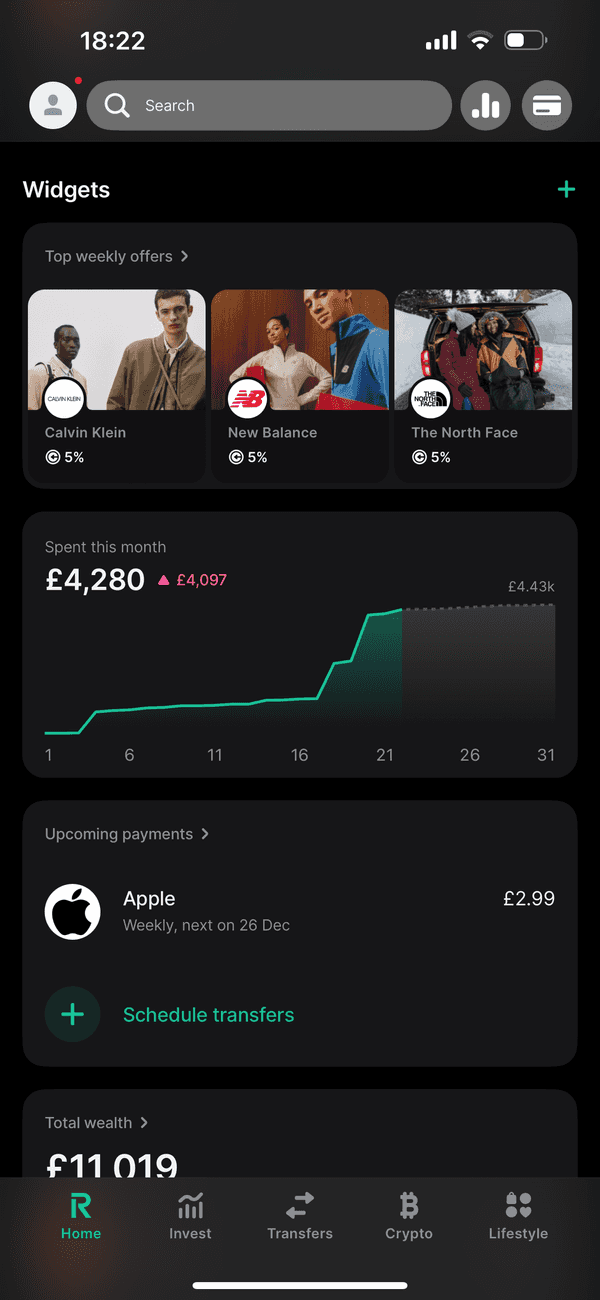

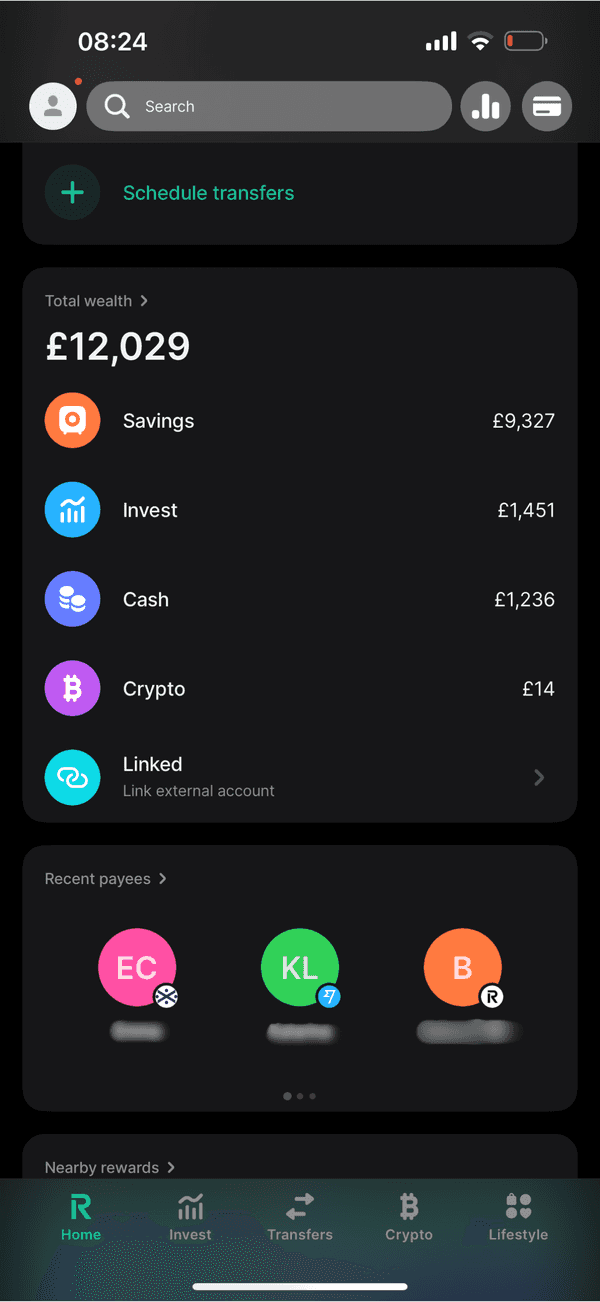

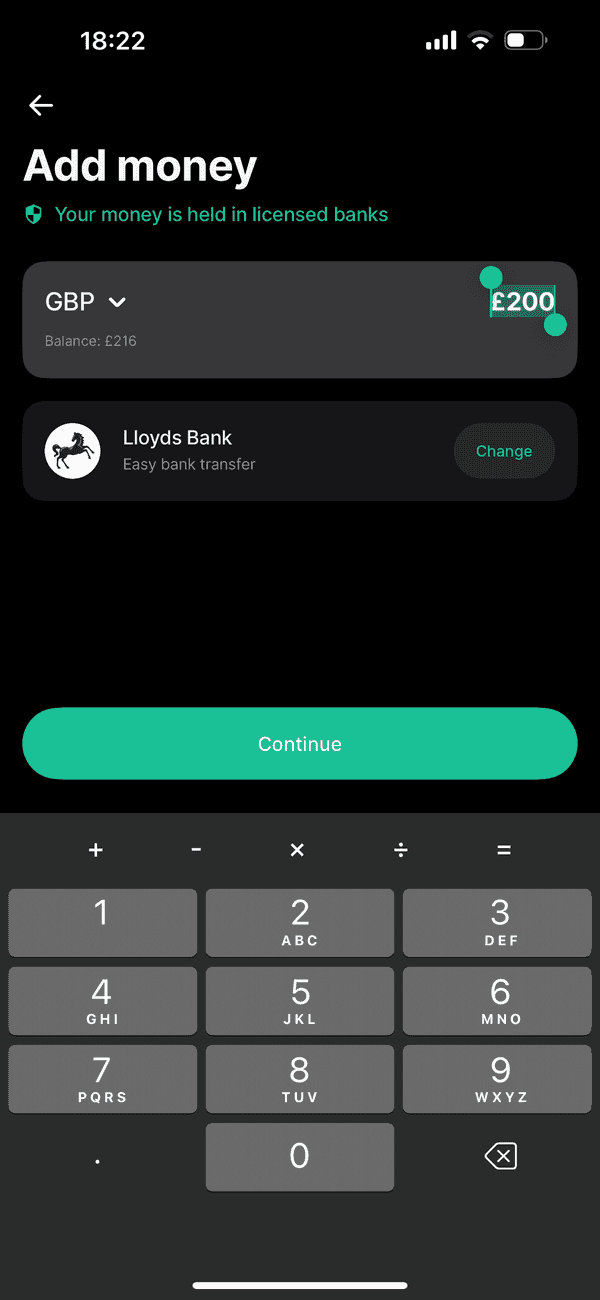

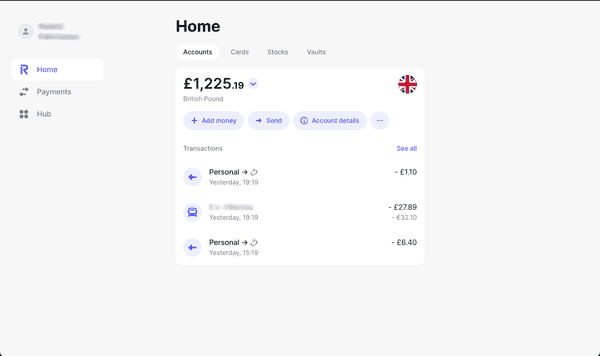

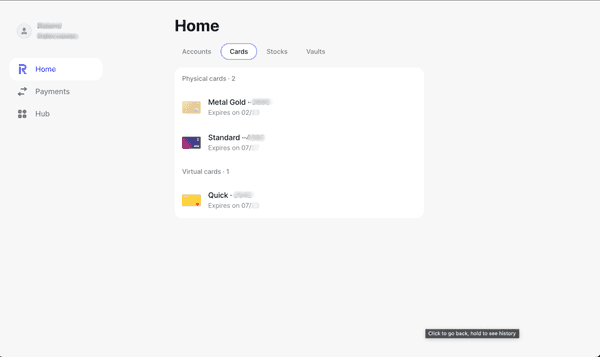

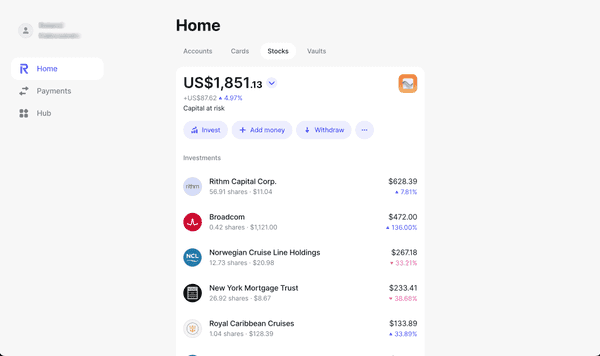

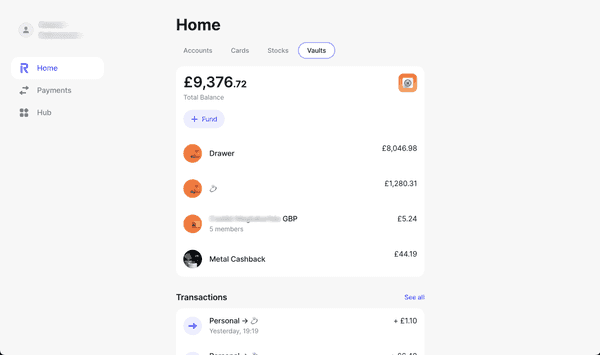

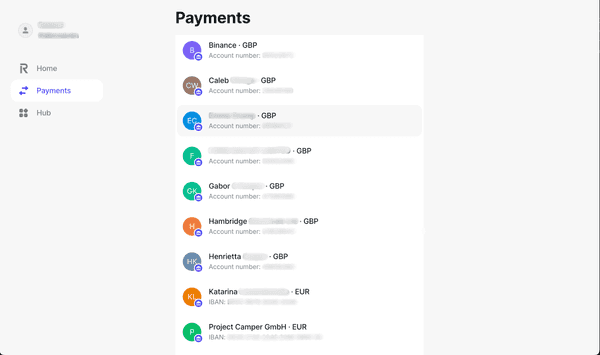

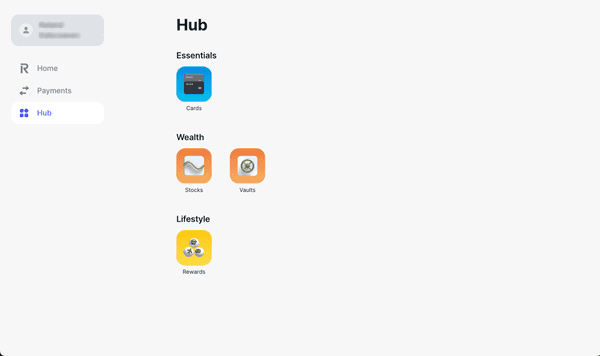

#Screenshots

#Pros & Cons

Pros

- Bundled variety of subscriptions cater to a range of personal and professional needs like news, fitness, and wellness.

- Global travel insurance and other financial protections come standard.

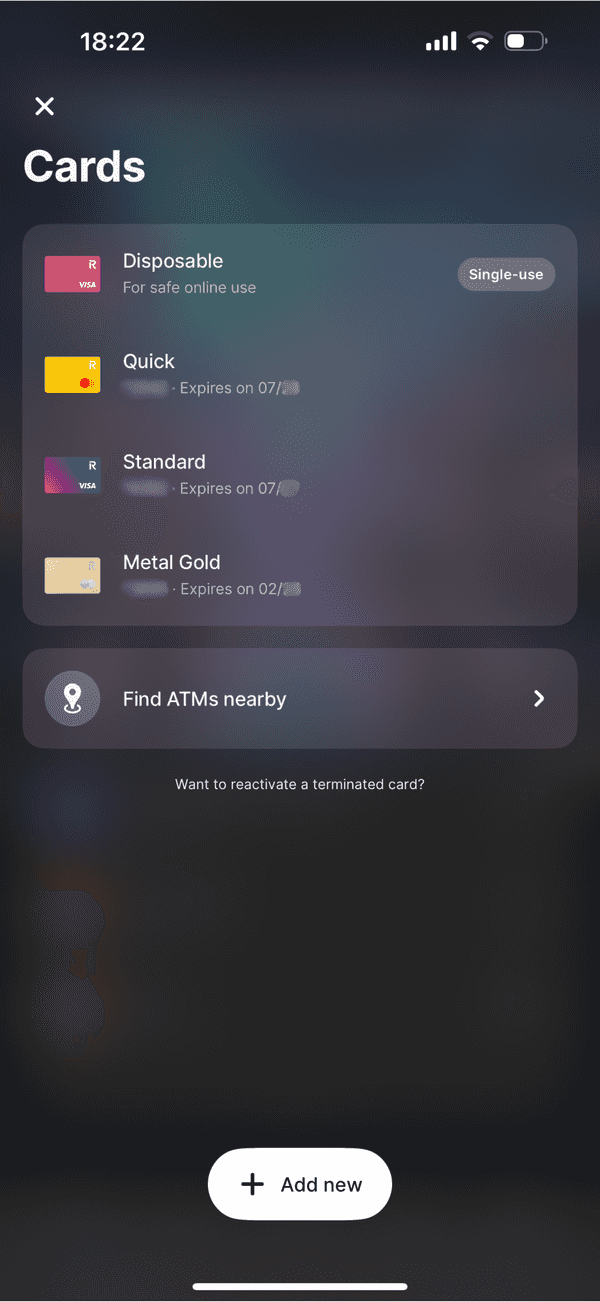

- Personalized exclusive cards that reflect the premium nature of the plan.

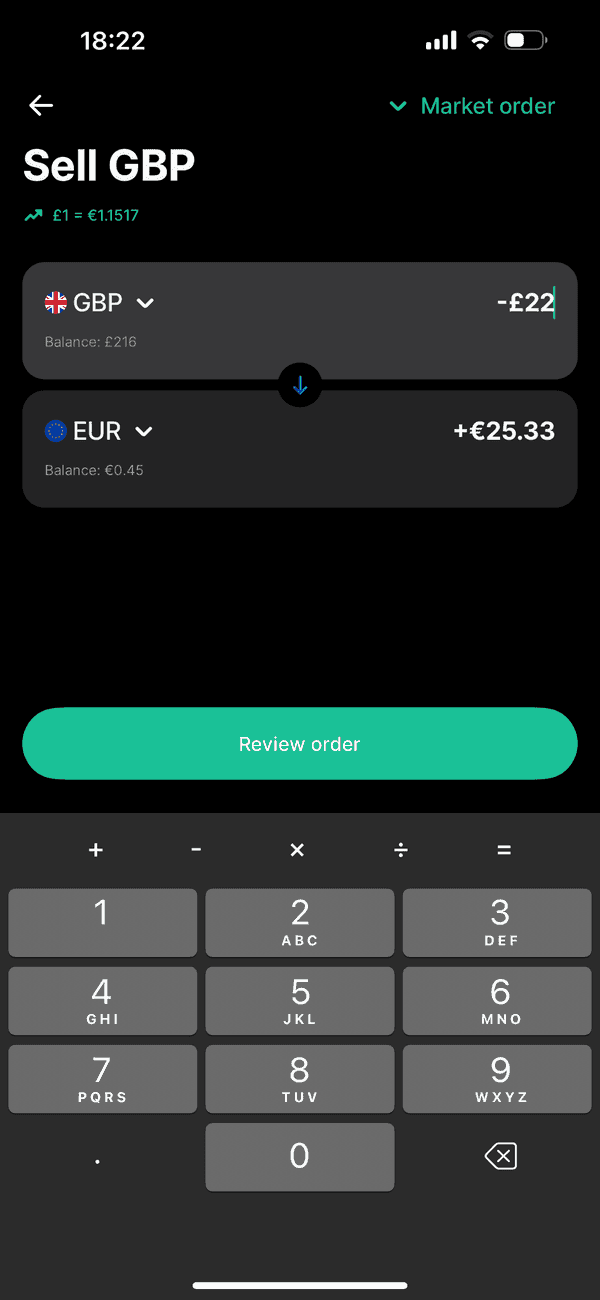

- Unlimited money exchanges with no additional fees during weekdays.

- Exclusive discounts on international money transfers and other Revolut services.

- Increase in fee-free ATM withdrawal limits.

Cons

- Price increase for the plans, though the first in five years.

- Benefits are more aligned to frequent travelers and might not be as useful for users with less travel needs.

#Fees

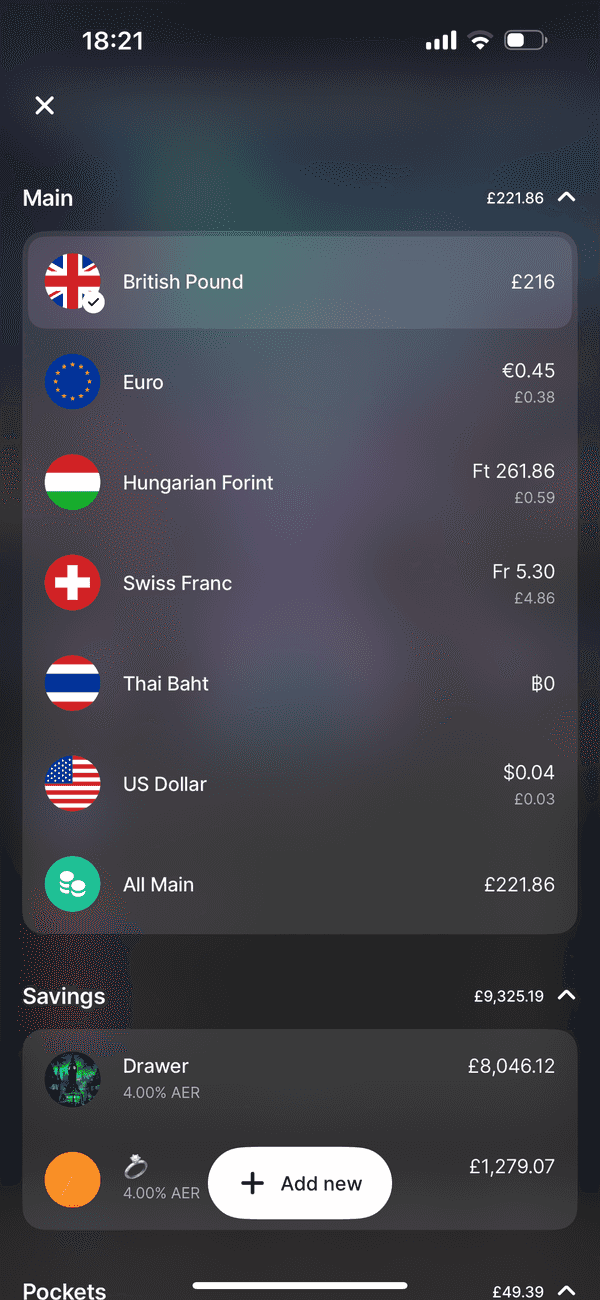

Revolut Premium, priced at £7.99 per month or £80 annually, has revised its fee structure, adding significant value to justify the rise.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

| LOCAL | Free | Free | Free | Free | £400.00 Free 2%(min. £1.00) |

| EUROPE | Free | Free | Free | Free | £400.00 Free 2%(min. £1.00) |

| INTERNATIONAL | Free | ~0% | Free | ~0% | £400.00 Free 2%(min. £1.00) |

Additional Information

- Insurance on purchases

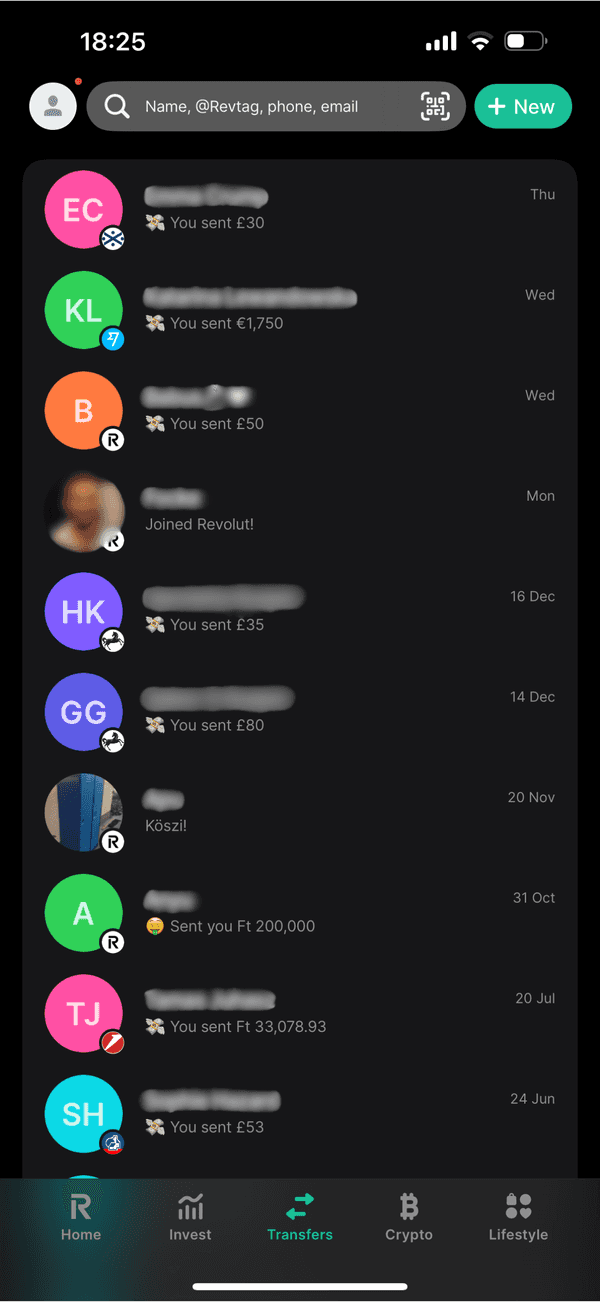

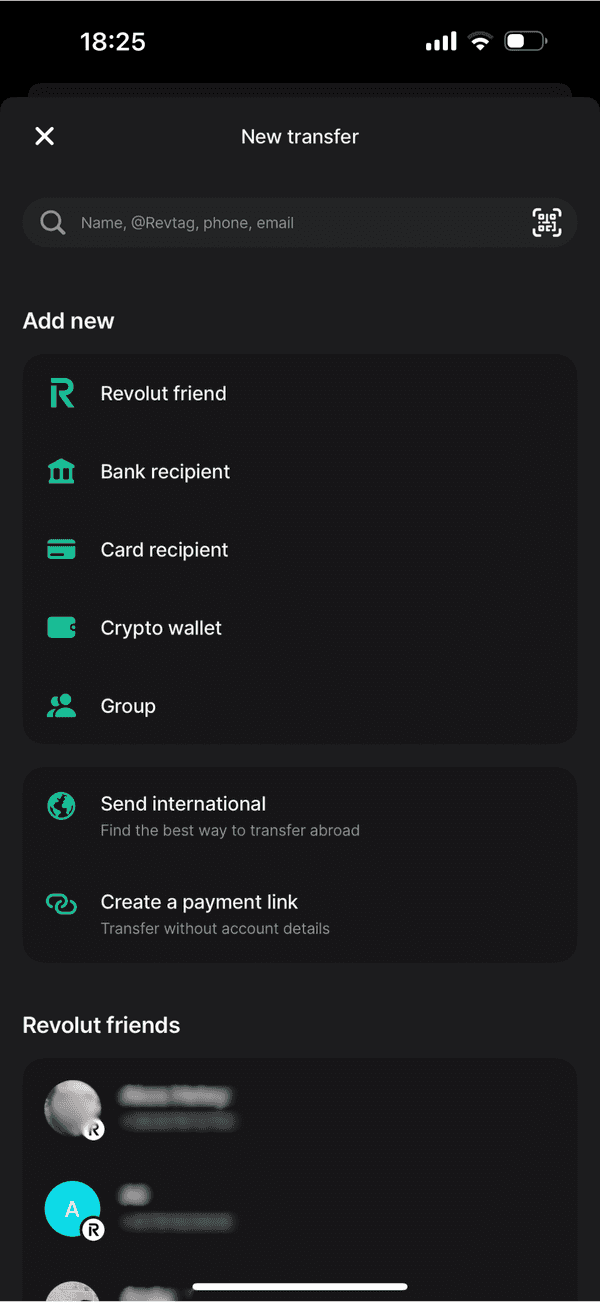

- Free instant transfers to other Revolut users

- Free local transfers in your country

- Free within Single European Payments Area (SEPA)

- Fee applies for card transfers

- 20% discount on international transfers.

- Receiving money is free.

- Adding money is free from UK or EEA card

- Fee charged form Commercial or US card or other counries

- Free withdrawals up to £400, then a fee applies.

- That fee is 2% of the withdrawal, subject to a minimum fee of £1 per withdrawal.

Overdraft

#Perks

Perks

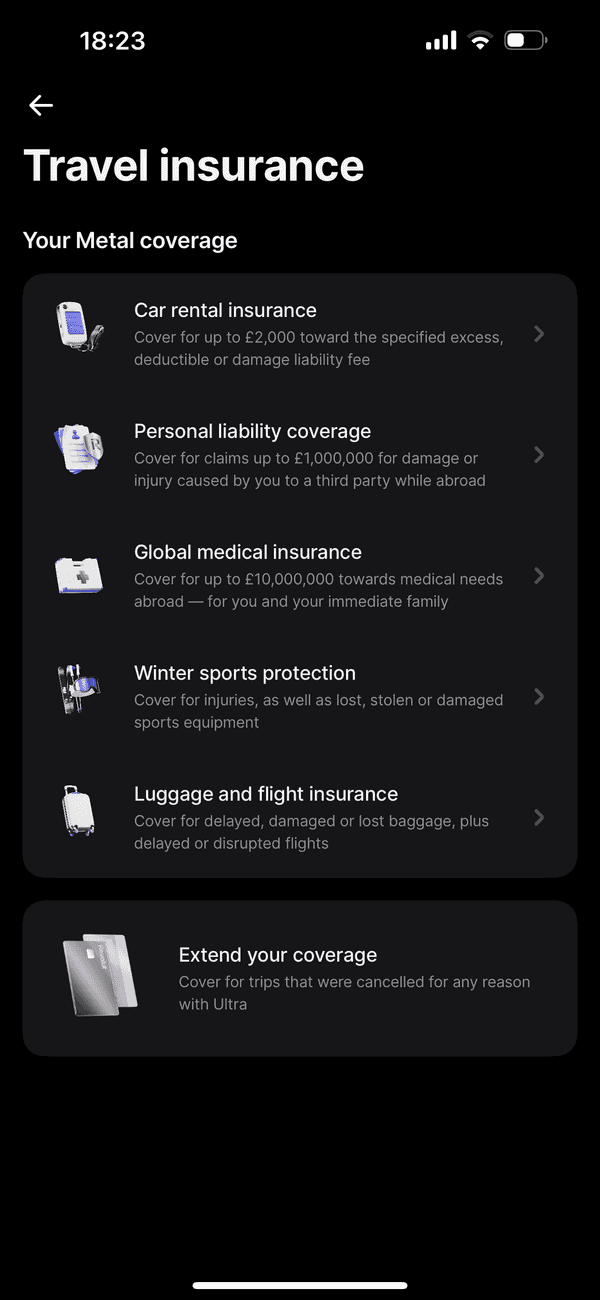

- Global Multi-Trip Family Travel Insurance by Chubb (90days, age 75)

- SmartDelay: 2 FREE lounge passes (1h+ flight delay)

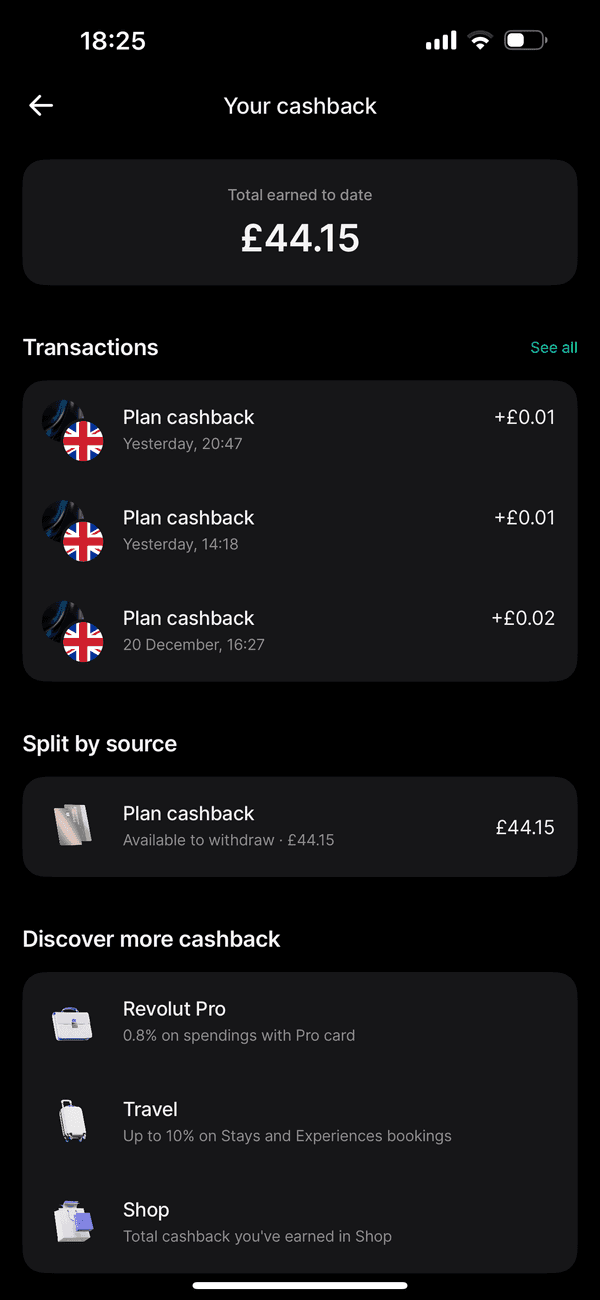

- Revolut Pro 0.6% Cashback

- 2 Revolut Junior Accounts

- Discounted Airport Lounge Access

- Currency Exchange - No exchange limit. Mon - Fri

- Up to 5% Cashback on Accomodations

- Winter Sports Insurance £3,000/y limit

- Delayed flight, lost or damaged luggage insurance £1,000/y limit

- Commodity Exchange - 1.49% (minimum fee £1)

- Cryptocurrency Exchange - Variable Fee

- NordVPN - Standard

- Deliveroo - Plus Silver

- Headspace - Subscription

- Sleep Cycle - Premium

- Freeletics - Coach

- Tinder - Plus

- Picsart - Gold

#Safety

Customers are assured of robust security measures across the platform, with in-built protections such as purchase and refund insurance that fortify user confidence when transacting through Revolut Premium. They maintain high-security standards to safeguard your finances but there is no FSCS protection unless you keep your money in a Vault.

#Support

Revolut’s Premium subscribers have access to dedicated customer support, ensuring that any concerns or inquiries are handled with a premium touch. This personalized care is integral to Revolut’s ethos—combining cutting-edge financial services with user-centric support.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

The price point of Revolut Premium, while recently increased to £7.99 per month or £80 annually, reflects a strategic enhancement aimed at expanding service quality and user benefits.

#Final thoughts

Revolut Premium emerges as a strong contender for those seeking an all-rounded financial tool, especially for individuals traversing the global scene. The added value through new partner subscriptions and traditional benefits like travel insurance makes it a plan that transcends conventional banking, espousing a modern approach to money management.

#FAQs

#What are the benefits of Revolut Premium?

Two Free Revolut Premium Cards, Comprehensive Travel Insurance, Enhanced ATM Withdrawals, Discounted Lounge Passes, Free Lounge Access for Flight Delays, Unlimited Currency Exchange and many more.

#Can I cancel Revolut premium after 1 month?

If you cancel your subscription after the free trial, you might be subject to fees associated with downgrading from Premium to a lower-tier plan or canceling the service before the term is complete. We advise you check this in the terms and conditions.

#Is Revolut Premium worth it?

Considering the expanded range of services, partnership subscriptions, and financial protections, Revolut Premium is worth it for those who can maximize these features.

#How to cancel Revolut Premium Plan?

You can cancel or downgrade your Revolut Premium subscription through the app, up until the implemented price change on your billing date.

#How much is Revolut Premium?

Revolut Premium is priced at £7.99 per month or £80 annually, with a variety of extra partnership benefits.

#What is Revolut Premium Plan?

It's a paid plan that offers exclusive services such as bundled subscriptions, insurances, and unlimited money exchanges with no additional exchange fees.

#Can I use my Premium Revolut card abroad?

Absolutely, the Revolut Premium card is designed for international use, with perks like global travel insurance and no fees on exchanges during weekdays.