Monzo Current Review 2024 -

Perfect for easy, fee-free UK banking

Updated 17 Feb 2024

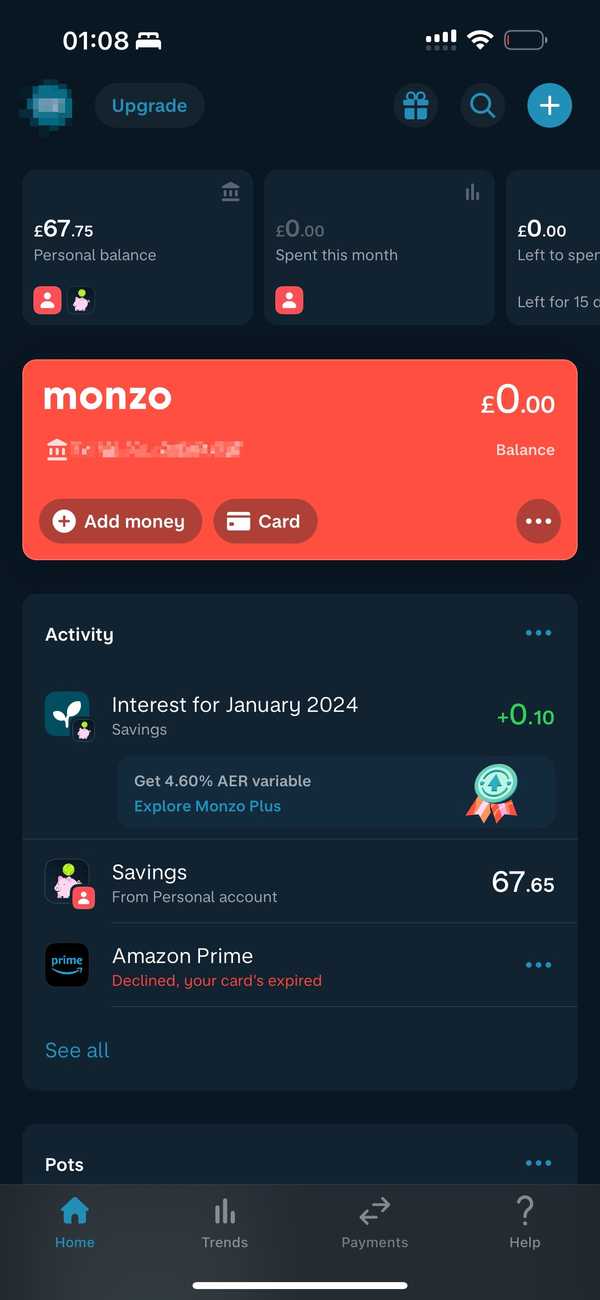

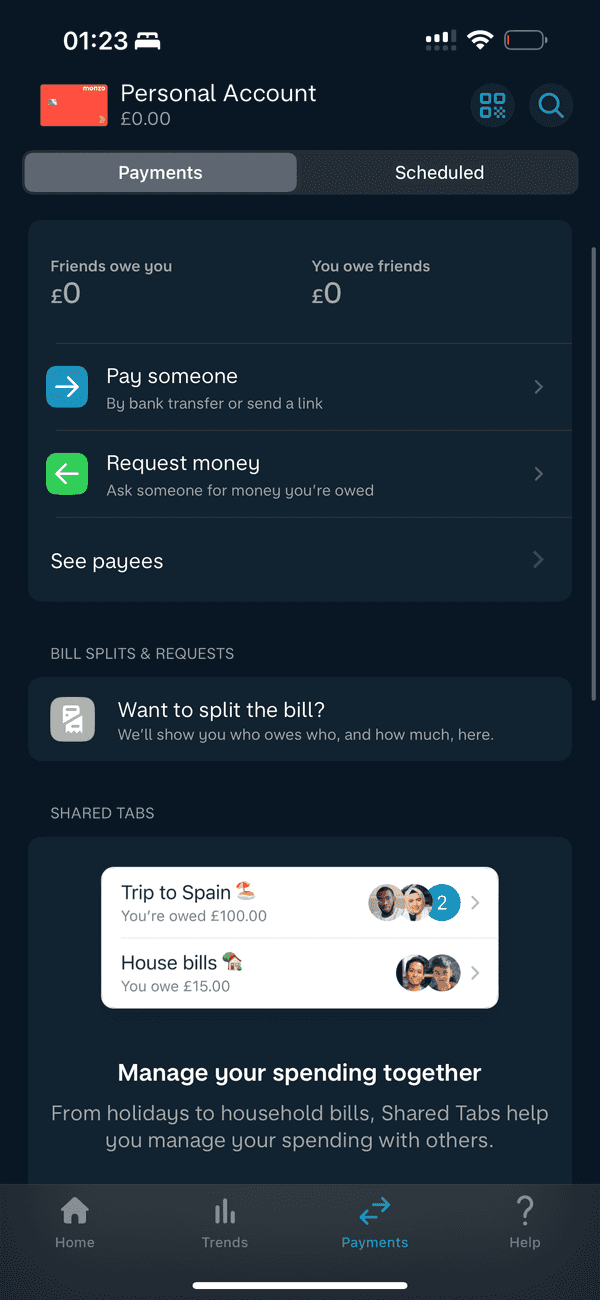

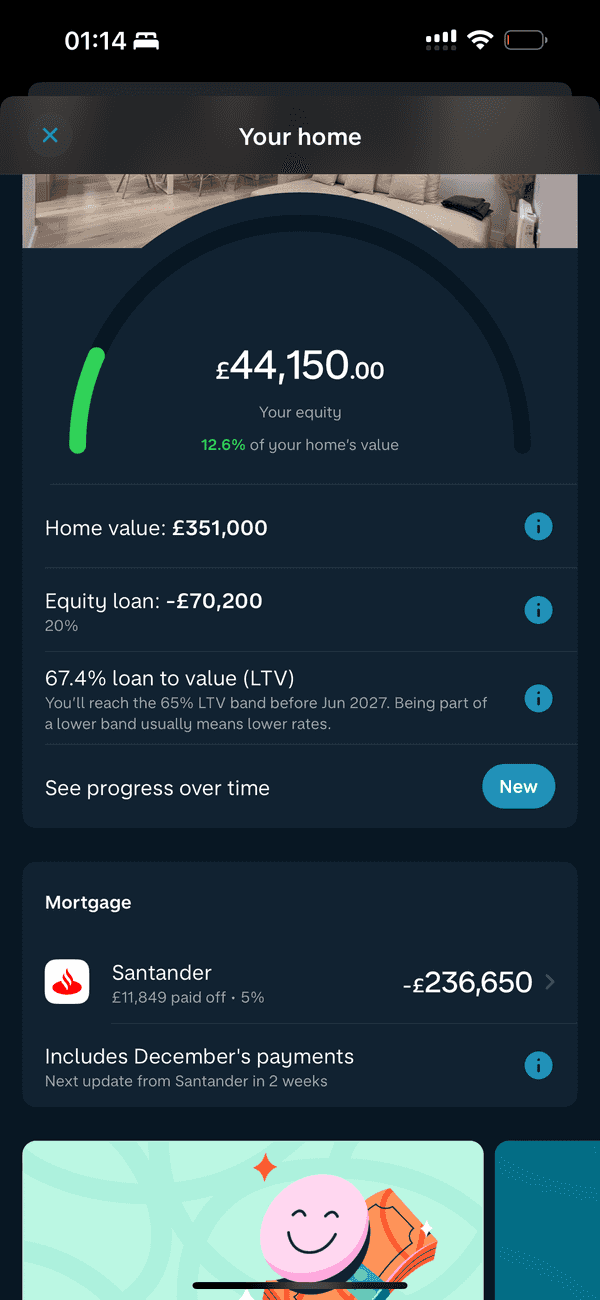

When it comes to selecting a current account that addresses your diversified financial needs, Monzo stands out as a distinctive player in the online banking landscape. With its proposition of “making money work for everyone”, Monzo offers a range of current accounts tailored to fit various consumer preferences.

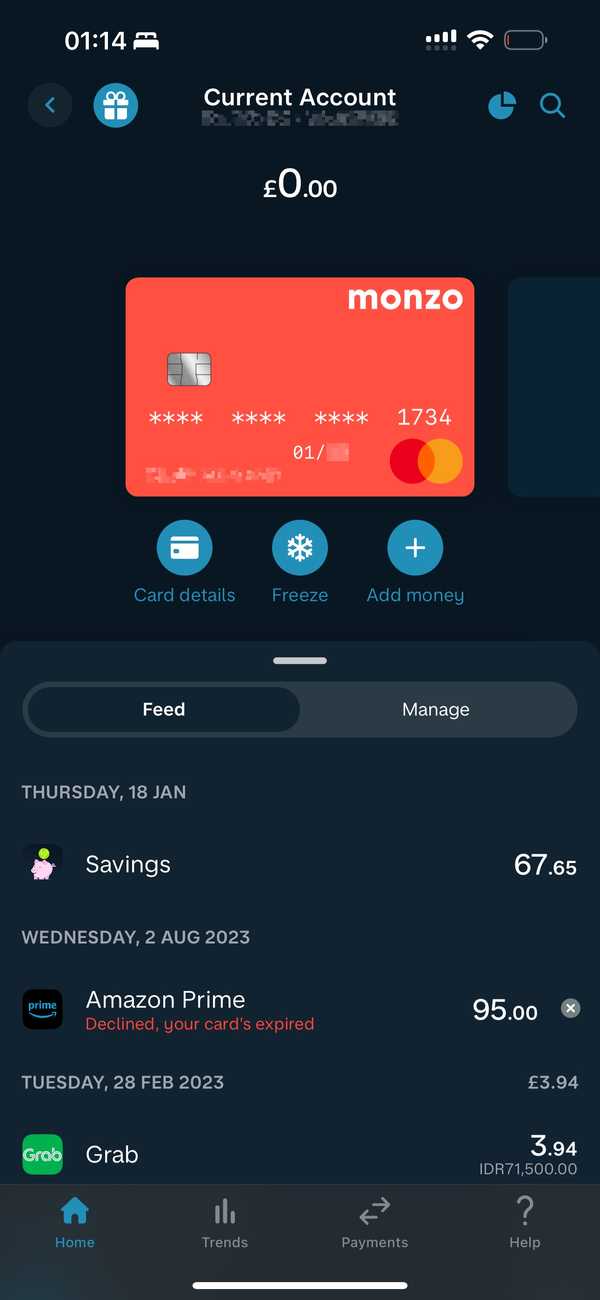

The Monzo Current Account is not only a UK current account providing the convenience of digital banking but one that exudes confidence and modernity.

Bank Account

Company

#Screenshots

#Pros & Cons

Pros

- FSCS protection up to £85,000 offers peace of mind for depositors

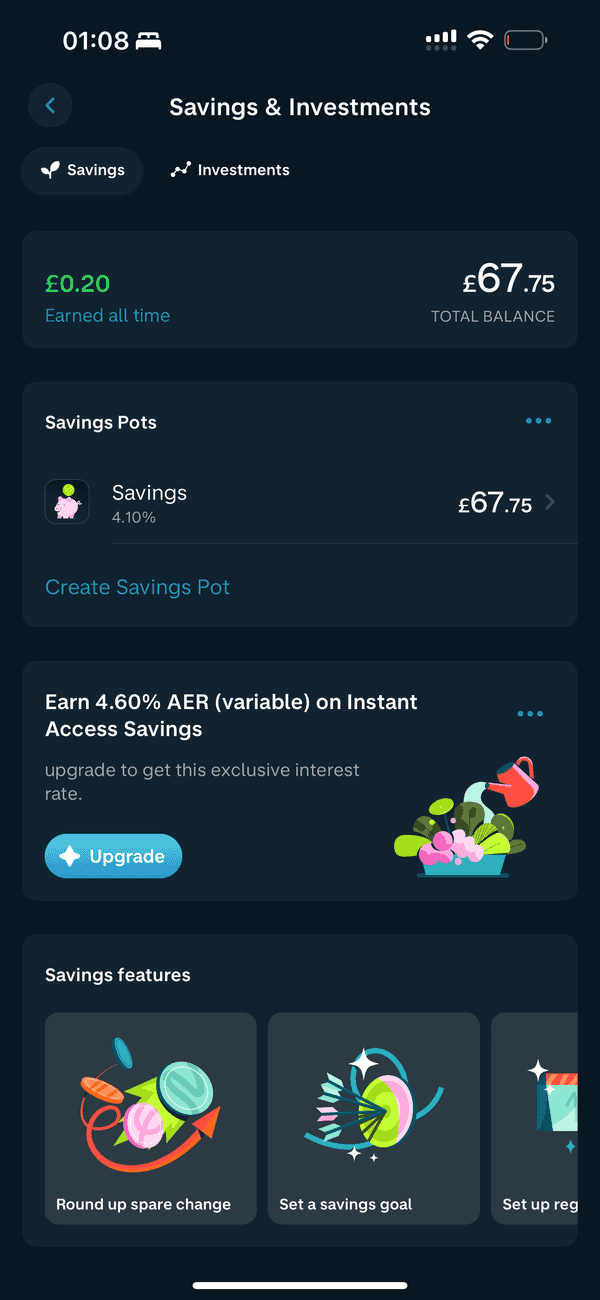

- Offers interest on eligible saving Pots which can be appealing

- Supports convenient features such as Apple Pay and Google Pay

- Provides friendly, accessible customer support directly through the app

- Flexible overdraft and loan options reviewed without affecting credit scores

Cons

- Interest rates may not be competitive with high-yield savings accounts

- Fee-free cash withdrawal limits abroad may not suffice for heavy travelers

- Exchange fee applies when receiving payments in foreign currencies

- There are no perks but, hey, it's a free account

#Fees

The free account offers fee-free UK bank transfers and fee-free withdrawals within limits.

To qualify for increased cash and card allowances, you need to meet one of the following criteria:

- Receive at least £500 into your Monzo account in the last rolling 35-day period and have an active Direct Debit on the same account during that period.

- Receive a payment from the Department of Work and Pensions or the Department for Communities into your Monzo account in the last rolling 35-day period.

- Receive a student loan payment into your Monzo account in the last rolling 8-month period.

- Share a Monzo Joint Account with someone who meets any of the above criteria.

As for overdrafts, Monzo has a representative APR of 39% (variable), which is standard for the industry.

| PURCHASE | SEND | RECEIVE | TOPUP | ATM | |

|---|---|---|---|---|---|

| LOCAL | Free | Free | Free | £1.00 | £400.00 Free 3% |

| EUROPE | Free | Free | 1% | N/A | £400.00 Free 3% |

| INTERNATIONAL | Free | ~0.6% | 1% | N/A | £400.00 Free 3% |

Additional Information

- Mastercard's exchange rate passed directly onto you

- Free local transfers in the UK

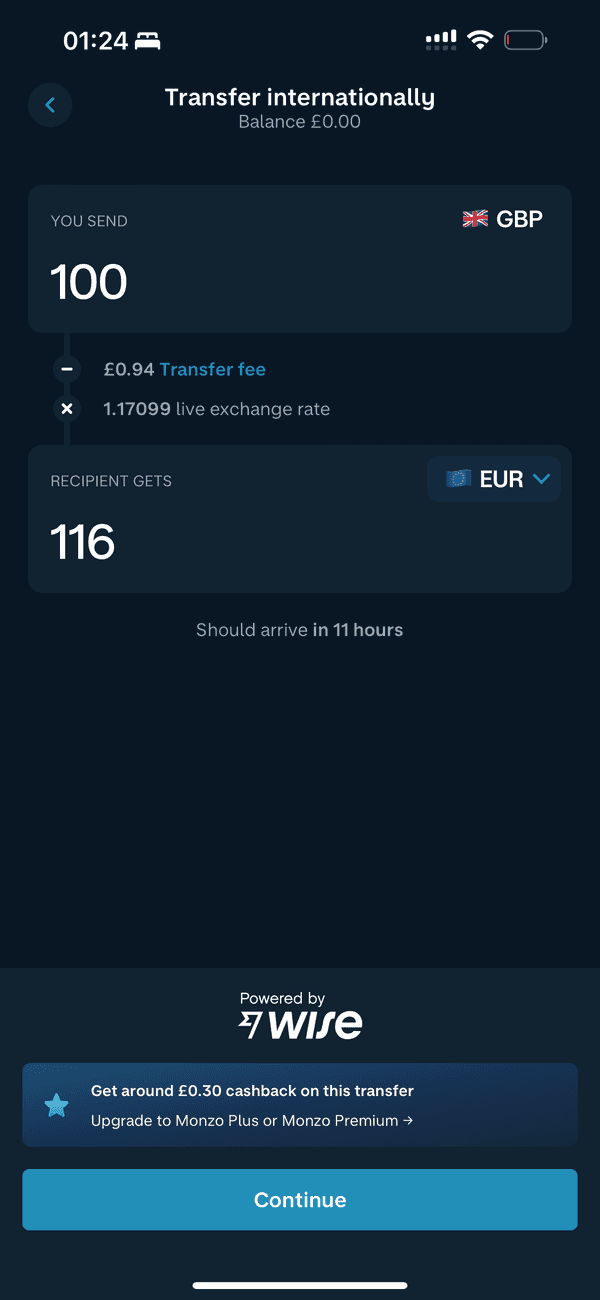

- International Transfers are powered by Wise

- Payments you receive in non-GBP currencies are converted to GBP before appearing in your account, incurring an associated conversion fee.

- Currency conversion fee is capped at £1000

- £1 per deposit to pay in cash at any PayPoint and Post Office

- Deposit £5-300 in one go, up to a maximum of £1,000 every rolling 180 days (shared)

- If Monzo is your main bank, then withdrawal is unlimited in UK & European Economic Area (EEA).

- The 30-day period for allowances resets exactly 30 days after your first withdrawal, rather than at the start of a new month.

Overdraft

#Perks

Perks

- Pots with interest for organizing money

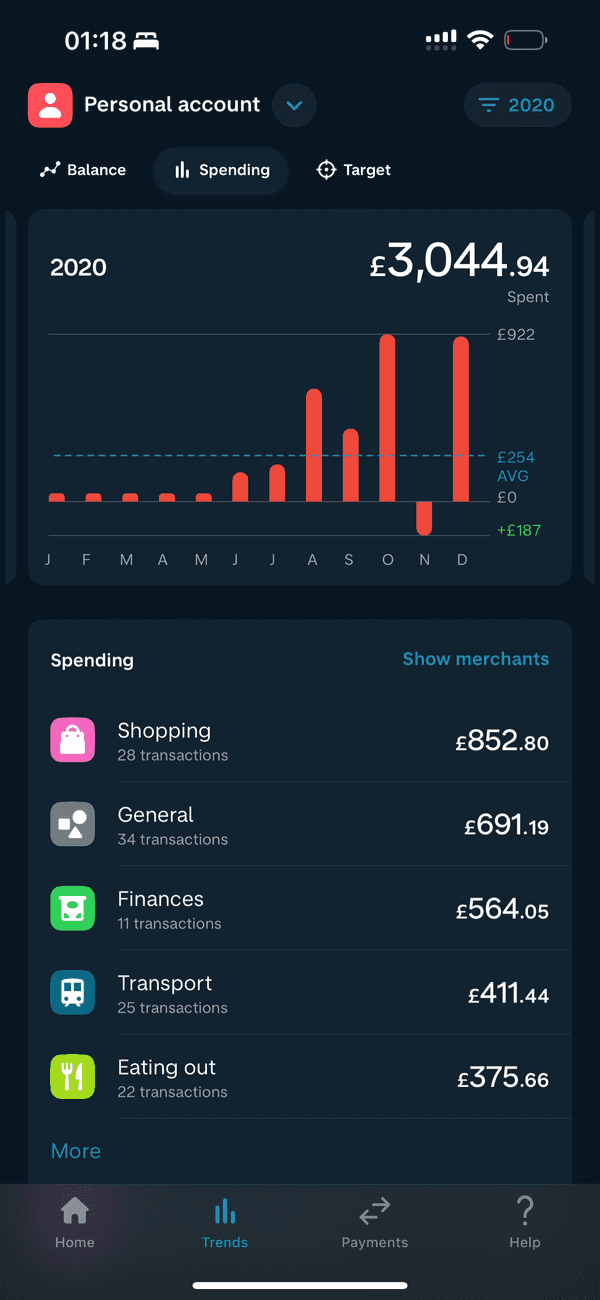

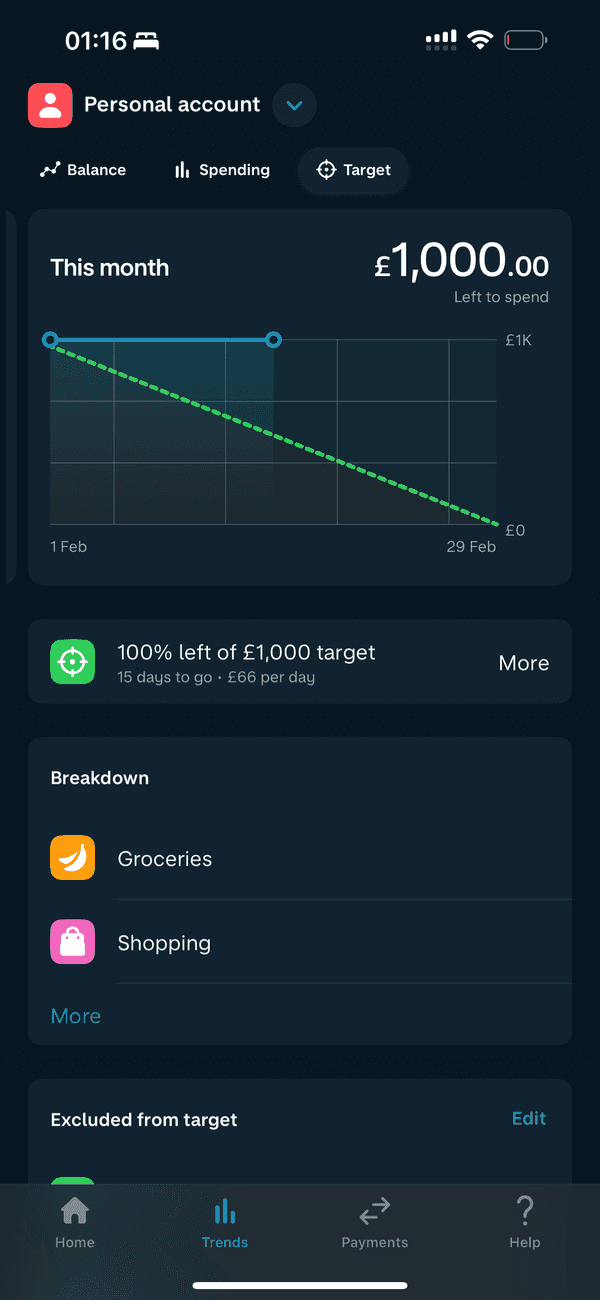

- Help in managing finances effectively

- Cashback offers with selected partners

- Loans up to £25,000 (eligibility check won't leave mark on your credit score)

#Safety

The Monzo Current Account adheres to rigorous industry safety standards. Backed by full authorization and regulation from the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA), Monzo reassures customers about the security and safety of their funds, protected up to £85,000 by The Financial Services Compensation Scheme (FSCS). For more details, explore Monzo’s regulatory status on the Financial Services Register

The Monzo app is fortified with advanced security features such as location-based security, passcode and more, ensuring user data and funds remain secure.

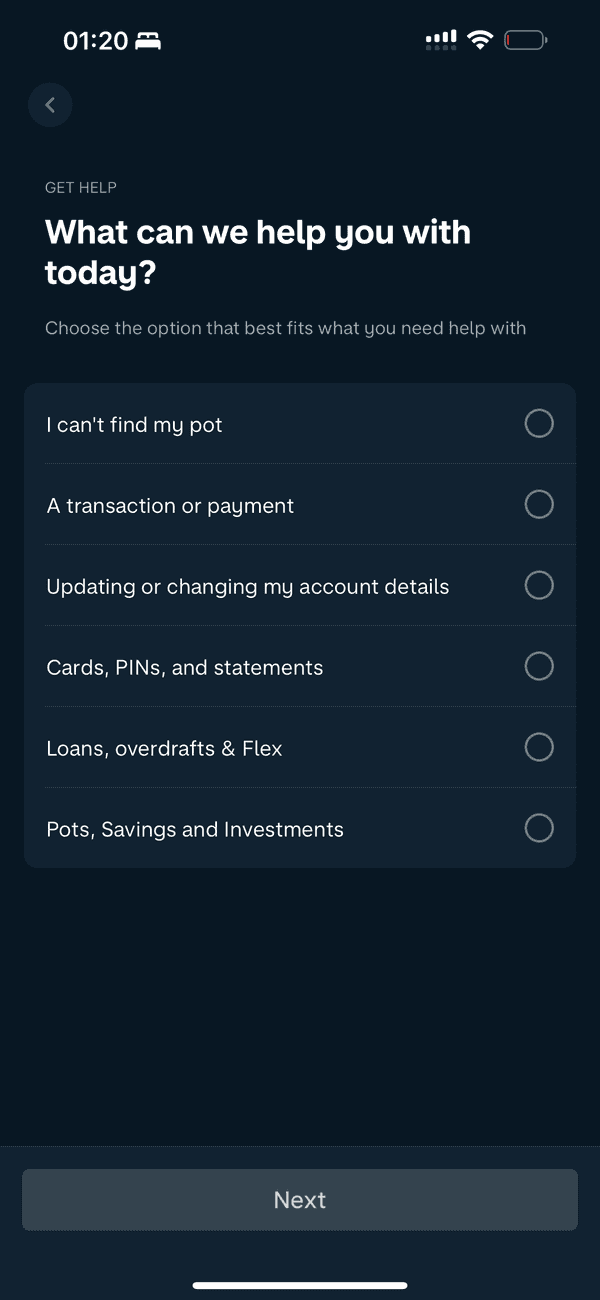

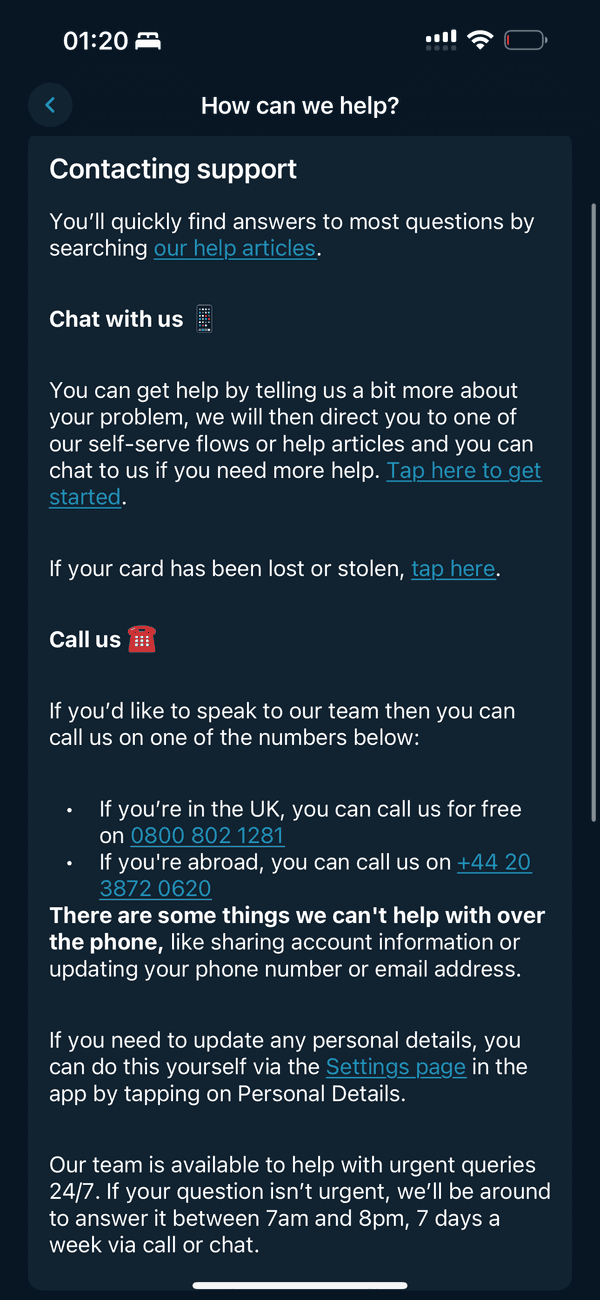

#Support

Support is a significant pillar of Monzo’s service. The app’s in-built messaging feature allows users to get help promptly. The bank has garnered recognition for its customer service, reflecting its commitment to resolving customer issues efficiently and empathetically.

Support Channels

- Live Chat

- Social Network

- Phone

- Callback

- Face To Face

#Price

Monzo stands out by providing a basic current account without monthly charges, but it introduces fees as you ascend to its value-added services. This original Monzo account is free and packed with features to manage money, save effectively, and categorize spending.

#Final thoughts

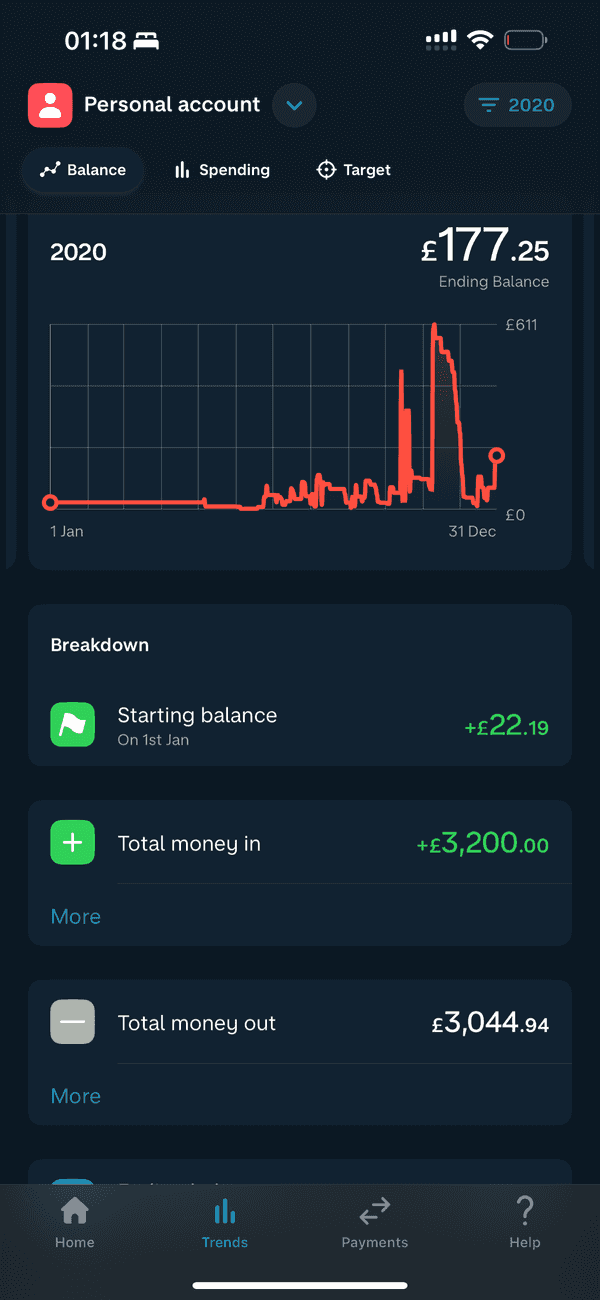

After an in-depth Monzo current account review, it is apparent that Monzo has successfully tapped into the digital banking revolution, offering an account that aligns with the needs and habits of contemporary banking customers. With its focus on customer experience and financial empowerment, Monzo provides a robust platform for daily financial management, savings, and smart spending.

Remember to always review the terms and conditions of any financial product, and consider whether Monzo’s current account offerings are the right fit for your personal banking needs.

#FAQs

#How to open a Monzo Current Account?

Opening a current account can be done entirely online through Monzo's website or via their banking app. A simple, user-friendly process guides you through setting up your account swiftly.

#How much is the interest on Monzo Current Account?

The current account offers 4.10% AER interest on Personal Instant Access Savings Pots.

#How to get Monzo Current Account?

ou can get a Monzo Current Account by applying on their website or app. Ensure you meet the eligibility requirements, such as being over 18 years old, and follow the steps provided.

#How to top up Monzo Current Account?

Top up your Monzo account via bank transfer, by setting up a regular standing order, or by depositing cash at a PayPoint.